Answered step by step

Verified Expert Solution

Question

1 Approved Answer

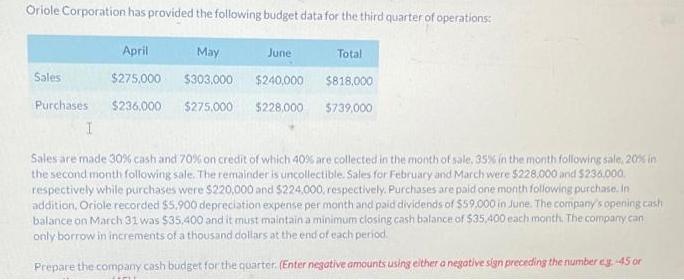

Oriole Corporation has provided the following budget data for the third quarter of operations: April May June Total Sales $275,000 $303,000 $240,000 $818,000 $236,000

Oriole Corporation has provided the following budget data for the third quarter of operations: April May June Total Sales $275,000 $303,000 $240,000 $818,000 $236,000 $275,000 $228,000 $739,000 Purchases I Sales are made 30% cash and 70% on credit of which 40% are collected in the month of sale, 35% in the month following sale, 20% in the second month following sale. The remainder is uncollectible. Sales for February and March were $228,000 and $236,000. respectively while purchases were $220,000 and $224,000, respectively. Purchases are paid one month following purchase. In addition, Oriole recorded $5,900 depreciation expense per month and paid dividends of $59,000 in June. The company's opening cash balance on March 31 was $35.400 and it must maintain a minimum closing cash balance of $35,400 each month. The company. can only borrow in increments of a thousand dollars at the end of each period. Prepare the company cash budget for the quarter. (Enter negative amounts using either a negative sign preceding the number eg.-45 or

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Oriole Corporation Cash Budget Third Quarter Data Summary Description April May June Total Sales 275...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started