Answered step by step

Verified Expert Solution

Question

1 Approved Answer

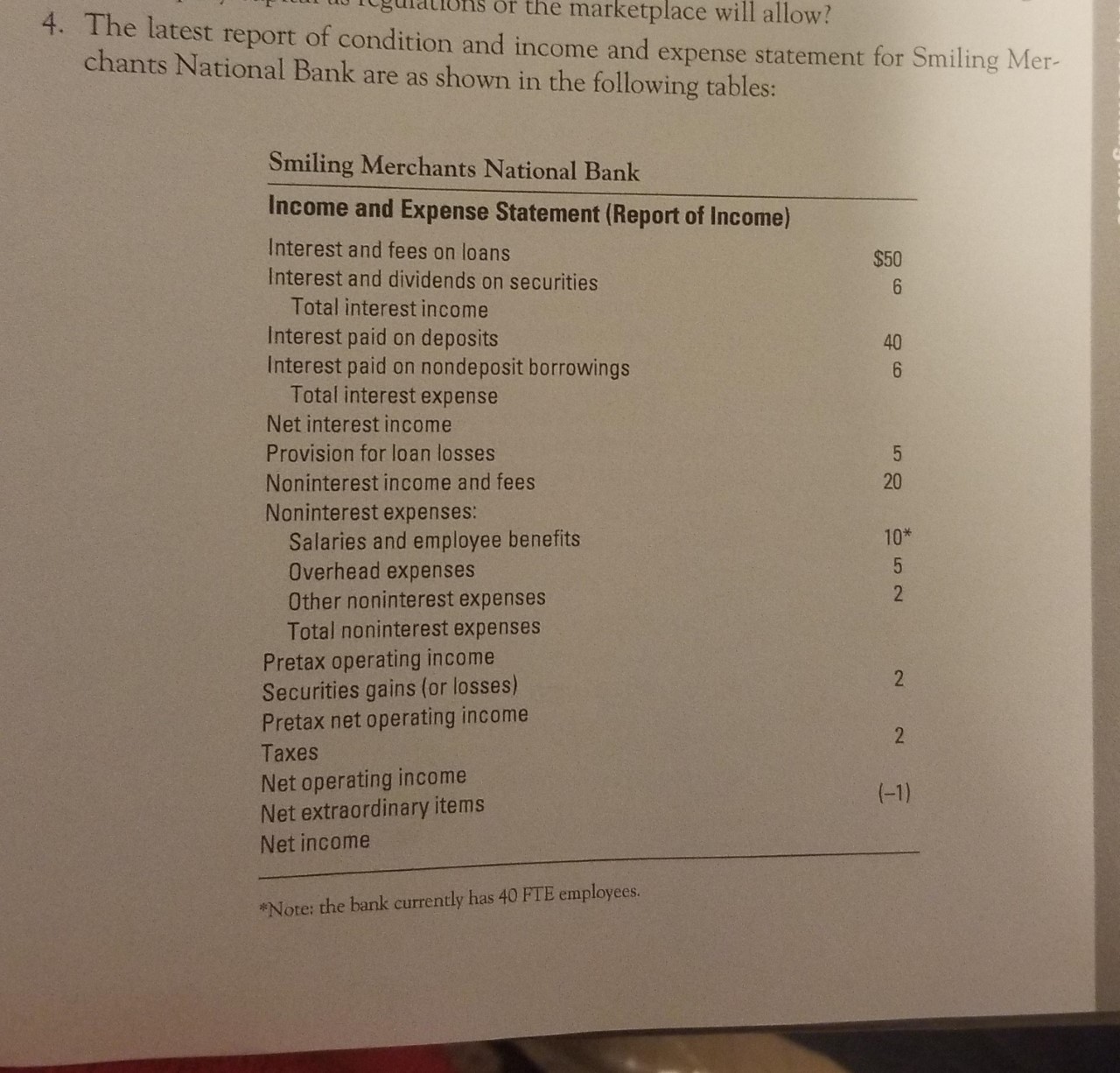

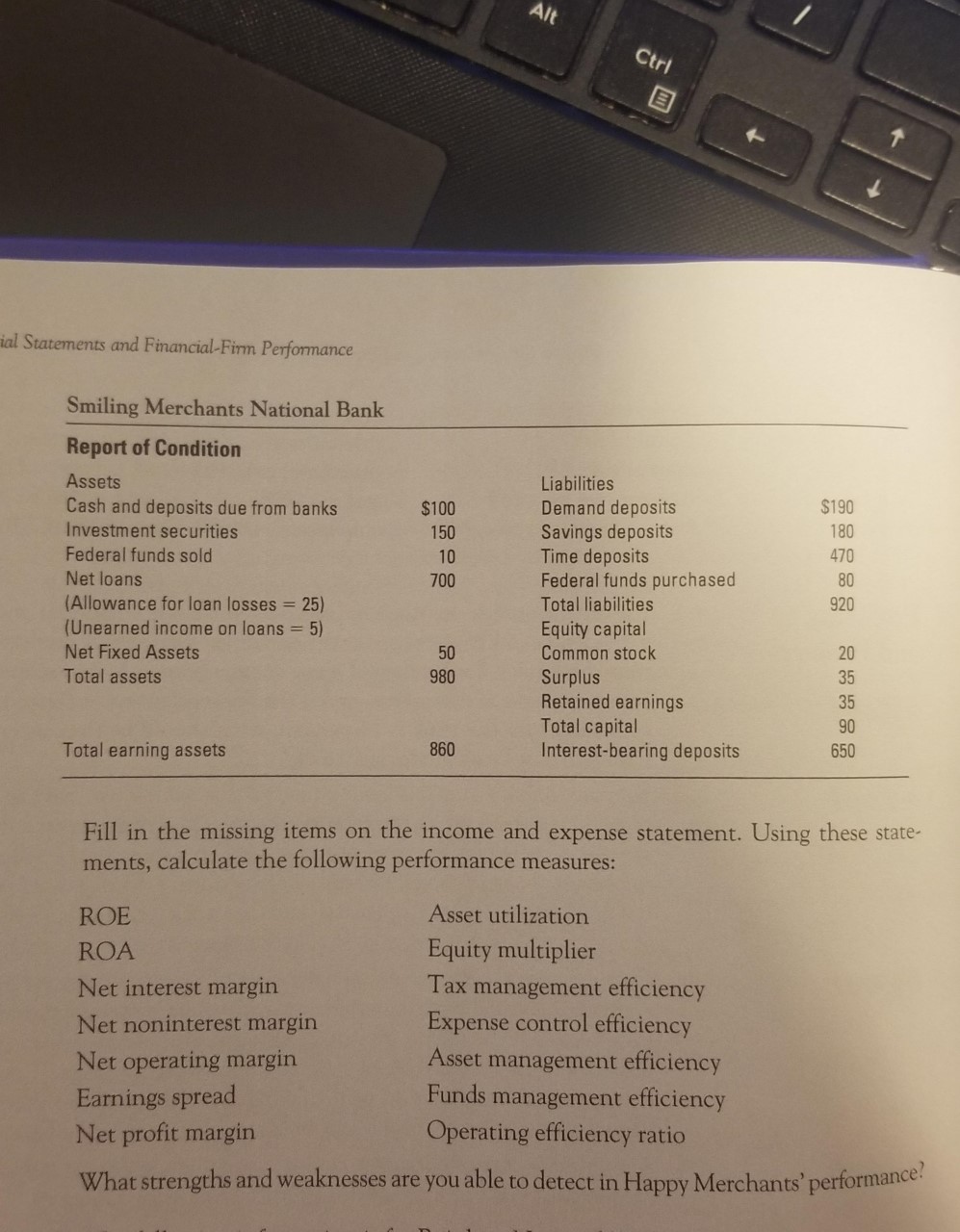

or the marketplace will allow? 4. The latest report of condition and income and expense statement for Smiling Mer- chants National Bank are as

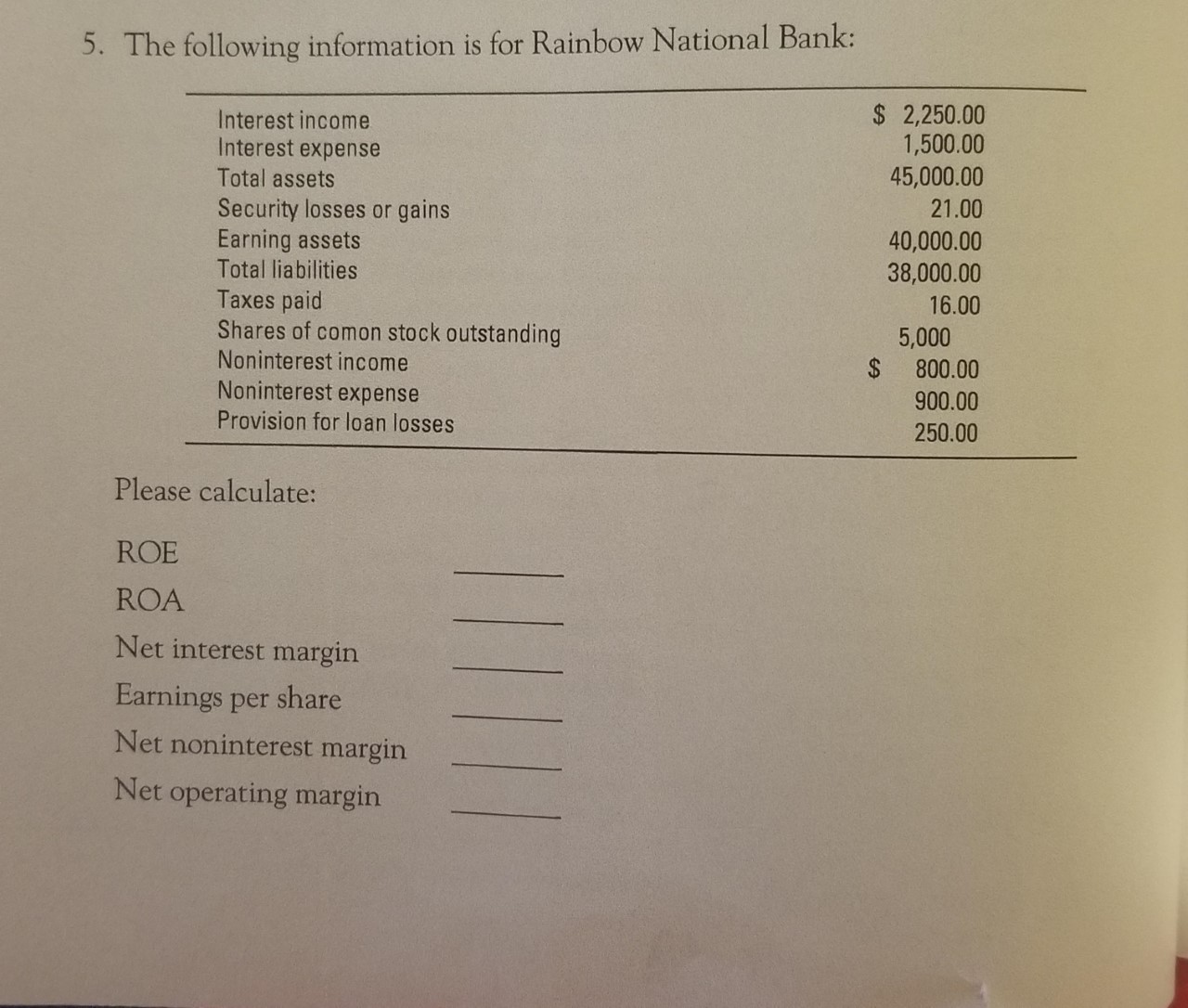

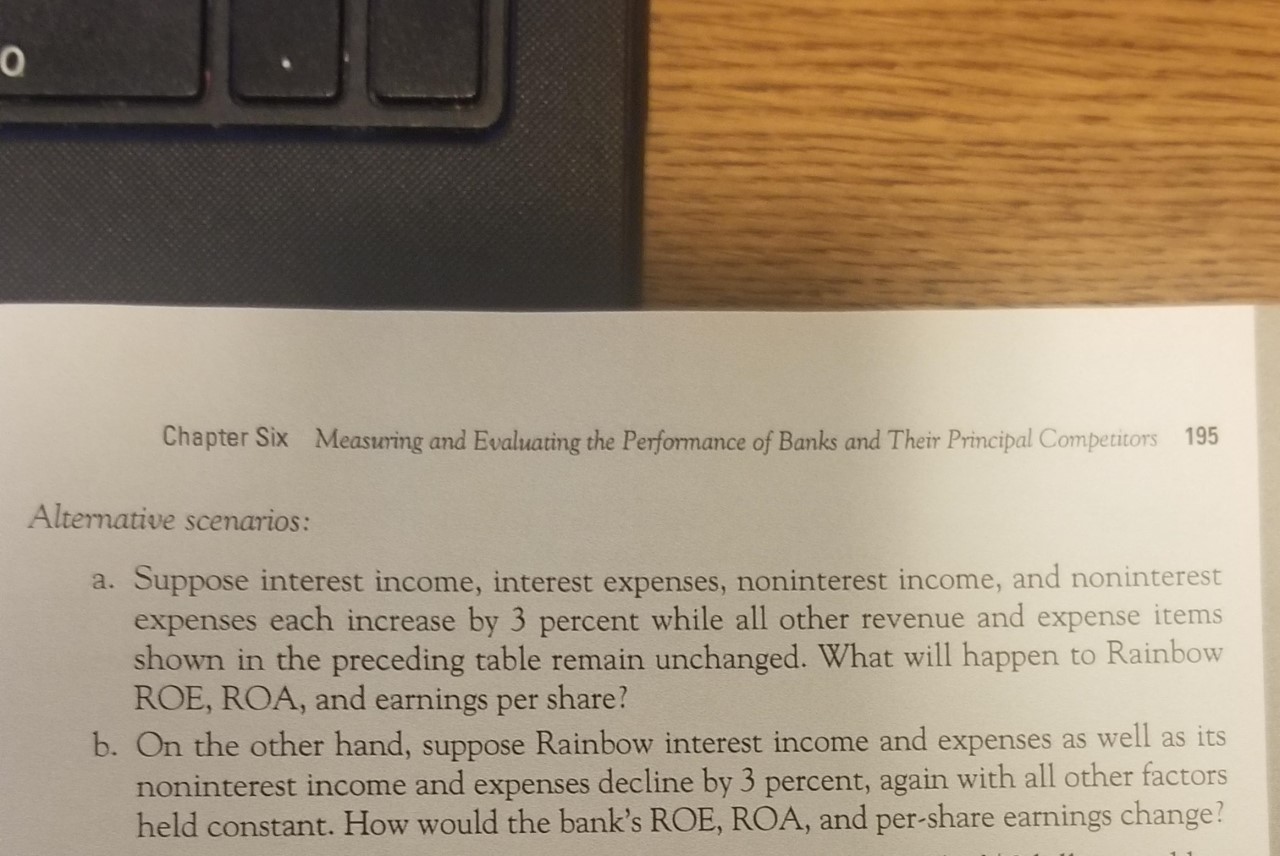

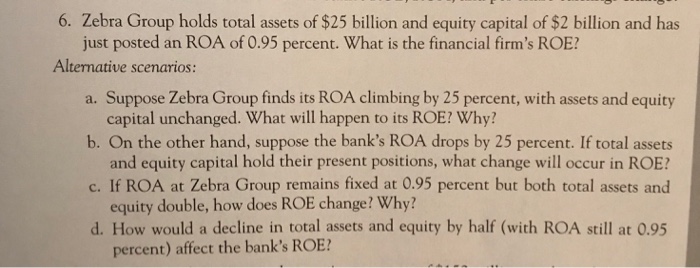

or the marketplace will allow? 4. The latest report of condition and income and expense statement for Smiling Mer- chants National Bank are as shown in the following tables: Smiling Merchants National Bank Income and Expense Statement (Report of Income) Interest and fees on loans Interest and dividends on securities Total interest income Interest paid on deposits Interest paid on nondeposit borrowings Total interest expense Net interest income Provision for loan losses Noninterest income and fees Noninterest expenses: Salaries and employee benefits Overhead expenses Other noninterest expenses Total noninterest expenses Pretax operating income Securities gains (or losses) Pretax net operating income Taxes Net operating income Net extraordinary items Net income *Note: the bank currently has 40 FTE employees. $50 6 40 6 5 20 10* 2 2 I Alt HNK ial Statements and Financial-Firm Performance Smiling Merchants National Bank Report of Condition Ctrl Assets Cash and deposits due from banks $100 Liabilities Demand deposits $190 Investment securities 150 Savings deposits 180 Federal funds sold 10 Time deposits 470 Net loans 700 Federal funds purchased 80 (Allowance for loan losses = 25) Total liabilities 920 (Unearned income on loans = 5) Equity capital Net Fixed Assets 50 Common stock 20 Total assets 980 Surplus 35 Retained earnings 35 Total capital 90 Total earning assets 860 Interest-bearing deposits 650 Fill in the missing items on the income and expense statement. Using these state- ments, calculate the following performance measures: ROE ROA Net interest margin Net noninterest margin Net operating margin Earnings spread Net profit margin Asset utilization Equity multiplier Tax management efficiency Expense control efficiency Asset management efficiency Funds management efficiency Operating efficiency ratio What strengths and weaknesses are you able to detect in Happy Merchants' performance? 5. The following information is for Rainbow National Bank: Interest income Interest expense Total assets Security losses or gains Earning assets Total liabilities Taxes paid Shares of comon stock outstanding Noninterest income Noninterest expense Provision for loan losses Please calculate: ROE ROA Net interest margin Earnings per share Net noninterest margin Net operating margin $2,250.00 1,500.00 45,000.00 21.00 40,000.00 38,000.00 16.00 $ 5,000 800.00 900.00 250.00 O Chapter Six Measuring and Evaluating the Performance of Banks and Their Principal Competitors 195 Alternative scenarios: a. Suppose interest income, interest expenses, noninterest income, and noninterest expenses each increase by 3 percent while all other revenue and expense items shown in the preceding table remain unchanged. What will happen to Rainbow ROE, ROA, and earnings per share? b. On the other hand, suppose Rainbow interest income and expenses as well as its noninterest income and expenses decline by 3 percent, again with all other factors held constant. How would the bank's ROE, ROA, and per-share earnings change? 6. Zebra Group holds total assets of $25 billion and equity capital of $2 billion and has just posted an ROA of 0.95 percent. What is the financial firm's ROE? Alternative scenarios: a. Suppose Zebra Group finds its ROA climbing by 25 percent, with assets and equity capital unchanged. What will happen to its ROE? Why? b. On the other hand, suppose the bank's ROA drops by 25 percent. If total assets and equity capital hold their present positions, what change will occur in ROE? c. If ROA at Zebra Group remains fixed at 0.95 percent but both total assets and equity double, how does ROE change? Why? d. How would a decline in total assets and equity by half (with ROA still at 0.95 percent) affect the bank's ROE?

Step by Step Solution

There are 3 Steps involved in it

Step: 1

To calculate the Return on Equity ROE we can use the formula ROE ROA Equity Ratio Where ROA Return o...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started