Question

Options: No Journal Entry Required Accounts Payable Accumulated Amortization Accumulated DepreciationBuildings Accumulated DepreciationEquipment Accumulated DepreciationVehicles Accumulated Other Comprehensive Income Additional Paid-In Capital, Common Stock Additional

Options:

No Journal Entry Required

Accounts Payable

Accumulated Amortization

Accumulated DepreciationBuildings

Accumulated DepreciationEquipment

Accumulated DepreciationVehicles

Accumulated Other Comprehensive Income

Additional Paid-In Capital, Common Stock

Additional Paid-In Capital, Preferred Stock

Additional Paid-In Capital, Treasury Stock

Advertising Expense

Allowance for Doubtful Accounts

Amortization Expense

Bad Debt Expense

Bonds Payable

Buildings

Cash

Cash Equivalents

Cash Overage

Cash Shortage

Charitable Contributions Payable

Common Stock

Copyrights

Cost of Goods Sold

Deferred Revenue

Delivery Expense

Depreciation Expense

Discount on Bonds Payable

Dividends

Dividends Payable

Donation Revenue

Equipment

FICA Payable

Franchise Rights

Gain on Bond Retirement

Gain on Disposal of PPE

Goodwill

Impairment Loss

Income Tax Expense

Income Tax Payable

Insurance Expense

Interest Expense

Interest Payable

Interest Receivable

Interest Revenue

Inventory

Inventory - Estimated Returns

Land

Legal Expense

Licensing Rights

Logo and Trademarks

Loss on Bond Retirement

Loss on Disposal of PPE

Natural Resource Assets

Notes Payable (long-term)

Notes Payable (short-term)

Notes Receivable (long-term)

Notes Receivable (short-term)

Office Expenses

Other Current Assets

Other Noncurrent Assets

Other Noncurrent Liabilities

Other Operating Expenses

Other Revenue

Patents

Payroll Tax Expense

Petty Cash

Preferred Stock

Premium on Bonds Payable

Prepaid Advertising

Prepaid Insurance

Prepaid Rent

Refund Liability

Rent Expense

Rent Revenue

Repairs and Maintenance Expense

Restricted Cash (long-term)

Restricted Cash (short-term)

Retained Earnings

Salaries and Wages Expense

Salaries and Wages Payable

Sales Revenue

Sales Tax Payable

Service Revenue

Short-term Investments

Software

Subscription Revenue

Supplies

Supplies Expense

Travel Expense

Treasury Stock

Unemployment Tax Payable

Utilities Expense

Vehicles

Withheld Income Taxes Payable

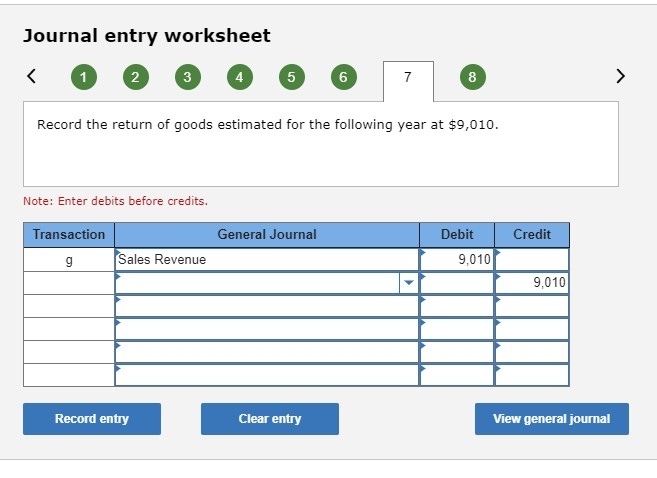

Journal entry worksheet 2 3 4 5 6 7 8 Record the return of goods estimated for the following year at $9,010. Note: Enter debits before credits. Transaction General Journal Debit Credit Sales Revenue 9,010 9,010 Record entry Clear entry View general journalStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started