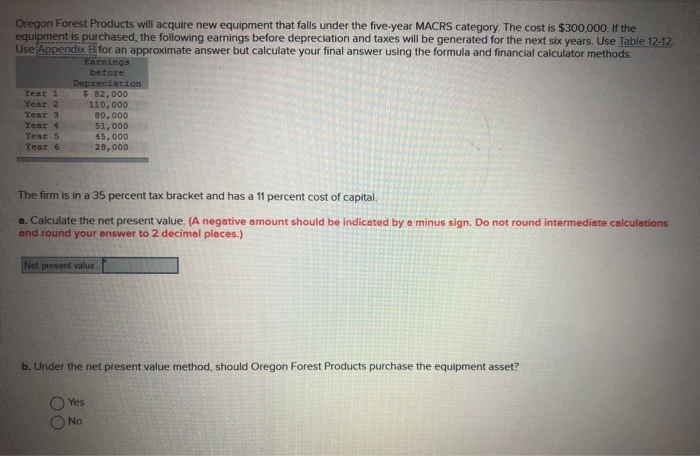

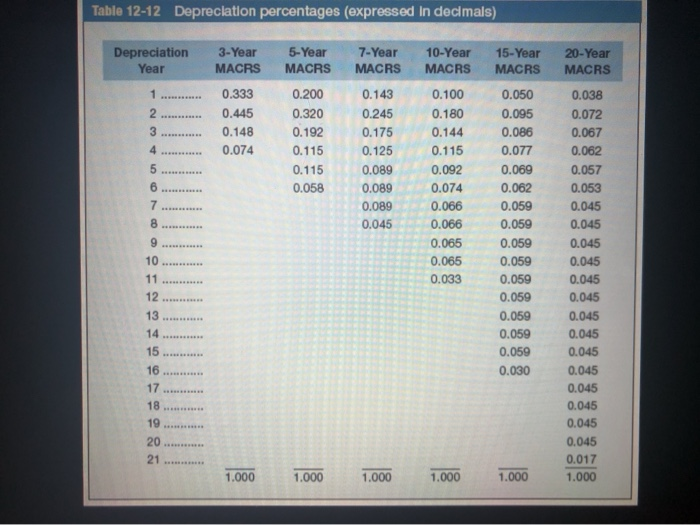

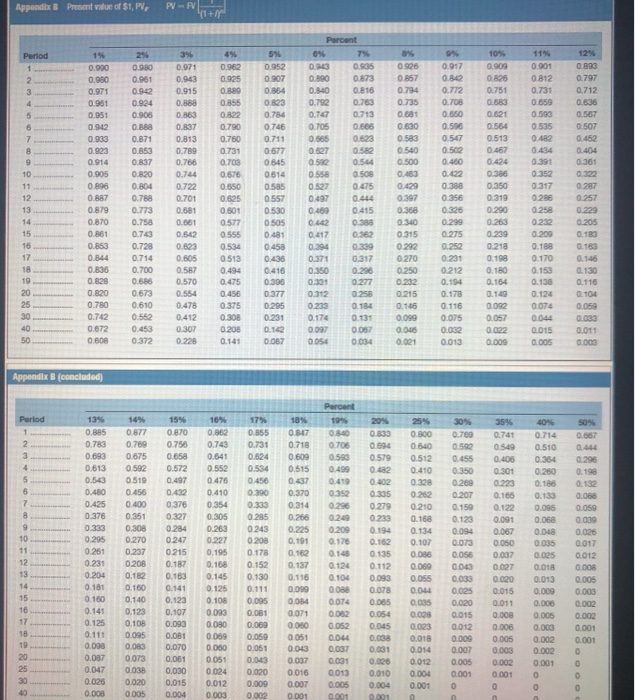

Oregon Forest Products will acquire new equipment that falls under the five-year MACRS category. The cost is $300,000. If the equipment is purchased, the following earnings before depreciation and taxes will be generated for the next six years. Use Table 12-12 Use Appendix for an approximate answer but calculate your final answer using the formula and financial calculator methods. Earnings before Depreciation Year 1 $ 82.000 Year 2 110,000 Year 3 80,000 Year 4 51,000 Year 5 45,000 Year 6 28,000 The firm is in a 35 percent tax bracket and has a 11 percent cost of capital. a. Calculate the net present value. (A negative amount should be indicated by a minus sign. Do not round intermediate calculations and round your answer to 2 decimal places.) Net present value b. Under the net present value method, should Oregon Forest Products purchase the equipment asset? O Yes NO Table 12-12 Depreciation percentages (expressed In decimals) Depreciation Year 3-Year 5-Year 7-Year 10-Year 15-Year 20-Year MACRS MACRS MACRS MACRS MACRS MACRS 0.333 0.200 0 .143 0.100 0.050 0.038 0.445 0.320 0.245 0.180 0.095 0.072 0.148 0.192 0.175 0.144 0.086 0.067 0.074 0.115 0.125 0.115 0.077 0.062 0.115 0.089 0.092 0.069 0.057 0.058 0.089 0.074 0.062 0.053 0.089 0.066 0.059 0.045 0.0450 .066 0.059 0.045 0.065 0.059 0.045 0.065 0.059 0.045 0.033 0.059 0.045 0.059 0.045 0.059 0.045 0.059 0.045 0.059 0.045 0.030 0.045 0.045 0.045 0.045 0.045 0.017 1.000 1.000 1.000 1.000 1.000 1.000 Appendix Present value of $1, PV, PV- Period 10% 0.909 0.001 0812 0 0 0.925 OBRO 0.855 0 13 0.890 0.840 0.792 0.747 0.705 565 0.952 0.907 0.864 0.03 0.784 0.746 0.711 0677 0545 0935 0.873 0.816 0.783 0.713 DEE 0.623 0926 0857 0.794 0.735 0.681 0.630 0 393 0.797 712 0.836 99 0.017 0.842 0.772 0.708 0.550 0.500 0.567 0502 0.660 OO 0.751 053 0.021 01564 0513 0.67 0.24 0790 0.750 0731 0700 SVE 0.507 0.859 0590 0535 62 044 0.391 0540 1500 0.361 0.544 508 8 D 0.429 0.590 055 0.527 0.497 03 15 256 0.000000 OLORO 0.961 0.971 0.942 0.981 0.924 0.951 0.900 0.88 0.983 0.871 0.853 0.914 0.837 0.905 0.820 0.896 0.804 0.758 0.879 0.773 0.870 0.758 0.70 0.853 0.729 0.844 0.714 0236 0.700 0.829 0.686 0.820 0.673 0.780 0.610 0.742 0.562 0.672 0.453 0.600 0.372 0717 0.071 0.963 0.915 0.88 0.863 DRS7 0.813 0.79 0.766 0.744 0.722 0.701 581 0.661 0.542 0.623 0.605 0.587 0.570 0.554 0.478 0.412 0.307 0.228 0.257 0415 05 0350 0310 0290 0263 0239 218 025 0242 0.275 0.205 0123 0.180 0525 0501 0577 0.555 5 0513 0.44 0.475 0.456 0.375 01308 0.200 0.340 0.315 0.292 0.270 0.250 0.317 0585 0557 0530 0.505 0.481 0458 0436 0416 0.396 0377 0.295 0.231 0.142 0087 0.130 0.142 0.417 0.294 0.371 0.350 0.301 012 0.238 0.174 0.097 O 054 10 0.164 0.140 8 8 8 8 8 8 0.277 0.258 0.134 0.131 0.067 0.014 0.231 0212 0.194 0.178 0.116 0.075 0.032 0.013 0.215 0.106 0.099 0.046 0.021 01059 0170 153 0.138 0.124 0074 00 01015 2005 0057 0.022 0.009 141 0011 GOS Appendix B (concluded Period 15% 105 0.862 073 0.355 0.444 0.783 0.693 0.613 0.847 0.718 0.609 0.515 0.437 0.370 0.314 0.266 0540 0706 0598 0.499 0.41 20% 0.833 500 0.579 0.682 0.42 305 0279 0800 0.540 0512 0.410 02209 0.132 0.30 0.330 0285 0.294 0210 168 0.039 0.200 0.178 0.194 Q1 161 8888888 0.480 0.425 0.376 0.333 0.295 0.261 0231 0.204 0.181 0.160 0.141 0.125 0.111 0.008 0.037 0.047 0.025 0.008 0270 0.237 0.208 0.182 0.160 0.140 0.123 0.108 0.095 0.083 0073 0.038 0.020 0.005 020 0.200 0.178 0.152 0.160 0.130 0.141 0.111 0.123 0.108 0.095 0.107 0.093 0081 0.093 0 080 0.069 0.001 0.069 0.050 0.0700 0500 051 0.061 0 051 0043 0.030 0.024 0.020 0.015 0.012 0.000 0.004 0.003 0.002 0.191 0.162 0.137 0.116 0.099 0,054 0.071 0.060 0.051 0.043 0.037 0.016 0.007 0.001 30% 0.700 0549 455 0.400 0.350 0.269 0.188 0.207 0.159 0.1095 0.123 01091 0.068 01067 0.048 DIO DOSO 0.035 0056 0.037 0.025 0.00 0.027 0.018 0.033 0.0200.013 0.025 0.015 0.009 0.0200.011 0.008 0015 000 0005 0.012 0.008 0.000 0.009 0.005 0.002 0.007 0.003 0.002 0.005 0.002 0.001 0.001 0.001 0 0 .124 0.104 0.088 0.074 0.062 01052 004 0.03 0.031 0.013 0.005 0.001 0.107 0.0 0 0 0 058 0.04 0.00 0.000 01023 0.018 0.014 0.012 0.004 0.001 0.112 0.093 0.078 0.065 0.054 0.045 0.033 0.001 0.026 0.010 0.004 0.001 0 0.017 0.012 0.00 0.005 0.005 0.002 01002 0.001 0.001 0 0 OO 0