Question

Orchid Capital recently hired two portfolio managers with stellar reputations in the industry, Jack and Jill. To decide who will be managing the lion's share

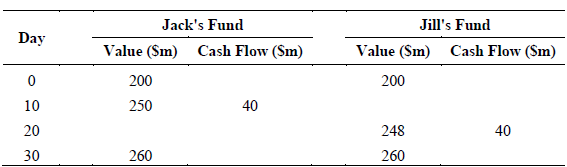

Orchid Capital recently hired two portfolio managers with stellar reputations in the industry, Jack and Jill. To decide who will be managing the lion's share of the fund's assets, the fund monitored their performance for the month of April, allocating each of them $200m at the start of the month and an additional $40m during the month. For each portfolio manager, the fund values (which are inclusive of contributions, if any) at the end of specific days in April and the additional injection of capital are tabulated as follows:

The chief investment officer claims that the two portfolio managers are equally competent since they both returned the same portfolio value by the end of April. His deputy argues that the portfolio managers are not equally competent and that the timing of the additional capital injection was made intentionally to favour one of the portfolio managers.

Examine whether the two (2) portfolio managers are equally competent and the claim that the timing of the additional capital injection was made intentionally to favour one of the portfolio managers.

In making these evaluations, calculate and compare, for each fund, two (2) monthly return measures of fund performance.

Jack's Fund Value ($m) Cash Flow (Sm) 200 Day 0 10 250 40 40 20 30 260 Jill's Fund Value (Sm) Cash Flow (Sm) 200 248 260 40 40

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Comparing the Performance of Jack and Jills Funds Based on the information provided we can analyze the performance of Jack and Jills funds using two m...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started