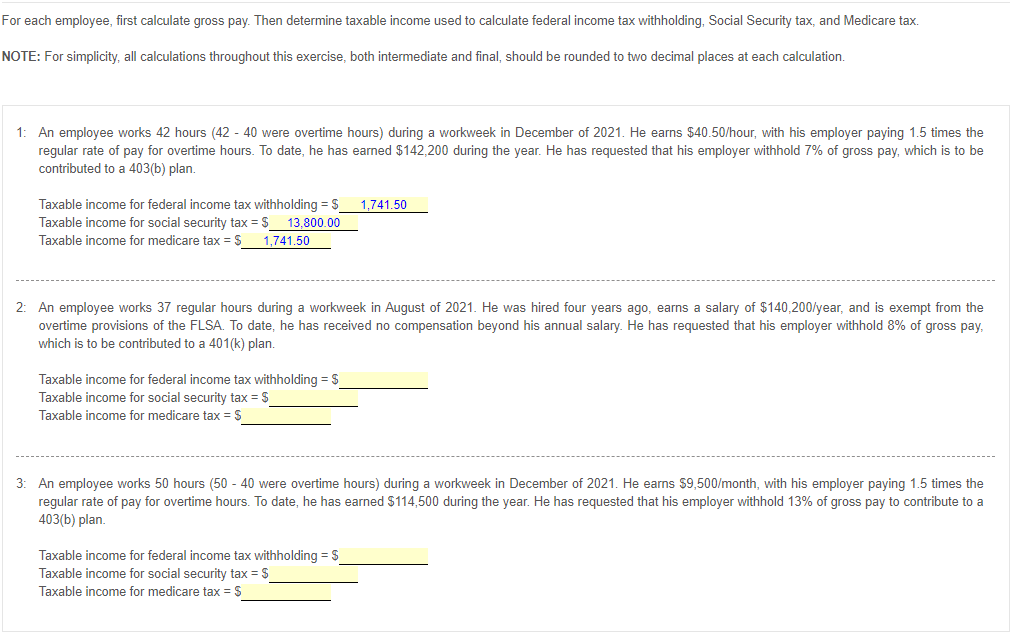

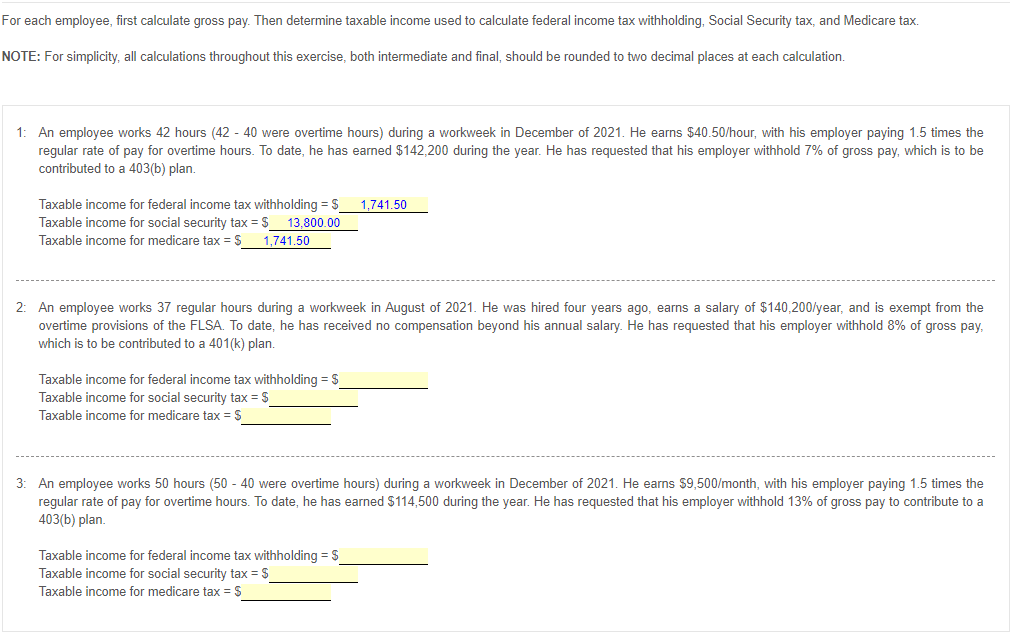

or each employee, first calculate gross pay. Then determine taxable income used to calculate federal income tax withholding, Social Security tax, and Medicare tax. OTE: For simplicity, all calculations throughout this exercise, both intermediate and final, should be rounded to two decimal places at each calculation. 1: An employee works 42 hours (42 - 40 were overtime hours) during a workweek in December of 2021 . He earns $40.50/ hour, with his employer paying 1.5 times the regular rate of pay for overtime hours. To date, he has earned $142,200 during the year. He has requested that his employer withhold 7% of gross pay, which is to be contributed to a 403(b) plan. Taxable income for federal income tax withholding =$ Taxable income for social security tax = Taxable income for medicare tax = 2: An employee works 37 regular hours during a workweek in August of 2021 . He was hired four years ago, earns a salary of $140,200/year, and is exempt from the which is to be contributed to a 401(k) plan. Taxable income for federal income tax withholding =$ Taxable income for social security tax =$ Taxable income for medicare tax= 3: An employee works 50 hours ( 50 - 40 were overtime hours) during a workweek in December of 2021 . He earns $9,500/ month, with his employer paying 1.5 times the regular rate of pay for overtime hours. To date, he has earned $114,500 during the year. He has requested that his employer withhold 13% of gross pay to contribute to a 403 (b) plan. Taxable income for federal income tax withholding =$ Taxable income for social security tax =$ Taxable income for medicare tax = or each employee, first calculate gross pay. Then determine taxable income used to calculate federal income tax withholding, Social Security tax, and Medicare tax. OTE: For simplicity, all calculations throughout this exercise, both intermediate and final, should be rounded to two decimal places at each calculation. 1: An employee works 42 hours (42 - 40 were overtime hours) during a workweek in December of 2021 . He earns $40.50/ hour, with his employer paying 1.5 times the regular rate of pay for overtime hours. To date, he has earned $142,200 during the year. He has requested that his employer withhold 7% of gross pay, which is to be contributed to a 403(b) plan. Taxable income for federal income tax withholding =$ Taxable income for social security tax = Taxable income for medicare tax = 2: An employee works 37 regular hours during a workweek in August of 2021 . He was hired four years ago, earns a salary of $140,200/year, and is exempt from the which is to be contributed to a 401(k) plan. Taxable income for federal income tax withholding =$ Taxable income for social security tax =$ Taxable income for medicare tax= 3: An employee works 50 hours ( 50 - 40 were overtime hours) during a workweek in December of 2021 . He earns $9,500/ month, with his employer paying 1.5 times the regular rate of pay for overtime hours. To date, he has earned $114,500 during the year. He has requested that his employer withhold 13% of gross pay to contribute to a 403 (b) plan. Taxable income for federal income tax withholding =$ Taxable income for social security tax =$ Taxable income for medicare tax =