Answered step by step

Verified Expert Solution

Question

1 Approved Answer

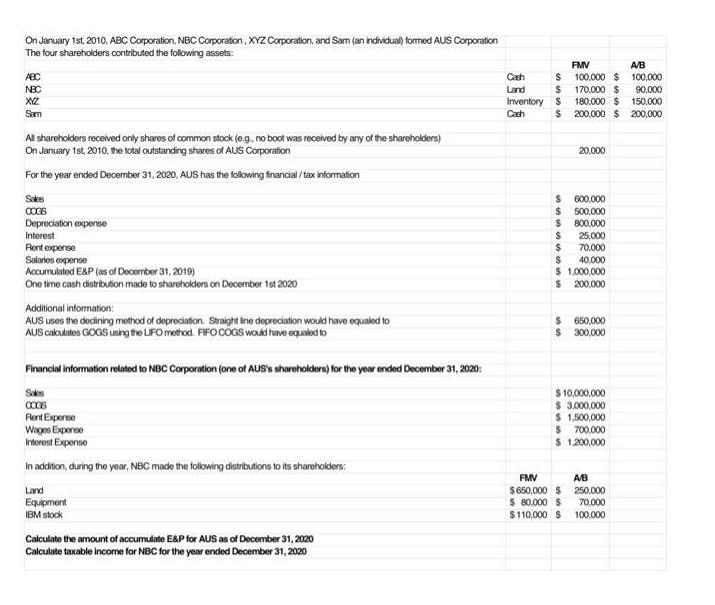

On January 1st, 2010, ABC Corporation, NBC Corporation, XYZ Corporation, and Sam (an individual) formed AUS Corporation The four shareholders contributed the following assets:

On January 1st, 2010, ABC Corporation, NBC Corporation, XYZ Corporation, and Sam (an individual) formed AUS Corporation The four shareholders contributed the following assets: ABC NBC XYZ Sam Al shareholders received only shares of common stock (e.g., no boot was received by any of the shareholders) On January 1st, 2010, the total outstanding shares of AUS Corporation For the year ended December 31, 2020, AUS has the following financial/tax information Sales COGS Depreciation expense Interest Rent expense Salaries expense Accumulated E&P (as of December 31, 2019) One time cash distribution made to shareholders on December 1st 2020 Additional information: AUS uses the declining method of depreciation. Straight line depreciation would have equaled to AUS calculates GOGS using the LIFO method. FIFO COGS would have equaled to Financial information related to NBC Corporation (one of AUS's shareholders) for the year ended December 31, 2020: Saks COGS Rent Expense Wages Expense Interest Expense In addition, during the year, NBC made the following distributions to its shareholders: Land Equipment IBM stock Calculate the amount of accumulate E&P for AUS as of December 31, 2020 Calculate taxable income for NBC for the year ended December 31, 2020 Cash Land Inventory Cash $ ssss $ S $ $ $ $ 600,000 500,000 800,000 25,000 70,000 40,000 $1,000,000 200,000 ssssss $ $ $ $ S $ FMV 100,000 $ 170,000 $ 180,000 $ 200,000 $200,000 20,000 FMV $650,000 $ $ 80,000 $ $110,000 $ 650,000 300,000 $10,000,000 $ 3,000,000 $ 1,500,000 $ 700,000 $ 1,200,000 A/B 100,000 90,000 150,000 A/B 250,000 70.000 100.000

Step by Step Solution

★★★★★

3.46 Rating (169 Votes )

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started