Question

Zizou Acquatics wants to compare two possible capital structures. In the first, the company would have 190,000 shares of stock outstanding. In the second,

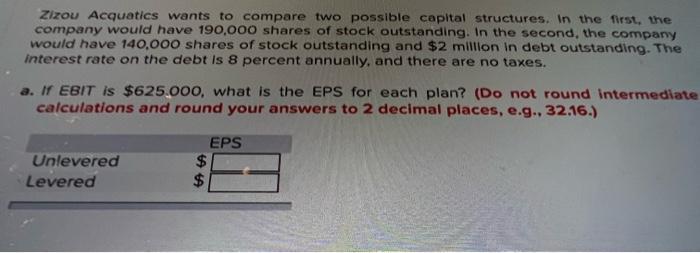

Zizou Acquatics wants to compare two possible capital structures. In the first, the company would have 190,000 shares of stock outstanding. In the second, the company would have 140,000 shares of stock outstanding and $2 million in debt outstanding. The interest rate on the debt is 8 percent annually, and there are no taxes. a. If EBIT is $625.000, what is the EPS for each plan? (Do not round intermediate calculations and round your answers to 2 decimal places, e.g., 32.16.) Unlevered Levered EPS

Step by Step Solution

3.51 Rating (161 Votes )

There are 3 Steps involved in it

Step: 1

Question Answers The EPS under unlevered plan is computed as shown below EBIT Number ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get StartedRecommended Textbook for

Managerial Accounting

Authors: Ray H. Garrison, Eric W. Noreen, Peter C. Brewer

13th Edition

978-0073379616, 73379611, 978-0697789938

Students also viewed these Accounting questions

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

View Answer in SolutionInn App