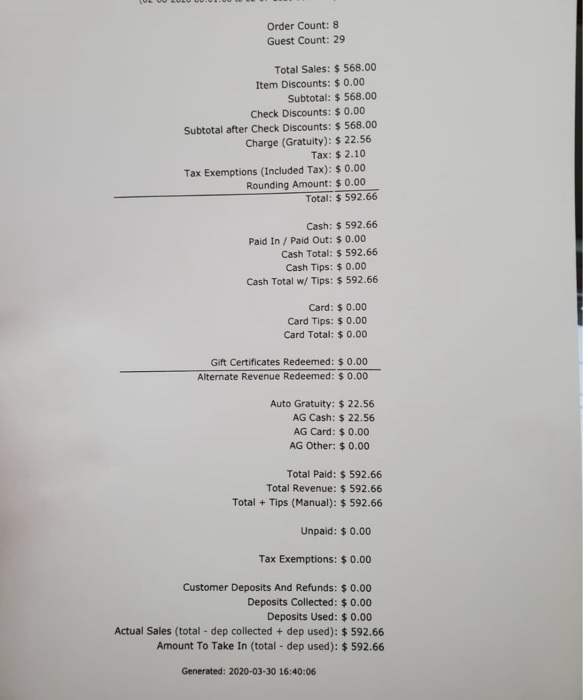

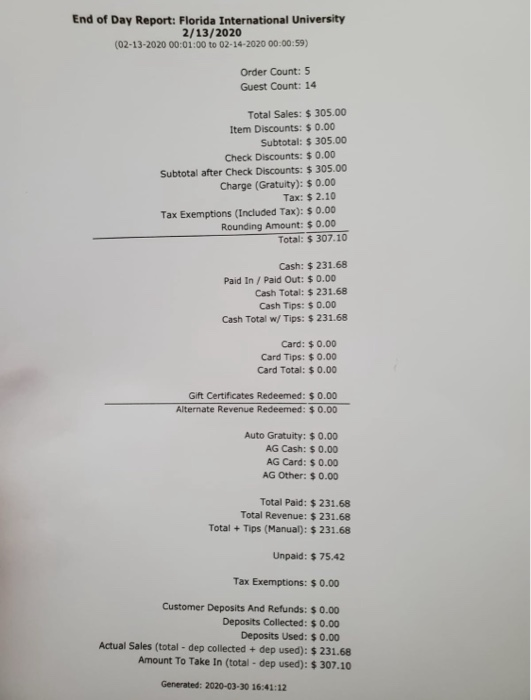

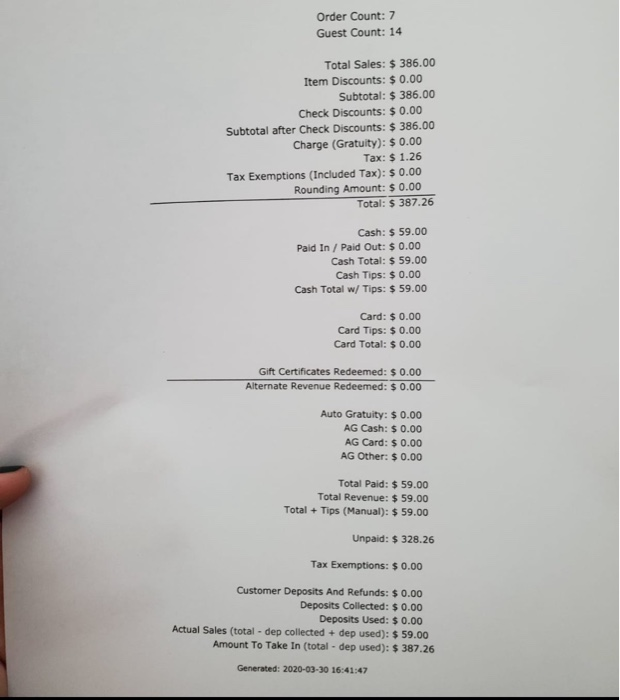

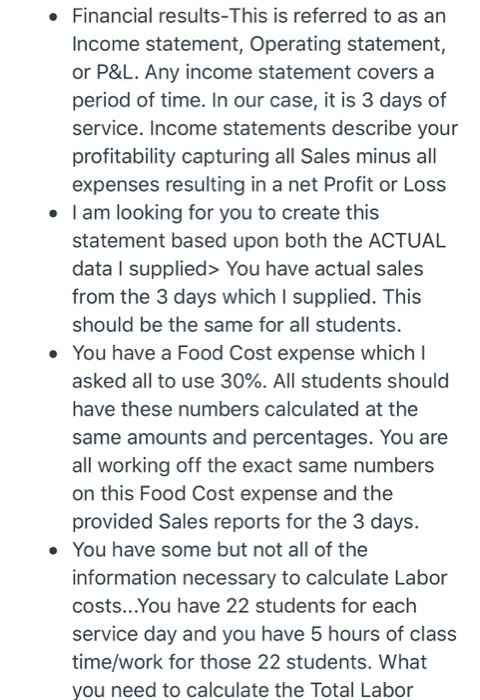

Order Count: 8 Guest Count: 29 Total Sales: $ 568.00 Item Discounts: $ 0.00 Subtotal: $ 568.00 Check Discounts: $ 0.00 Subtotal after Check Discounts: $ 568.00 Charge (Gratuity): $ 22.56 Tax: $ 2.10 Tax Exemptions (Included Tax): $ 0.00 Rounding Amount: $ 0.00 Total: $ 592.66 Cash: $ 592.66 Paid In / Paid Out: $ 0.00 Cash Total: $ 592.66 Cash Tips: $ 0.00 Cash Total w/ Tips: $ 592.66 Card: $ 0.00 Card Tips: $ 0.00 Card Total: $ 0.00 Gift Certificates Redeemed: $ 0.00 Alternate Revenue Redeemed: $ 0.00 Auto Gratuity: $ 22.56 AG Cash: $ 22.56 AG Card: $ 0.00 AG Other: $ 0.00 Total Paid: $ 592.66 Total Revenue: $ 592.66 Total + Tips (Manual): $ 592.66 Unpaid: $ 0.00 Tax Exemptions: $ 0.00 Customer Deposits And Refunds: $ 0.00 Deposits Collected: $ 0.00 Deposits Used: $ 0.00 Actual Sales (total - dep collected + dep used): $ 592.66 Amount To Take In (total - dep used): $ 592.66 Generated: 2020-03-30 16:40:06 End of Day Report: Florida International University 2/13/2020 (02-13-2020 00:01:00 to 02-14-2020 00:00:59) Order Count: 5 Guest Count: 14 Total Sales: $ 305.00 Item Discounts: $ 0.00 Subtotal: $ 305.00 Check Discounts: $ 0.00 Subtotal after Check Discounts: $ 305.00 Charge (Gratuity): $ 0.00 Tax: $ 2.10 Tax Exemptions (Included Tax): $ 0.00 Rounding Amount: $ 0.00 Total: $ 307.10 Cash: $ 231.68 Paid In / Paid Out: $ 0.00 Cash Total: $ 231.68 Cash Tips: $ 0.00 Cash Total w/ Tips: $ 231.68 Card: $ 0.00 Card Tips: $ 0.00 Card Total: $ 0.00 Gift Certificates Redeemed: $ 0.00 Alternate Revenue Redeemed: $ 0.00 Auto Gratuity: $ 0.00 AG Cash: $ 0.00 AG Card: $ 0.00 AG Other: $ 0.00 Total Paid: $ 231.68 Total Revenue: $ 231.68 Total + Tips (Manual): $ 231.68 Unpaid: $75.42 Tax Exemptions: $ 0.00 Customer Deposits And Refunds: $ 0.00 Deposits Collected: $ 0.00 Deposits Used: $ 0.00 Actual Sales (total - dep collected + dep used): $ 231.68 Amount To Take In (total - dep used): $ 307.10 Generated: 2020-03-30 16:41:12 Order Count: 7 Guest Count: 14 Total Sales: $ 386.00 Item Discounts: $ 0.00 Subtotal: $ 386.00 Check Discounts: $ 0.00 Subtotal after Check Discounts: $ 386.00 Charge (Gratuity): $ 0.00 Tax: $ 1.26 Tax Exemptions (Included Tax): $ 0.00 Rounding Amount: $ 0.00 Total: $ 387.26 Cash: $ 59.00 Paid In / Paid Out: $ 0.00 Cash Total: $ 59.00 Cash Tips: $ 0.00 Cash Total w/ Tips: $ 59.00 Card: $ 0.00 Card Tips: $ 0.00 Card Total: $ 0.00 Gift Certificates Redeemed: $ 0.00 Alternate Revenue Redeemed: $ 0.00 Auto Gratuity: $ 0.00 AG Cash: $ 0.00 AG Card: $ 0.00 AG Other: $ 0.00 Total Paid: $59.00 Total Revenue: $ 59.00 Total + Tips (Manual): $ 59.00 Unpaid: $ 328.26 Tax Exemptions: $ 0.00 Customer Deposits And Refunds: $ 0.00 Deposits Collected: $ 0.00 Deposits Used: $ 0.00 Actual Sales (total - dep collected + dep used): $59.00 Amount To Take In (total - dep used): $ 387.26 Generated: 2020-03-30 16:41:47 Financial results-This is referred to as an Income statement, Operating statement, or P&L. Any income statement covers a period of time. In our case, it is 3 days of service. Income statements describe your profitability capturing all Sales minus all expenses resulting in a net Profit or Loss I am looking for you to create this statement based upon both the ACTUAL data I supplied> You have actual sales from the 3 days which I supplied. This should be the same for all students. You have a Food Cost expense which asked all to use 30%. All students should have these numbers calculated at the same amounts and percentages. You are all working off the exact same numbers on this Food Cost expense and the provided Sales reports for the 3 days. You have some but not all of the information necessary to calculate Labor costs... You have 22 students for each service day and you have 5 hours of class time/work for those 22 students. What you need to calculate the Total Labor