Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Oscar Manufacturing Co. Ltd. is a British based company that regularly receives orders from the Euro zone countries. Some raw materials are imported from

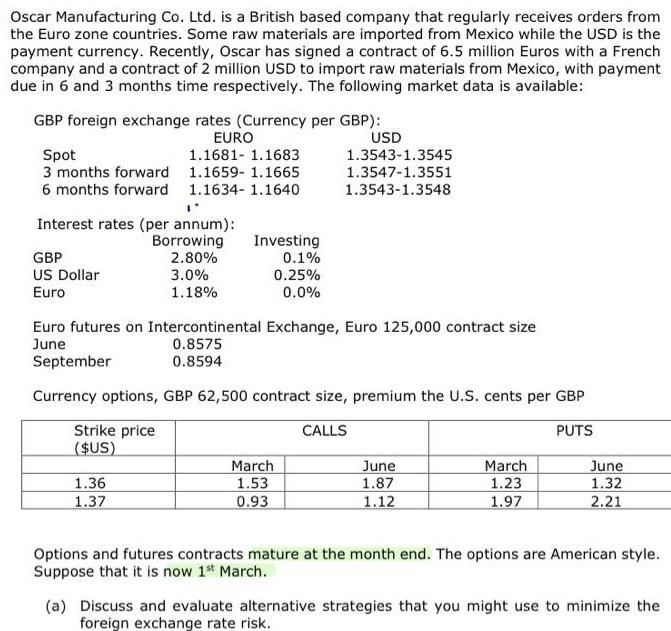

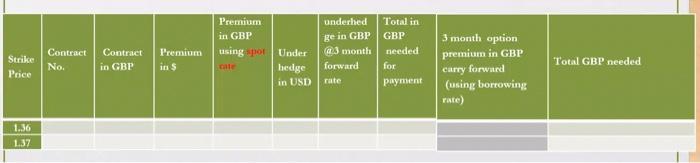

Oscar Manufacturing Co. Ltd. is a British based company that regularly receives orders from the Euro zone countries. Some raw materials are imported from Mexico while the USD is the payment currency. Recently, Oscar has signed a contract of 6.5 million Euros with a French company and a contract of 2 million USD to import raw materials from Mexico, with payment due in 6 and 3 months time respectively. The following market data is available: GBP foreign exchange rates (Currency per GBP): EURO Spot 1.1681 1.1683 3 months forward 1.1659- 1.1665 6 months forward 1.1634- 1.1640 Interest rates (per annum): Borrowing 2.80% 3.0% 1.18% GBP US Dollar Euro Investing 0.1% 0.25% 0.0% 1.36 1.37 Euro futures on Intercontinental Exchange, Euro 125,000 contract size June 0.8575 September 0.8594 Currency options, GBP 62,500 contract size, premium the U.S. cents per GBP Strike price CALLS PUTS ($US) USD 1.3543-1.3545 1.3547-1.3551 1.3543-1.3548 March 1.53 0.93 June 1.87 1.12 March 1.23 1.97 June 1.32 2.21 Options and futures contracts mature at the month end. The options are American style. Suppose that it is now 1st March. (a) Discuss and evaluate alternative strategies that you might use to minimize the foreign exchange rate risk. Strike Price 1.36 1.37 Contract No. Contract in GBP Premium in $ Premium in GBP underhed ge in GBP @3 month using spot Under hedge in USD rate forward Total in GBP needed for payment 3 month option premium in GBP carry forward (using borrowing rate) Total GBP needed

Step by Step Solution

★★★★★

3.52 Rating (166 Votes )

There are 3 Steps involved in it

Step: 1

Foreign Exchange Rate Risk Minimization Strategies for Oscar Manufacturing Oscar Manufacturing can use a variety of strategies to minimize its foreign exchange rate risk Natural hedge This involves ma...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started