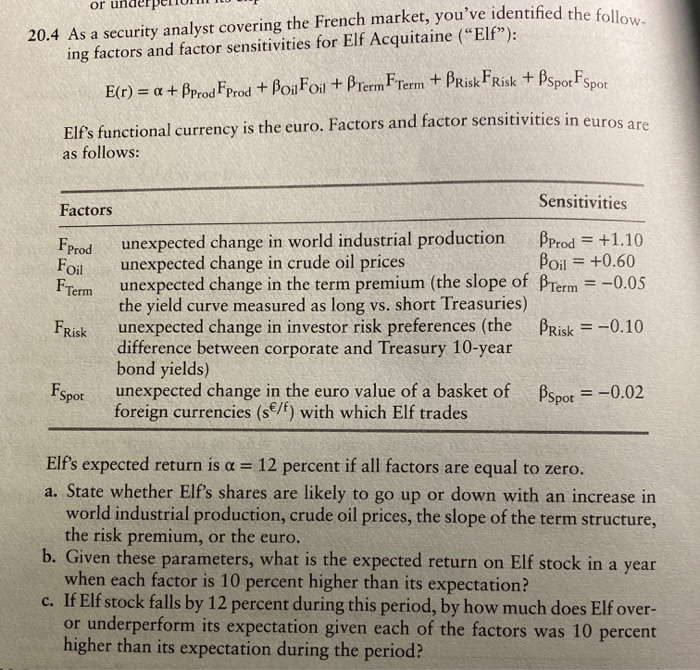

or under per UT 20.4 As a security analyst covering the French market, you've identified the foll ing factors and factor sensitivities for Elf Acquitaine ("Elf): E(r) = a + Bprod FProd + BoaFoil + B Term FTerm + Brisk Frisk + Bspor FSpor Elf's functional currency is the euro. Factors and factor sensitivities in euros ar as follows: FProd Foil Flem Factors Sensitivities unexpected change in world industrial production Prod = +1.10 unexpected change in crude oil prices Boil = +0.60 unexpected change in the term premium (the slope of B Term = -0.05 the yield curve measured as long vs. short Treasuries) Frisk unexpected change in investor risk preferences (the PRisk = -0.10 difference between corporate and Treasury 10-year bond yields) unexpected change in the euro value of a basket of Bspor = -0.02 foreign currencies (s/) with which Elf trades Fspot Elf's expected return is a = 12 percent if all factors are equal to zero. a. State whether Elf's shares are likely to go up or down with an increase in world industrial production, crude oil prices, the slope of the term structure, the risk premium, or the euro. b. Given these parameters, what is the expected return on Elf stock in a year when each factor is 10 percent higher than its expectation? c. If Elf stock falls by 12 percent during this period, by how much does Elf over- or underperform its expectation given each of the factors was 10 percent higher than its expectation during the period? or under per UT 20.4 As a security analyst covering the French market, you've identified the foll ing factors and factor sensitivities for Elf Acquitaine ("Elf): E(r) = a + Bprod FProd + BoaFoil + B Term FTerm + Brisk Frisk + Bspor FSpor Elf's functional currency is the euro. Factors and factor sensitivities in euros ar as follows: FProd Foil Flem Factors Sensitivities unexpected change in world industrial production Prod = +1.10 unexpected change in crude oil prices Boil = +0.60 unexpected change in the term premium (the slope of B Term = -0.05 the yield curve measured as long vs. short Treasuries) Frisk unexpected change in investor risk preferences (the PRisk = -0.10 difference between corporate and Treasury 10-year bond yields) unexpected change in the euro value of a basket of Bspor = -0.02 foreign currencies (s/) with which Elf trades Fspot Elf's expected return is a = 12 percent if all factors are equal to zero. a. State whether Elf's shares are likely to go up or down with an increase in world industrial production, crude oil prices, the slope of the term structure, the risk premium, or the euro. b. Given these parameters, what is the expected return on Elf stock in a year when each factor is 10 percent higher than its expectation? c. If Elf stock falls by 12 percent during this period, by how much does Elf over- or underperform its expectation given each of the factors was 10 percent higher than its expectation during the period