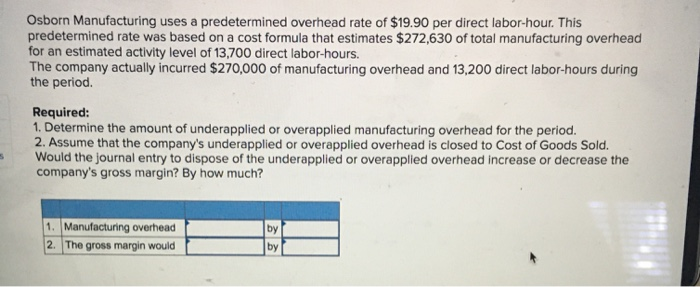

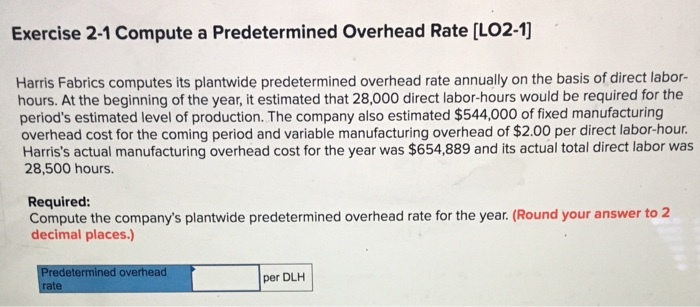

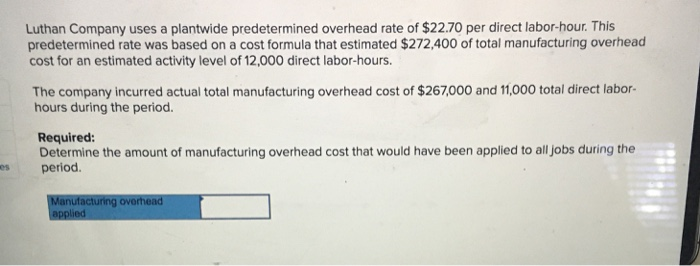

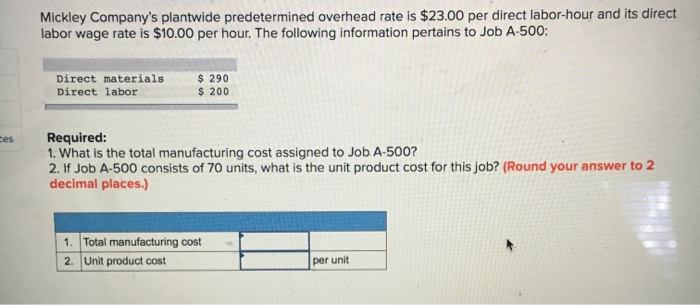

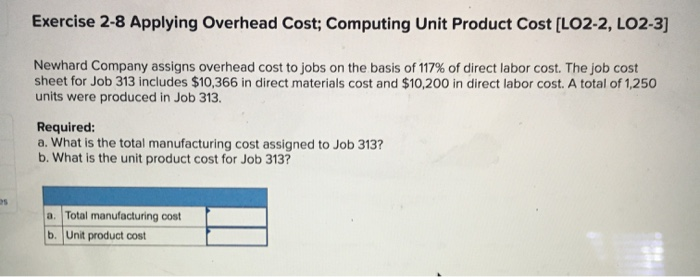

Osborn Manufacturing uses a predetermined overhead rate of $19.90 per direct labor-hour. This predetermined rate was based on a cost formula that estimates $272,630 of total manufacturing overhead for an estimated activity level of 13,700 direct labor-hours. The company actually incurred $270,000 of manufacturing overhead and 13,200 direct labor-hours during the period. Required: 1. Determine the amount of underapplied or overapplied manufacturing overhead for the period. 2. Assume that the company's underapplied or overapplied overhead is closed to cost of Goods Sold. Would the journal entry to dispose of the underapplied or overapplied overhead increase or decrease the company's gross margin? By how much? 5 by 1. Manufacturing overhead 2. The gross margin would by Exercise 2-1 Compute a Predetermined Overhead Rate (LO2-1) Harris Fabrics computes its plantwide predetermined overhead rate annually on the basis of direct labor- hours. At the beginning of the year, it estimated that 28,000 direct labor-hours would be required for the period's estimated level of production. The company also estimated $544,000 of fixed manufacturing overhead cost for the coming period and variable manufacturing overhead of $2.00 per direct labor-hour. Harris's actual manufacturing overhead cost for the year was $654,889 and its actual total direct labor was 28,500 hours. Required: Compute the company's plantwide predetermined overhead rate for the year. (Round your answer to 2 decimal places.) Predetermined overhead per DLH rate Luthan Company uses a plantwide predetermined overhead rate of $22.70 per direct labor-hour. This predetermined rate was based on a cost formula that estimated $272,400 of total manufacturing overhead cost for an estimated activity level of 12,000 direct labor-hours. The company incurred actual total manufacturing overhead cost of $267,000 and 11,000 total direct labor- hours during the period. Required: Determine the amount of manufacturing overhead cost that would have been applied to all jobs during the period. Manufacturing overhead applied Mickley Company's plantwide predetermined overhead rate is $23.00 per direct labor-hour and its direct labor wage rate is $10.00 per hour. The following information pertains to Job A-500: Direct materials Direct labor $ 290 $ 200 es Required: 1. What is the total manufacturing cost assigned to Job A-500? 2. If Job A-500 consists of 70 units, what is the unit product cost for this job? (Round your answer to 2 decimal places.) 1. Total manufacturing cost 2. Unit product cost per unit Exercise 2-8 Applying Overhead Cost; Computing Unit Product Cost [LO2-2, LO2-3] Newhard Company assigns overhead cost to jobs on the basis of 117% of direct labor cost. The job cost sheet for Job 313 includes $10,366 in direct materials cost and $10,200 in direct labor cost. A total of 1,250 units were produced in Job 313. Required: a. What is the total manufacturing cost assigned to Job 313? b. What is the unit product cost for Job 313? a. Total manufacturing cost b. Unit product cost