Answered step by step

Verified Expert Solution

Question

1 Approved Answer

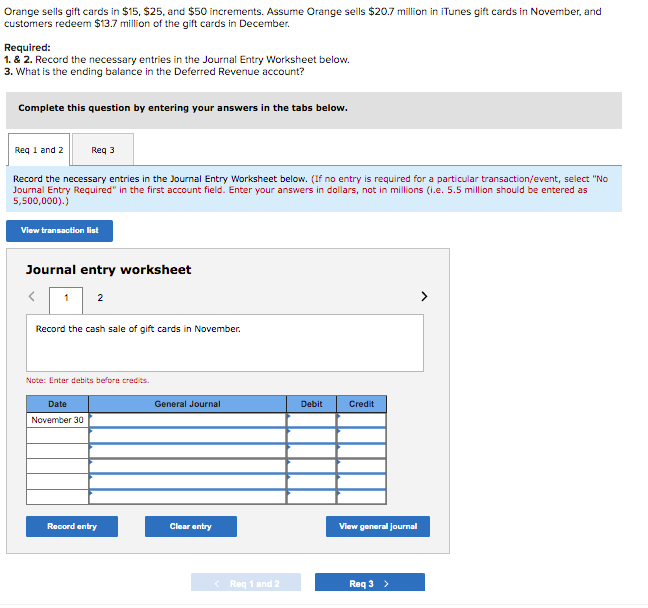

Orange sells gift cards in $15, $25, and $50 increments. Assume Orange sells $20.7 million in iTunes gift cards in November, and customers redeem

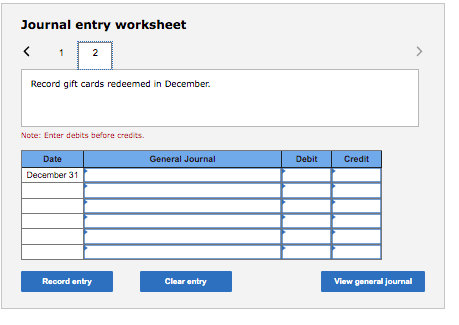

Orange sells gift cards in $15, $25, and $50 increments. Assume Orange sells $20.7 million in iTunes gift cards in November, and customers redeem $13.7 million of the gift cards in December. Required: 1. & 2. Record the necessary entries in the Journal Entry Worksheet below. 3. What is the ending balance in the Deferred Revenue account? Complete this question by entering your answers in the tabs below. Req 1 and 2 Req 3 Record the necessary entries in the Journal Entry Worksheet below. (If no entry is required for a particular transaction/event, select "No Journal Entry Required" in the first account field. Enter your answers in dollars, not in millions (i.e. 5.5 million should be entered as 5,500,000).) View transaotion list Journal entry worksheet 1 > 2 Record the cash sale of gift cards in November. Note: Enter debits before credits. Date General Journal Debit Credit November 30 Record entry Clear entry View general journal < Req 1 and 2 Req 3 > Journal entry worksheet 2 Record gift cards redeemed in December. Note: Enter debits before credits. Date General Journal Debit Credit December 31 Record entry Clear entry View general jourmal Req 1 and 2 Req 3 What is the ending balance in the Deferred Revenue account? (Enter your answer in dollars, not in millions. (i.e. 5.5 million should be entered as 5,500,000).) Ending balance < Req 1 and 2 Req 3>

Step by Step Solution

★★★★★

3.33 Rating (138 Votes )

There are 3 Steps involved in it

Step: 1

1 2 The required journal entries have been made as follows 3 Ending Balanc...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started