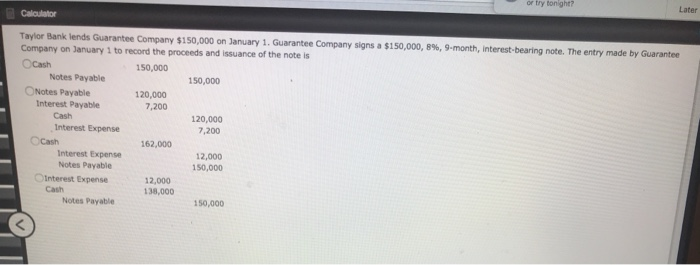

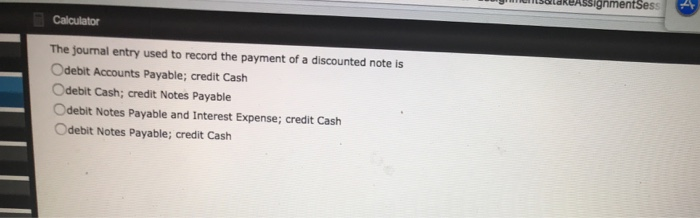

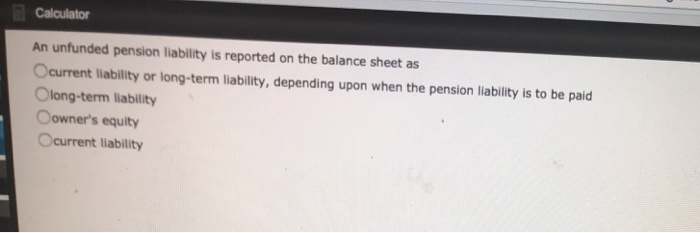

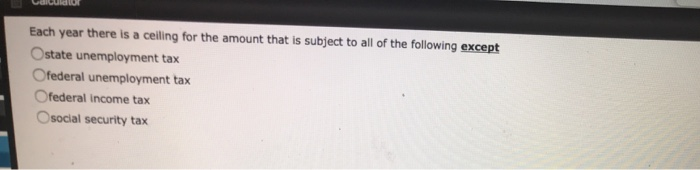

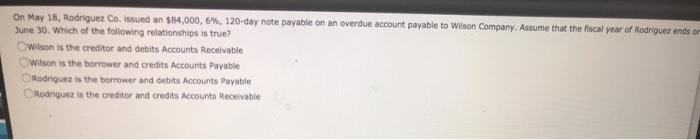

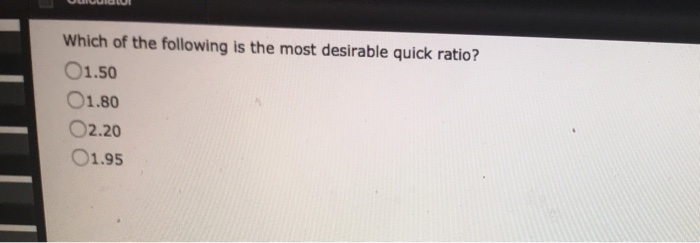

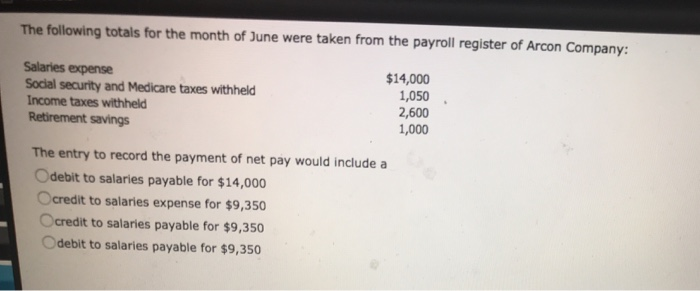

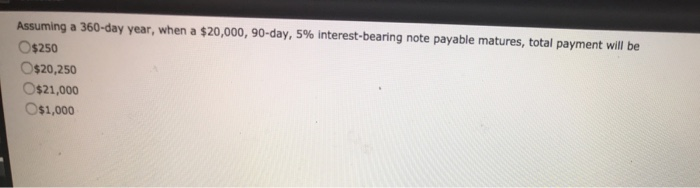

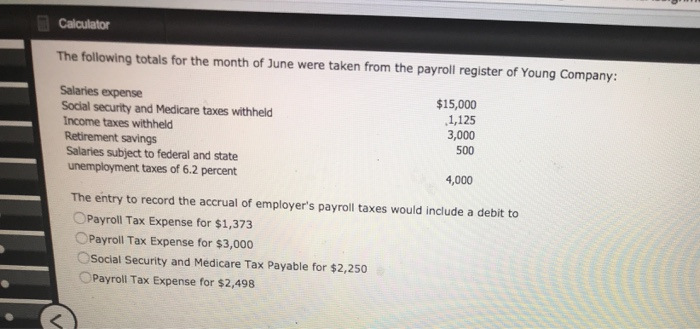

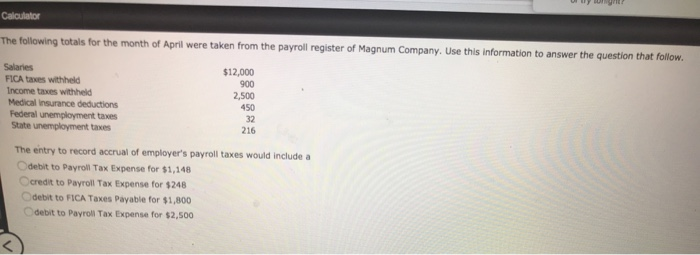

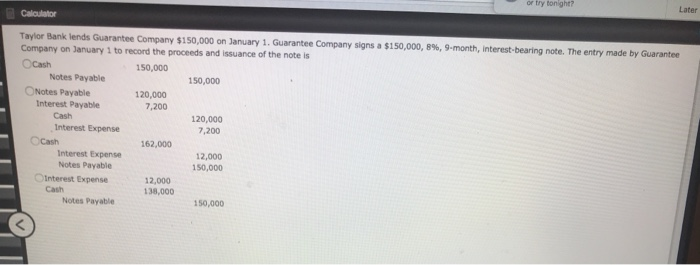

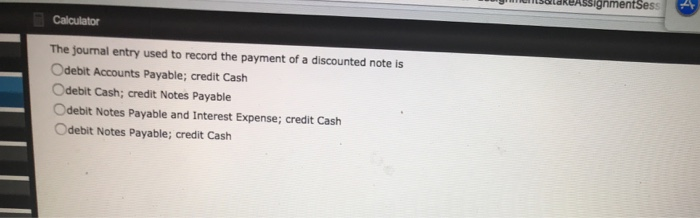

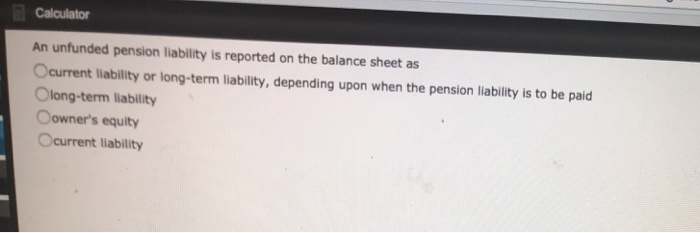

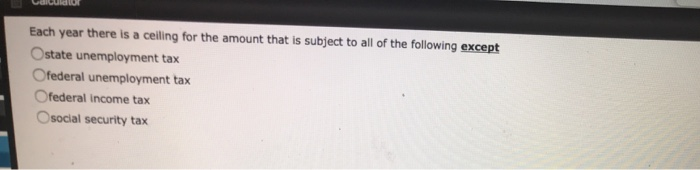

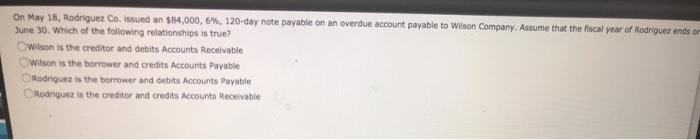

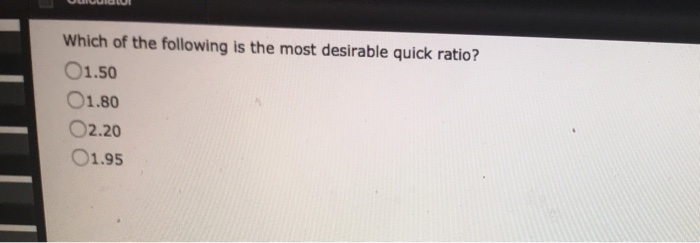

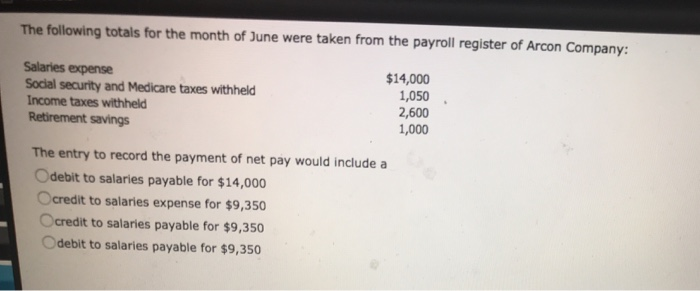

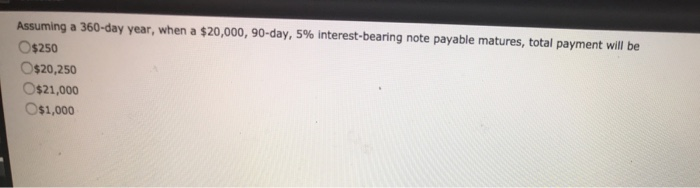

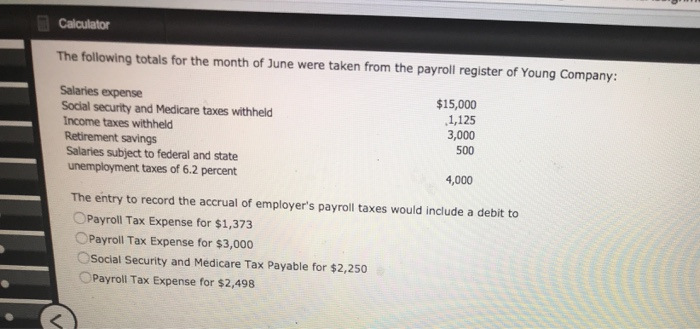

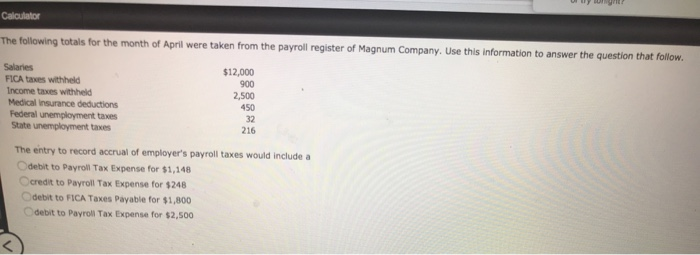

or tr tonight? Later Calculator Taylor Bank lends Guarantee Company $150,000 on January 1. Guarantee Company signs a $150,000, 8 % , 9-month, interest-bearing note. The entry made by Guarantee Company on January 1 to record the proceeds and issuance of the note is OCash 150,000 Notes Payable 150,000 ONotes Payable Interest Payable 120,000 7,200 Cash 120,000 Interest Expense 7,200 OCash 162,000 Interest Expense Notes Payable 12,000 150,000 Ointerest Expense 12,000 138,000 Cash Notes Payable 150,000 graeTtsCtakeASSignmentSess Calculator The journal entry used to record the payment of a discounted note is Odebit Accounts Payable; credit Cash Odebit Cash; credit Notes Payable Odebit Notes Payable and Interest Expense; credit Cash Odebit Notes Payable; credit Cash Cacualo Each year there is a ceiling for the amount that is subject to all of the following except Ostate unemployment tax Ofederal unemployment tax Ofederal income tax Osocial security tax On May 18, Rodriguez Co. issued an $84,000, 6 %, 120-day note payable on an overdue account payable to Wilson Company. Assume that the fiscal year of Rodriguez ends on June 30. Which of the following relationships is true? OWilson is the creditor and debits Accounts Receivable Owilson is the borrower and credits Accounts Payable ORodriguez is the borrower and debits Accounts Payable ORodriguez is the creditor and credits Accounts Receivable Which of the following is the most desirable quick ratio? O1.50 O1.80 O2.20 O1.95 The following totals for the month of June were taken from the payroll register of Arcon Company: Salaries expense Social security and Medicare taxes withheld Income taxes withheld Retirement savings $14,000 1,050 2,600 1,000 The entry to record the payment of net pay would include a Odebit to salaries payable for $14,000 Ocredit to salaries expense for $9,350 Ocredit to salaries payable for $9,350 Odebit to salaries payable for $9,350 Assuming a 360-day year, when a $20,000, 90-day, 5 % interest-bearing note payable matures, total payment will be Os250 O$20,250 O$21,000 O$1,000 Calculator The following totals for the month of June were taken from the payroll register of Young Company: Salaries expense Social security and Medicare taxes withheld Income taxes withheld Retirement savings Salaries subject to federal and state unemployment taxes of 6.2 percent $15,000 1,125 3,000 500 4,000 The entry to record the accrual of employer's payroll taxes would include a debit to OPayroll Tax Expense for $1,373 OPayroll Tax Expense for $3,000 OSocial Security and Medicare Tax Payable for $2,250 OPayroll Tax Expense for $2,498 Calculator The following totals for the month of April were taken from the payroll register of Magnum Company. Use this information to answer the question that follow. Salaries FICA taxes withheld Income taxes withheld Medical Insurance deductions Federal unemployment taxes State unemployment taxes $12,000 900 2,500 450 32 216 The entry to record accrual of employer's payroll taxes would include a Odebit to Payroll Tax Expense for $1,148 Ocredit to Payroll Tax Expense for $248 Odebit to FICA Taxes Payable for $1,800 Odebit to Payroll Tax Expense for $2,500