Answered step by step

Verified Expert Solution

Question

1 Approved Answer

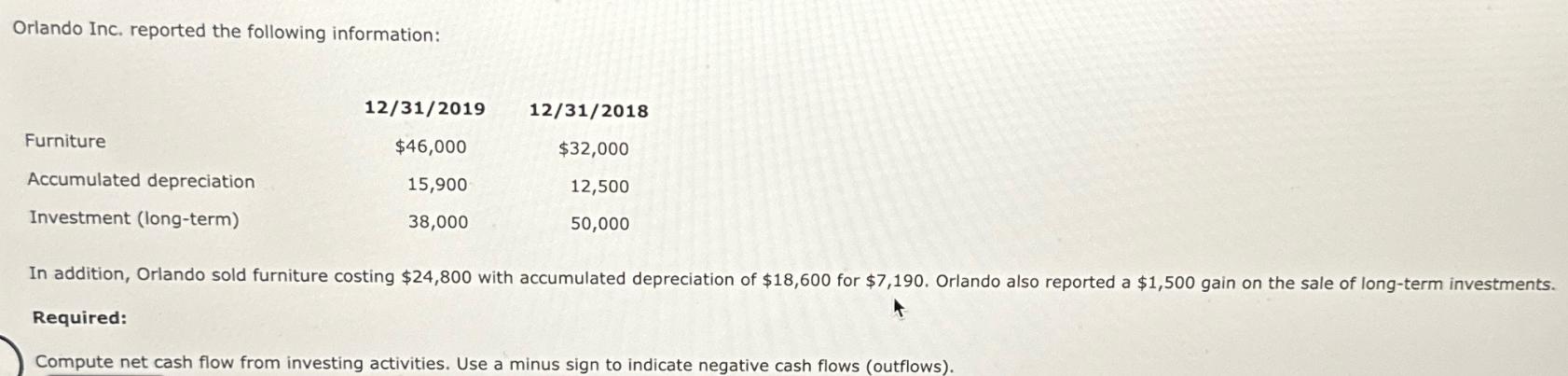

Orlando Inc. reported the following information: Furniture Accumulated depreciation Investment (long-term) 12/31/2019 12/31/2018 $46,000 $32,000 15,900 38,000 12,500 50,000 In addition, Orlando sold furniture

Orlando Inc. reported the following information: Furniture Accumulated depreciation Investment (long-term) 12/31/2019 12/31/2018 $46,000 $32,000 15,900 38,000 12,500 50,000 In addition, Orlando sold furniture costing $24,800 with accumulated depreciation of $18,600 for $7,190. Orlando also reported a $1,500 gain on the sale of long-term investments. Required: Compute net cash flow from investing activities. Use a minus sign to indicate negative cash flows (outflows).

Step by Step Solution

★★★★★

3.32 Rating (149 Votes )

There are 3 Steps involved in it

Step: 1

Net Cash Flow from Investing Activities for Orlando Inc Cash Inflows No...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started