Answered step by step

Verified Expert Solution

Question

1 Approved Answer

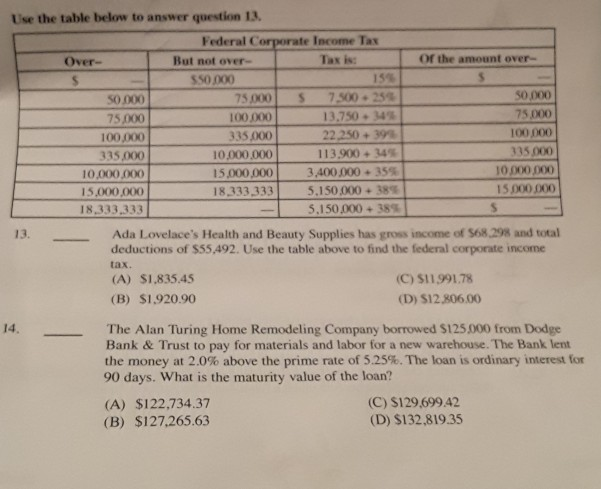

or the amount over Use the table below to answer question 13. Federal Corporate Income Tax Over- But not over- Taxis 550.000 15 50.000 75000

or the amount over Use the table below to answer question 13. Federal Corporate Income Tax Over- But not over- Taxis 550.000 15 50.000 75000 7.500 - 250 75.000 100 000 13.750 45 100.000 335.000 22.250 39 335.000 10.000.000 113.900 - 49 10.000.000 15.000.000 3.400.000 - 355 15.000.000 18.333,333 5.150.000 - 380 18.333.333 5.150.000 + 380 50.000 75.000 100 000 335.000 10.000.000 15.000.000 13. Ada Lovelace's Health and Beauty Supplies has gross income of 568.298 and total deductions of 555,492. Use the table above to find the federal corporate income tax. (A) S1.835.45 (C) S11.991.78 (B) 51.920.90 (D) S12.806.00 14. The Alan Turing Home Remodeling Company borrowed $125.000 from Dodge Bank & Trust to pay for materials and labor for a new warehouse. The Bank lent the money at 2.0% above the prime rate of 5.25%. The loan is ordinary interest for 90 days. What is the maturity value of the loan? (A) $122.734.37 (C) $129,699.42 (B) $127,265.63 (D) $132.819.35

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started