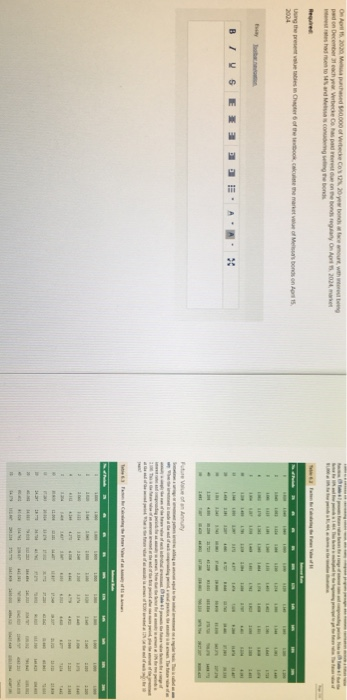

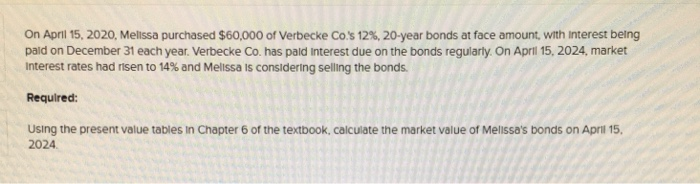

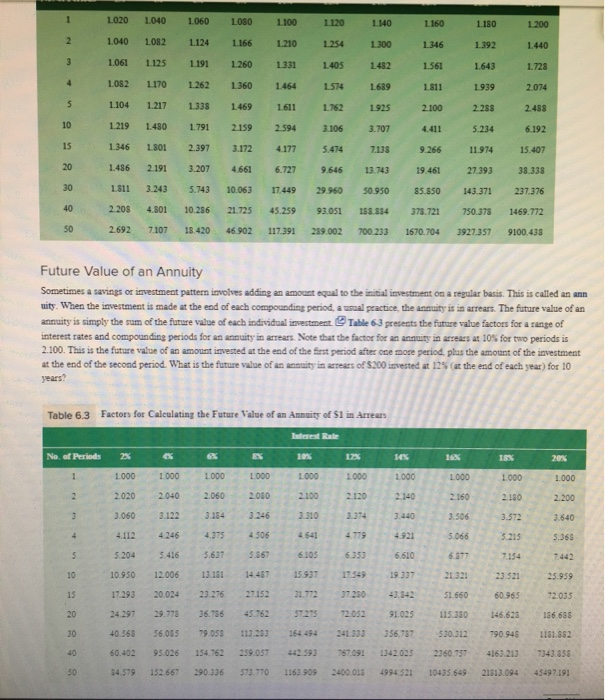

Os 2020 e 60.000 ped on Decembeach yeur Verbrece has do 20 bandement where rebonden on 2014 Here Ung the presentes in Chapter of th e the man verbonds on AS BI VS EE3 aa A. mm On April 15, 2020, Melissa purchased $60,000 of Verbecke Co.'s 12%, 20-year bonds at face amount, with interest being pald on December 31 each year. Verbecke Co. has paid interest due on the bonds regularly. On April 15, 2024, market Interest rates had risen to 14% and Melissa is considering selling the bonds. Required: Using the present value tables in Chapter 6 of the textbook, calculate the market value of Melissa's bonds on April 15. 2024 1 2 1 3 + 5 10 15 20 30 40 .020 1.040 1060 1090 100 .040_10121.124 1.166 1.210 1.061 1125 1.191 1.260 1331 1082 LITO 1262 1360 1.464 104 1.217 1.338 .469 161 1 219 1480 1791 2159 2594 1.346 101 2.397 31124177 1436 2191 3.20746616.721 18 3.243 5.74 10.063 17.449 2.2084301 10.286 21.725 45.259 2.692 7107 18420 46.902 117.391 1120 125 1.405 1514 1962 3.106 5.474 9645 29.960 93.01 289.002 1.10 1.160 1.300 1.96 142 1.561 1 689 1.311 1925 2.100 3.707 1.411 73339 .266 13.1 19.461 50.950 5.350 18.04 17.721 700 23 1670.704 1.180 1392 1643 939 2.285 5.234 11914 2739 13.371 750.373 3927.357 1200 1.449 1.728 2.074 2431 6.192 15.407 33.33 237.376 1469.712 9100.438 Future Value of an Annuity Sometimes a savings or investment pattern involves adding an amount equal to the initial investment on a regular basis. This is called an ann uits. When the investment is made at the end of each compounding period, a usual practice, the annuity is in arrears. The future value of an annuity is simply the sum of the future value of each individual investment Table 6-3 presents the future value factors for a range of interest rates and compounding periods for an annuity in arrears. Note that the factor for an annuity in arrears at 10S for two periods is 2.100. This is the future value of an amount invested at the end of the first period after one more period, plus the amount of the investment at the end of the second period. What is the future value of an annuity in areas of $200 invested at 125 at the end of each year) for 10 Table 6.3 Factor for Calculating the Future Value of an Annuity of $1 in Arrears 1.000 1.000 1.000 1000 2.30 3.67 6.105 4345 5 204 5.416 10.950 12.006 11.393 20.034 24.297 29.773 40.368 36055 60.40295.026 14.579 152.667 000 1.000 1000 1000 1.000 2.340 2.100 3.640 5066 3.215 5.365 6.350 6.510 6.577 7154 7.442 15.937 19.307 25.959 21772 51560 60.965 72033 57.275 72.052 91025 115.330 146.623 156.685 154 494 241.333 356.787 530.312 790.943 1151.552 2.593757091 1342.0252360.7974163.2137343.855 1963 909 3400.0134994.52110435.549 21813.09445497.191 23.276 27152 3 6.756 45.762 79.058 113253 154.762 259057 290.336593.770