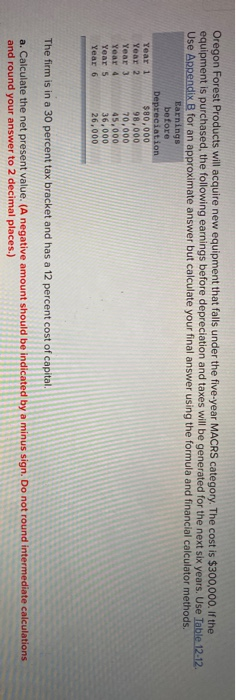

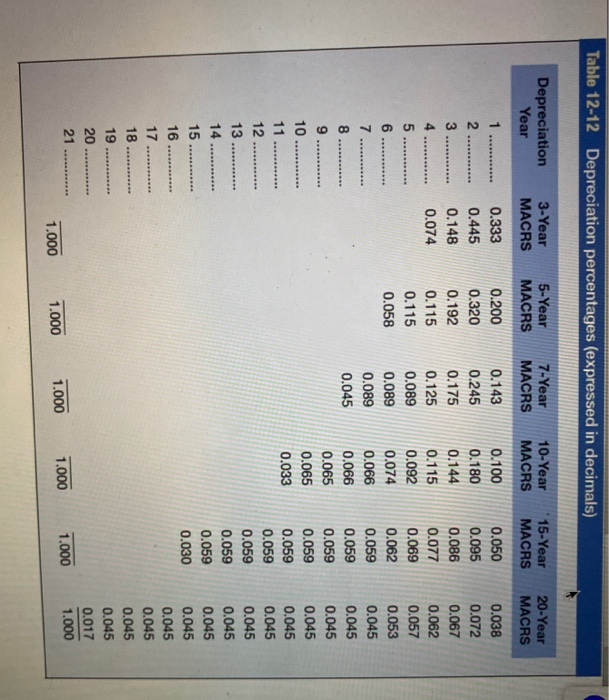

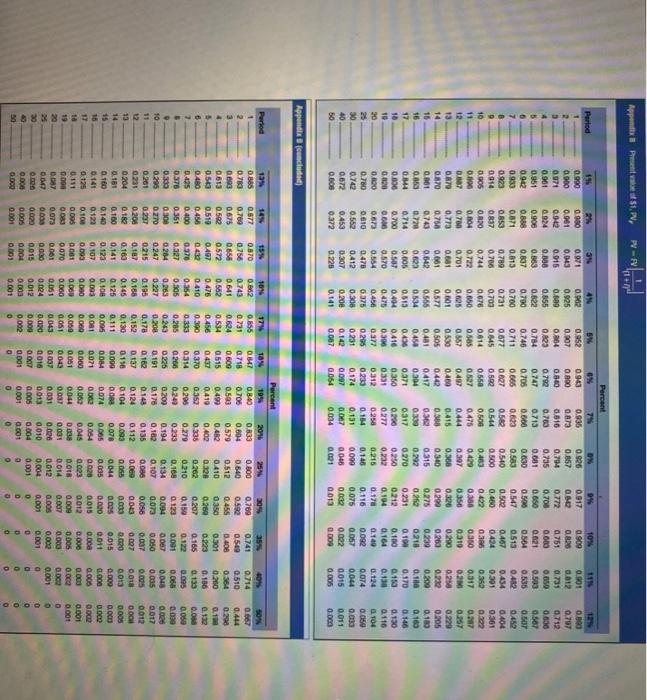

Oregon Forest Products will acquire new equipment that falls under the five-year MACRS category. The cost is $300,000. If the equipment is purchased, the following earnings before depreciation and taxes will be generated for the next six years. Use Table 12.12. Use Appendix B for an approximate answer but calculate your final answer using the formula and financial calculator methods. Earnings before Depreciation Year 1 $80,000 Year 2 98,000 Year 3 70,000 45,000 Year 5 36,000 Year 6 26,000 Year 4 The firm is in a 30 percent tax bracket and has a 12 percent cost of capital. a. Calculate the net present value. (A negative amount should be indicated by a minus sign. Do not round intermediate calculations and round your answer to 2 decimal places.) Table 12-12 Depreciation percentages (expressed in decimals), Depreciation Year 3-Year 5-Year MACRS MACRS 0.333 0.200 0.445 0.320 0.148 0.192 0.074 0.115 0.115 0.058 7-Year MACRS 0.143 0.245 0.175 0.125 0.089 0.089 0.089 0.045 10-Year MACRS 0.100 0.180 0.144 0.115 0.092 '15-Year MACRS 0.050 0.095 0.086 0.077 0.069 0.062 0.059 0.059 0.059 0.059 0.059 0.074 0.066 0.066 0.065 0.065 0.033 20-Year MACRS 0.038 0.072 0.067 0.062 0.057 0.053 0.045 0.045 0.045 0.045 0.045 0.045 0.045 0.045 0.045 0.045 0.045 0.045 0.045 0.045 0.017 1.000 0.059 0.059 0.059 0.059 0.030 1.000 1.000 1.000 1.000 1.000 Appendix Presentate of $17, W-NL Percent 0.971 0.043 0.000 0.952 0.007 0.864 0.001 0.812 0.002 0.025 0.00 0.155 0.822 0.015 0.90 0.890 0.640 072 0.74 0.705 0.665 10% 0.00 ..26 0.751 0.660 0.035 0.873 0.816 0.763 0.713 0.017 .8420 0.772 0.700 0.000 0.797 0.712 0.600 0.650 0.000 0.920 0.8570 0.794 0.735 0.001 0.650 0.583 0.540 0.500 0.784 0.746 0.711 0.677 0.83 0 0.700 547 0502 0.504 0.513 0.467 0424 0501 0.550 0.02 0702 675 0.352 0.317 0.300 DY 0.550 0.350 310 0.280 0.400 0.250 0.42 0.001 0.16 014 0.394 0.001 0.642 0.623 0.005 0.567 0.570 0.554 0478 0.160 0.140 0.371 0.006 0.700 0.350 0.307 0.368 0.340 0.315 0.282 0.270 0.250 0.232 0.215 0.146 0.090 0.046 0.021 0.415 0.388 0.36 0.339 0.317 0.00 0277 0.250 0.184 0.131 0.067 0.034 0.320 0.290 0.275 0.25 0.231 0212 0.104 0.178 0.110 0.075 0.002 0.013 0.000 0.780 0.72 0.672 0:391 0.312 0233 0.174 0.097 0.054 0.673 0.610 0.552 0.453 0.372 0.230 0218 0.100 0.100 0.164 0.149 0.092 0.057 0.022 0.000 0200 0.185 0.170 0.150 0.130 0.124 0.074 0.04 0.015 0.005 0.412 0.110 0.104 0.050 0.033 0.011 0.000 0.307 0.228 0.142 0.600 0.141 0087 AppendConcluded 0.800 0.780 0.667 0.700 UN 0.833 0.594 0.579 0.482 0.402 0.675 0542 0.714 0.510 0.000 0.640 0.512 0.410 0.300 0.70 0.592 0.455 0.350 0.741 0.549 0.405 0.301 0.223 0.165 0.100 0.200 0.136 0.207 0.150 0.000 0.050 0.210 0.168 0.134 0.107 0.050 0.048 0.035 0.073 0056 000 0.017 0.012 0.112 0.000 0.078 0.000 0.055 0.04 0.005 0.130 0.111 0.005 0.081 0.000 0.005 0.027 0018 0.00 0.013 0.015 0.000 0.0110.000 0.008 0.005 0.123 0.100 0.015 0.012 0.160 0.141 0.125 0.111 0.000 0.067 0047 0.000 BBBBBBB 0.002 0.062 0.044 0.037 0.054 0.045 0.030 0.001 0.00 0.001 0.059 0.000 0.000 0.000 0.051 0.004 0.070 0.001 0.030 0.015 0.083 Gora 0.036 0.020 0.006 0.051 0.043 0.020 0.003 0.097 0.018 0.007 0.003 0.018 0014 0.012 0.004 0.001 0.005 0.000 0.002 0.001 0.013 0.001 0.009 0.005 0.00 0.010 0.004 0.001 0.001 0.001 0.001 000