Answered step by step

Verified Expert Solution

Question

1 Approved Answer

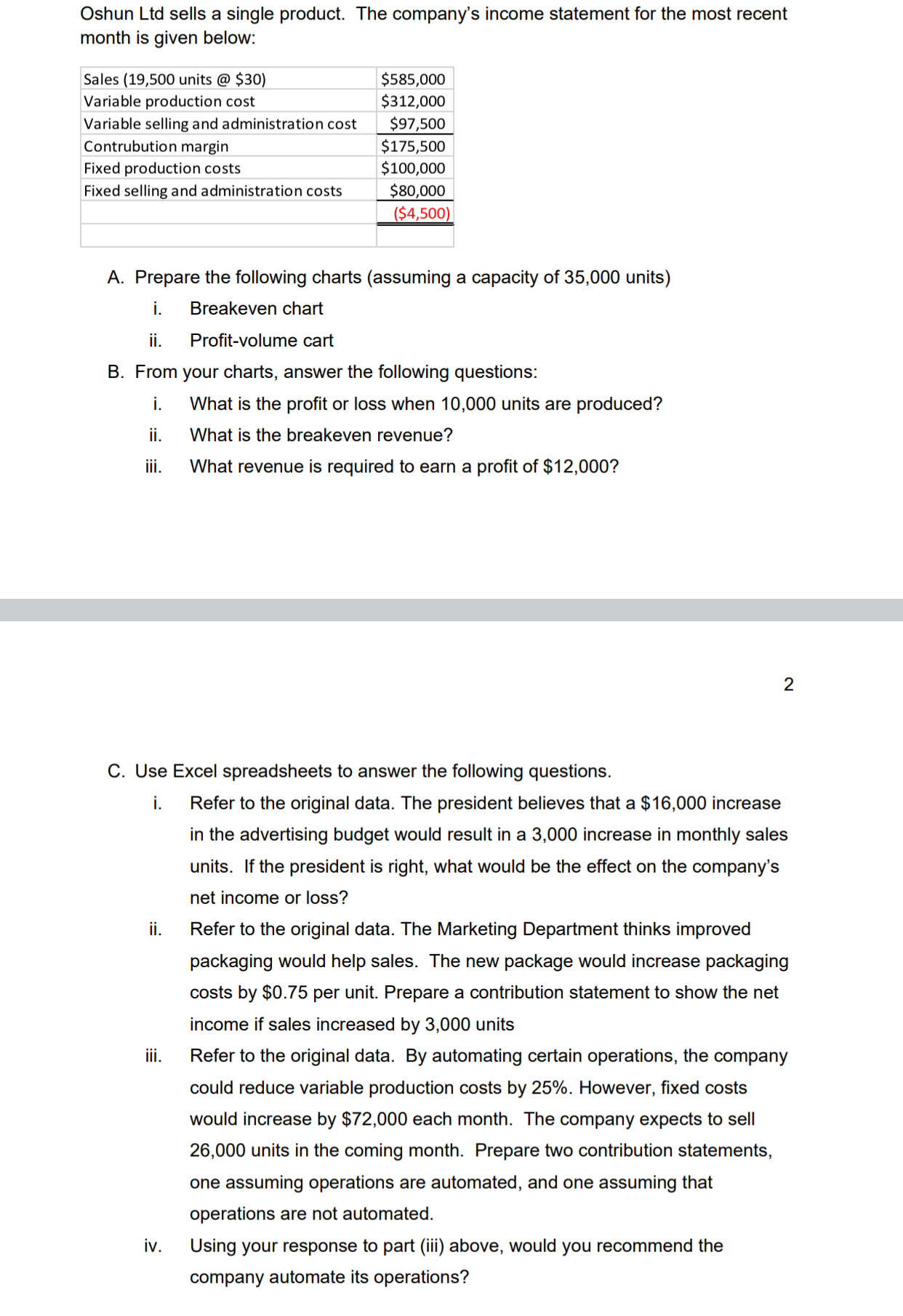

Oshun Ltd sells a single product. The company's income statement for the most recent month is given below: Sales (19,500 units @ $30) $585,000

Oshun Ltd sells a single product. The company's income statement for the most recent month is given below: Sales (19,500 units @ $30) $585,000 Variable production cost $312,000 Variable selling and administration cost $97,500 Contrubution margin $175,500 Fixed production costs $100,000 Fixed selling and administration costs $80,000 ($4,500) A. Prepare the following charts (assuming a capacity of 35,000 units) i. ii. Breakeven chart Profit-volume cart B. From your charts, answer the following questions: . What is the profit or loss when 10,000 units are produced? ii. What is the breakeven revenue? iii. What revenue is required to earn a profit of $12,000? 2 C. Use Excel spreadsheets to answer the following questions. i. Refer to the original data. The president believes that a $16,000 increase in the advertising budget would result in a 3,000 increase in monthly sales units. If the president is right, what would be the effect on the company's net income or loss? ii. iii. iv. Refer to the original data. The Marketing Department thinks improved packaging would help sales. The new package would increase packaging costs by $0.75 per unit. Prepare a contribution statement to show the net income if sales increased by 3,000 units Refer to the original data. By automating certain operations, the company could reduce variable production costs by 25%. However, fixed costs would increase by $72,000 each month. The company expects to sell 26,000 units in the coming month. Prepare two contribution statements, one assuming operations are automated, and one assuming that operations are not automated. Using your response to part (iii) above, would you recommend the company automate its operations?

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started