Answered step by step

Verified Expert Solution

Question

1 Approved Answer

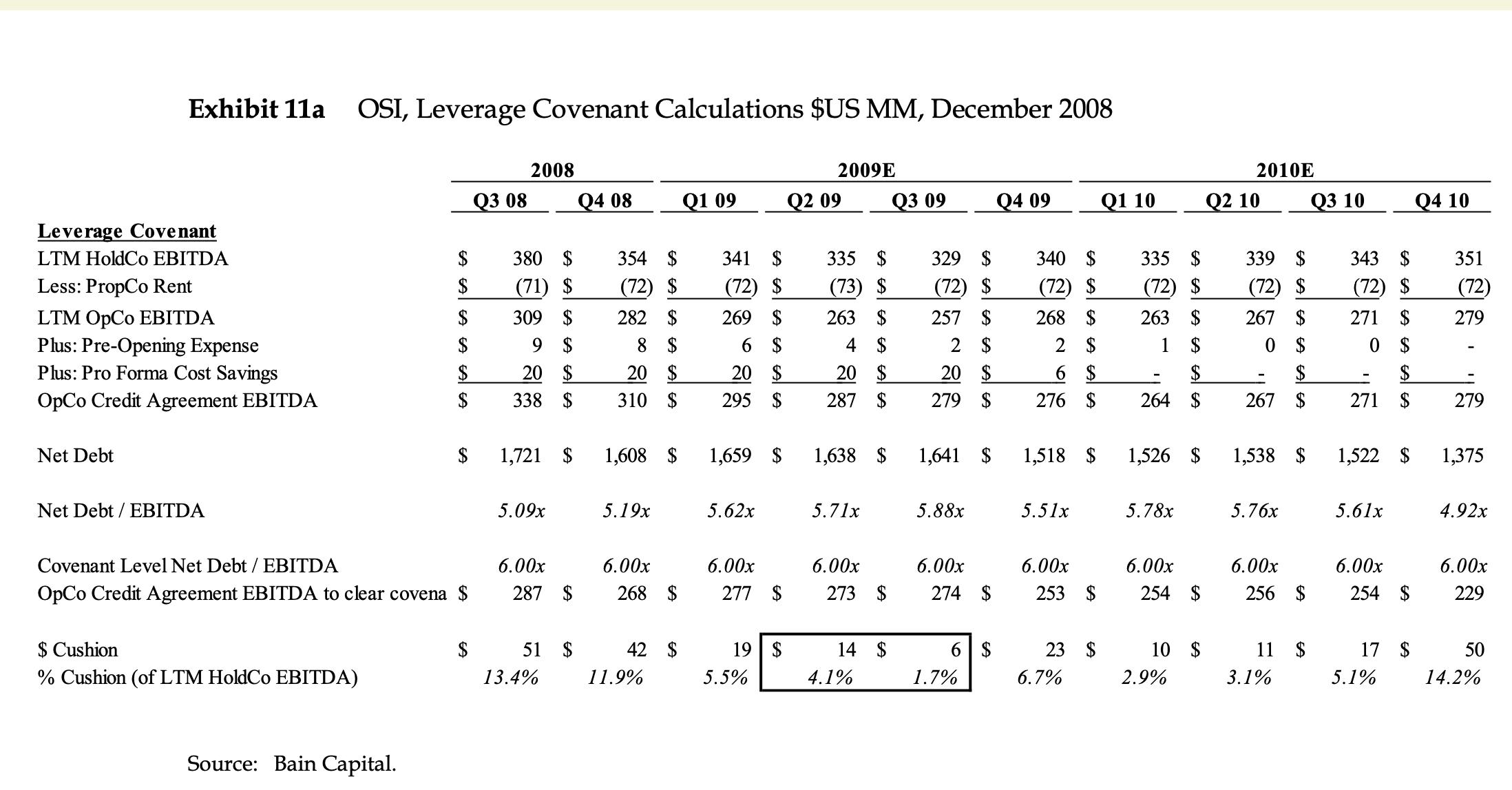

OSI has to maintain a Net Debt/EBITDA ratio of 6.0x to comply with the covenants in its bank agreement. They were concerned that they

OSI has to maintain a Net Debt/EBITDA ratio of 6.0x to comply with the covenants in its bank agreement. They were concerned that they would run dangerously close to failing that test during 2009. In particular, they were worried about the 2Q 2009. If they used $42 million to buy back their high yield bonds at 29.6 cents on the dollar, what would their Net Debt/EBITDA ratio be as of the end of the 2Q of 2009? See Exhibit 11a of the case for more information. You can use Exhibit 11a from the case or the version shown above. Format 1.23x as 1.23 Exhibit 11a OSI, Leverage Covenant Calculations $US MM, December 2008 Leverage Covenant LTM HoldCo EBITDA Less: PropCo Rent LTM OpCo EBITDA Plus: Pre-Opening Expense Plus: Pro Forma Cost Savings OpCo Credit Agreement EBITDA Net Debt Net Debt / EBITDA $ Cushion % Cushion (of LTM HoldCo EBITDA) EA EA EA Source: Bain Capital. $ $ $ $ EA EA EA $ $ Covenant Level Net Debt / EBITDA OpCo Credit Agreement EBITDA to clear covena $ $ $ Q3 08 2008 380 $ (71) $ 309 $ 9 $ 20 $ 338 $ 1,721 $ 5.09x 6.00x 287 $ 51 $ 13.4% Q4 08 354 $ (72) $ 282 $ 8 $ 20 $ 310 $ 1,608 $ 5.19x 6.00x 268 $ 42 $ 11.9% Q1 09 341 $ (72) $ 269 $ 6 $ 20 $ 295 $ 1,659 $ 5.62x 6.00x 277 $ 19 $ 5.5% 2009E Q2 09 335 $ (73) $ 263 $ 4 $ 20 $ 287 $ 1,638 $ 5.71x 6.00x 273 $ 14 $ 4.1% Q3 09 329 $ (72) $ 257 $ 2 $ 20 $ 279 $ 1,641 $ 5.88x 6.00x 274 $ 6 $ 1.7% Q4 09 340 $ (72) $ 268 $ 2 $ $ 276 $ 1,518 $ 5.51x 6.00x 253 $ 23 6.7% $ Q1 10 335 $ (72) $ 263 $ $ - A LA 264 $ 1,526 $ 5.78x 6.00x 254 $ 10 $ 2.9% 2010E Q2 10 339 $ (72) $ 267 $ 0 $ $ 267 $ - 1,538 $ 5.76x 6.00x 256 $ 11 $ 3.1% Q3 10 343 $ (72) $ 271 $ 0 $ 271 $ 1,522 $ 5.61x 6.00x 254 $ 17 $ 5.1% Q4 10 351 (72) 279 279 1,375 4.92x 6.00x 229 50 14.2%

Step by Step Solution

There are 3 Steps involved in it

Step: 1

To determine what OSIs Net DebtEBITDA ratio would be at the end of the second quarter Q2 of 2009 aft...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started