Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Mr Essien retired from his employment abroad and returned to this country, where he purchased a small kiosk. He took over the business on

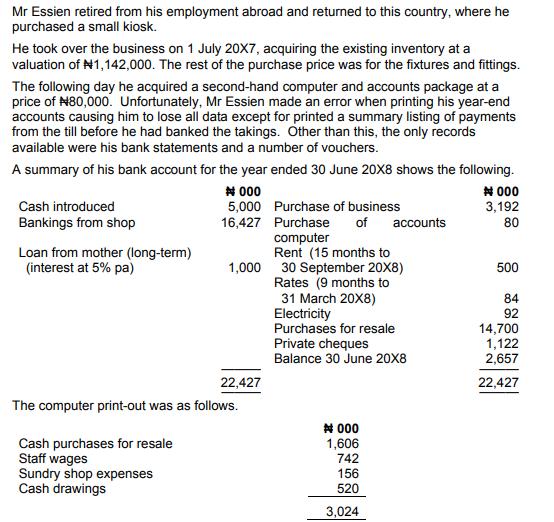

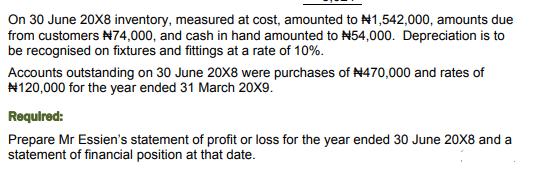

Mr Essien retired from his employment abroad and returned to this country, where he purchased a small kiosk. He took over the business on 1 July 20X7, acquiring the existing inventory at a valuation of #1,142,000. The rest of the purchase price was for the fixtures and fittings. The following day he acquired a second-hand computer and accounts package at a price of N80,000. Unfortunately, Mr Essien made an error when printing his year-end accounts causing him to lose all data except for printed a summary listing of payments from the till before he had banked the takings. Other than this, the only records available were his bank statements and a number of vouchers. A summary of his bank account for the year ended 30 June 20X8 shows the following. Cash introduced Bankings from shop Loan from mother (long-term) (interest at 5% pa) #000 5,000 Purchase of business 16,427 Purchase of computer Sundry shop expenses Cash drawings Rent (15 months to 1,000 30 September 20X8) Rates (9 months to 31 March 20X8) 22,427 The computer print-out was as follows. Cash purchases for resale Staff wages accounts Electricity Purchases for resale Private cheques Balance 30 June 20X8 #000 1,606 742 156 520 3,024 #000 3,192 80 500 84 92 14,700 1,122 2,657 22,427 On 30 June 20X8 inventory, measured at cost, amounted to #1,542,000, amounts due from customers N74,000, and cash in hand amounted to N54,000. Depreciation is to be recognised on fixtures and fittings at a rate of 10%. Accounts outstanding on 30 June 20X8 were purchases of #470,000 and rates of #120,000 for the year ended 31 March 20X9. Required: Prepare Mr Essien's statement of profit or loss for the year ended 30 June 20X8 and a statement of financial position at that date.

Step by Step Solution

★★★★★

3.42 Rating (158 Votes )

There are 3 Steps involved in it

Step: 1

Statement of Profit or Loss for the year ended 30 June 20X8 Revenue Sales 2657000 Cost of Sale...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started