Answered step by step

Verified Expert Solution

Question

1 Approved Answer

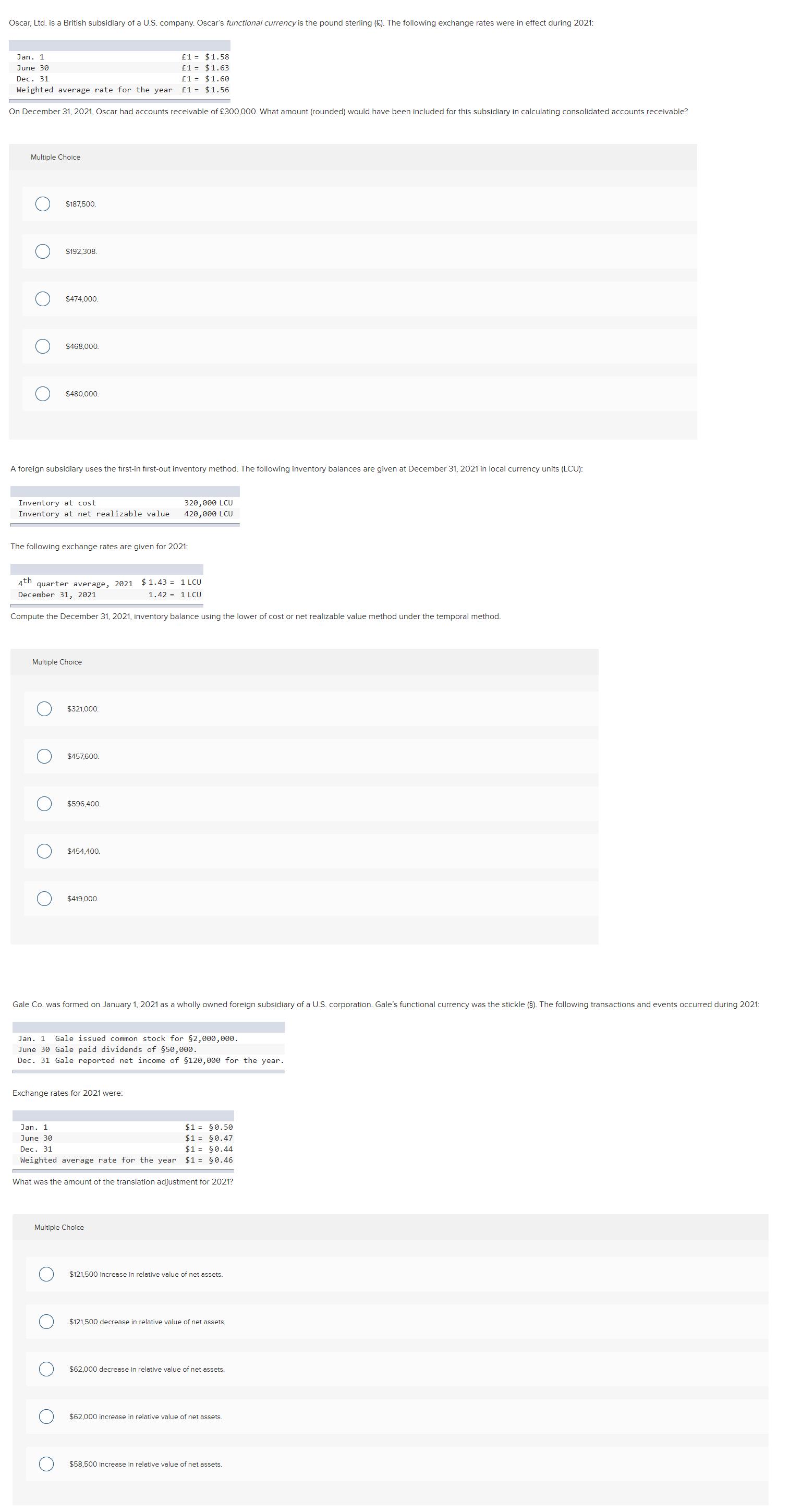

Oscar, Ltd. is a British subsidiary of a U.S. company. Oscar's functional currency is the pound sterling (). The following exchange rates were in

Oscar, Ltd. is a British subsidiary of a U.S. company. Oscar's functional currency is the pound sterling (). The following exchange rates were in effect during 2021: Jan. 1 1 = $1.58 1 = $1.63 1 = $1.60 1 = $1.56 June 30 Dec. 31 Weighted average rate for the year On December 31, 2021, Oscar had accounts receivable of 300,000. What amount (rounded) would have been included for this subsidiary in calculating consolidated accounts receivable? Multiple Choice $187,500. $192,308. $474,000. $468.000. $480,000. A foreign subsidiary uses the first-in first-out inventory method. The following inventory balances are given at December 31, 2021 in local currency units (LCU): 320,000 LCU 420,000 LCU Inventory at cost Inventory at net realizable value The following exchange rates are given for 2021: $ 1.43 = 1 LCU 1.42 = 1 LCU 4th quarter average, 2021 December 31, 2021 Compute the December 31, 2021, inventory balance using the lower of cost or net realizable value method under the temporal method. Multiple Choice $321.000. $457,600. $596,400. $454.400. $419,000. Gale Co. was formed on January 1, 2021 as a wholly owned foreign subsidiary of a U.S. corporation. Gale's functional currency was the stickle (S). The following transactions and events occurred during 2021: Jan. 1 Gale issued common stock for 2,000,000. June 30 Gale paid dividends of 50,000. Dec. 31 Gale reported net income of 120,000 for the year. Exchange rates for 2021 were: $1 = 50.50 $1 = 50.47 $1 = 0.44 $1 = 50.46 Jan. 1 June 30 Dec. 31 Weighted average rate for the year What was the amount of the translation adjustment for 2021? Multiple Choice $121,500 increase in relative value of net assets. $121,500 decrease in relative value of net assets. $62,000 decrease in relative value of net assets. $62,000 increase in relative value of net assets. $58,500 increase in relative value of net assets.

Step by Step Solution

★★★★★

3.47 Rating (167 Votes )

There are 3 Steps involved in it

Step: 1

The answer of above qu...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started