Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Oryx Investment Properties has three properties, details of which are listed below. The company uses the cost model for property, plant and equipment and

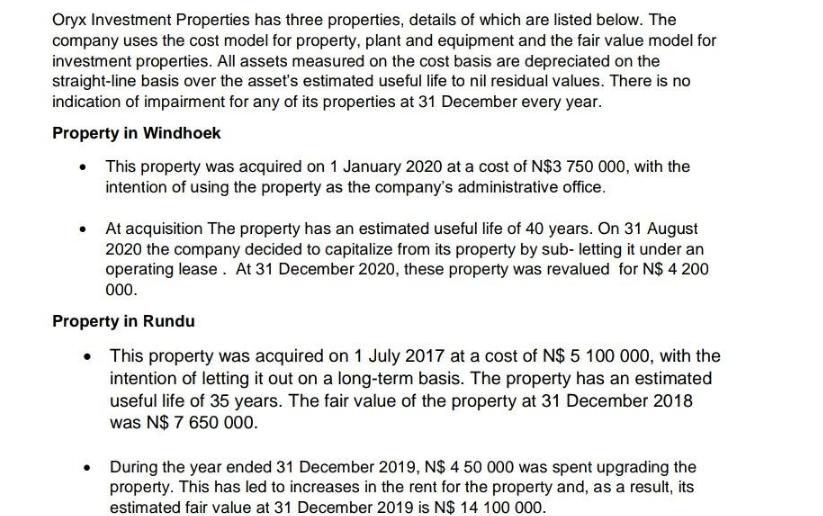

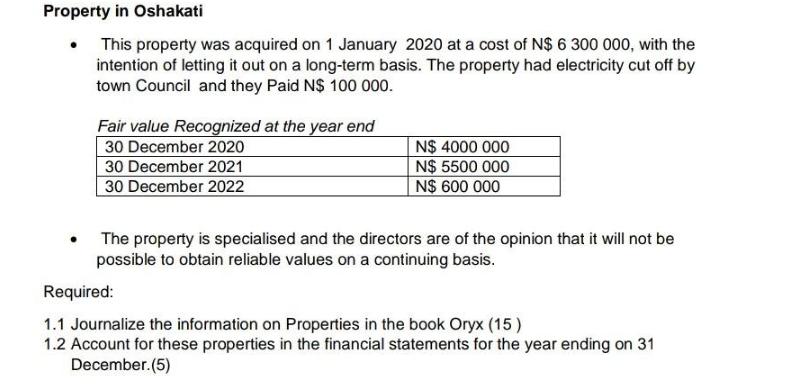

Oryx Investment Properties has three properties, details of which are listed below. The company uses the cost model for property, plant and equipment and the fair value model for investment properties. All assets measured on the cost basis are depreciated on the straight-line basis over the asset's estimated useful life to nil residual values. There is no indication of impairment for any of its properties at 31 December every year. Property in Windhoek This property was acquired on 1 January 2020 at a cost of N$3 750 000, with the intention of using the property as the company's administrative office. At acquisition The property has an estimated useful life of 40 years. On 31 August 2020 the company decided to capitalize from its property by sub- letting it under an operating lease. At 31 December 2020, these property was revalued for N$ 4 200 000. Property in Rundu This property was acquired on 1 July 2017 at a cost of N$ 5 100 000, with the intention of letting it out on a long-term basis. The property has an estimated useful life of 35 years. The fair value of the property at 31 December 2018 was N$ 7 650 000. . During the year ended 31 December 2019, N$ 4 50 000 was spent upgrading the property. This has led to increases in the rent for the property and, as a result, its estimated fair value at 31 December 2019 is N$ 14 100 000.

Step by Step Solution

★★★★★

3.35 Rating (161 Votes )

There are 3 Steps involved in it

Step: 1

11 Journalizing the information for Oryx Investment Properties Property in Windhoek On January 1 202...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started