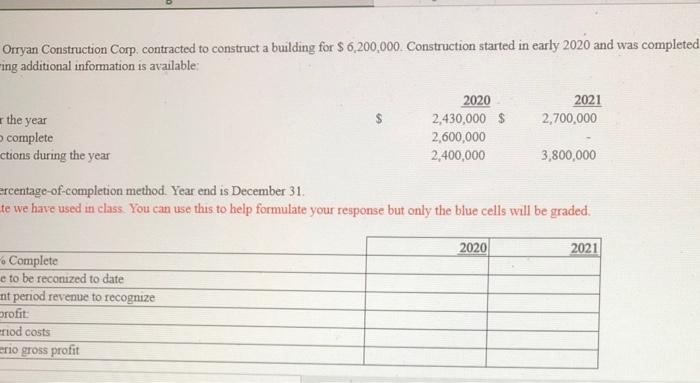

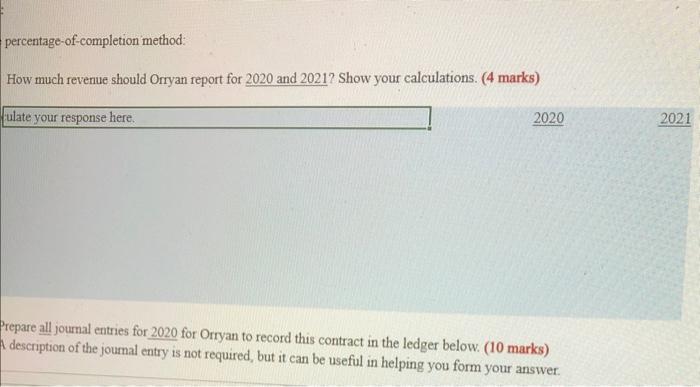

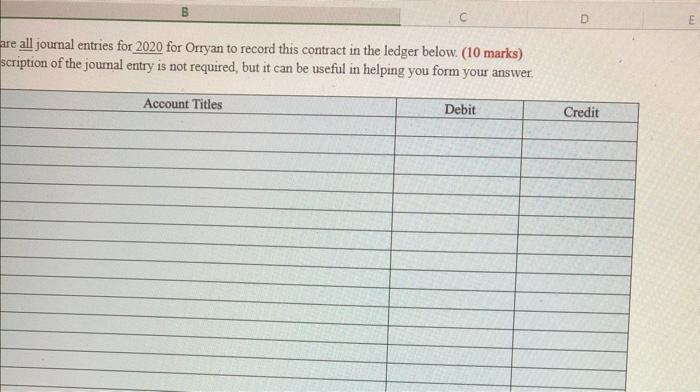

Orryan Construction Corp. contracted to construct a building for $ 6,200,000. Construction started in early 2020 and was completed -ing additional information is available: 2021 2,700,000 the year complete ctions during the year 2020 2,430,000 $ 2,600,000 2,400,000 3,800,000 ercentage-of-completion method. Year end is December 31. te we have used in class. You can use this to help formulate your response but only the blue cells will be graded. 2020 2021 Complete e to be reconized to date ent period revenue to recognize profit eriod costs erio gross profit percentage-of-completion method: How much revenue should Orryan report for 2020 and 2021? Show your calculations. (4 marks) ulate your response here. 2020 2021 Prepare all journal entries for 2020 for Orryan to record this contract in the ledger below. (10 marks) description of the journal entry is not required, but it can be useful in helping you form your answer. D E are all journal entries for 2020 for Orryan to record this contract in the ledger below. (10 marks) scription of the journal entry is not required, but it can be useful in helping you form your answer. Account Titles Debit Credit B yan is reporting using IFRS, and it was determined there was significant uncertainty in relation to the costs of the act, what gross profit would be reported in the 2020 year end for this contract? (2 marks) Orryan Construction Corp. contracted to construct a building for $ 6,200,000. Construction started in early 2020 and was completed -ing additional information is available: 2021 2,700,000 the year complete ctions during the year 2020 2,430,000 $ 2,600,000 2,400,000 3,800,000 ercentage-of-completion method. Year end is December 31. te we have used in class. You can use this to help formulate your response but only the blue cells will be graded. 2020 2021 Complete e to be reconized to date ent period revenue to recognize profit eriod costs erio gross profit percentage-of-completion method: How much revenue should Orryan report for 2020 and 2021? Show your calculations. (4 marks) ulate your response here. 2020 2021 Prepare all journal entries for 2020 for Orryan to record this contract in the ledger below. (10 marks) description of the journal entry is not required, but it can be useful in helping you form your answer. D E are all journal entries for 2020 for Orryan to record this contract in the ledger below. (10 marks) scription of the journal entry is not required, but it can be useful in helping you form your answer. Account Titles Debit Credit B yan is reporting using IFRS, and it was determined there was significant uncertainty in relation to the costs of the act, what gross profit would be reported in the 2020 year end for this contract? (2 marks)