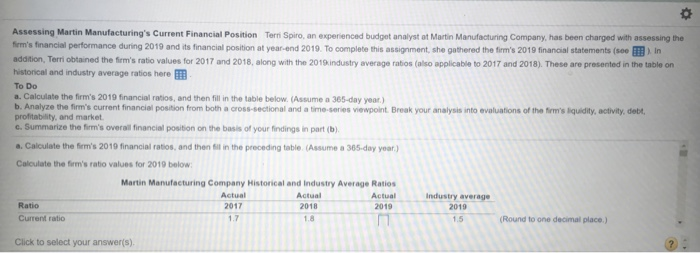

ot Assessing Martin Manufacturing's Current Financial Position Tern piro, an experienced budget analyst at Martin Manufacturing Company, has been charged with assessing the n's r ancial perform ance du ng 2019 and its financial position at year-end 2019. To complete this assign ment, she gathered the t mis 2019 fi anal statements seEB pin addition, Terri obtained the firm's ratio values for 2017 and 2018, along with the 2019 industry average ratios (also applicable to 2017 and 2018). These are presented in the table on historical and industry average ratios here To Do a. Calculate the firm's 2019 financial ratios, and then fill in the table below. (Assume a 36s-day year.) b. Analyze the firm's current financial position from both a cross-sectional and a time-series viewpoint Break your analysis into evaluations of the firm's liquidity, activity, debt profitability, and market e. Summarize the firm's overall financial position on the basis of your findings in part (b) a. Calculate the firm's 2019 financial ratios, and then Sil in the preceding table. (Assume a 365-day year) Caloulate the firm's ratio values for 2019 below Martin Manufacturing Company Historical and Industry Average Ratios Actual 2017 1.7 Actual 2018 Actual Ratio Current ratio 2019KS( 2019 Round to one decimal place.) Click to select your answer(s). ot Assessing Martin Manufacturing's Current Financial Position Tern piro, an experienced budget analyst at Martin Manufacturing Company, has been charged with assessing the n's r ancial perform ance du ng 2019 and its financial position at year-end 2019. To complete this assign ment, she gathered the t mis 2019 fi anal statements seEB pin addition, Terri obtained the firm's ratio values for 2017 and 2018, along with the 2019 industry average ratios (also applicable to 2017 and 2018). These are presented in the table on historical and industry average ratios here To Do a. Calculate the firm's 2019 financial ratios, and then fill in the table below. (Assume a 36s-day year.) b. Analyze the firm's current financial position from both a cross-sectional and a time-series viewpoint Break your analysis into evaluations of the firm's liquidity, activity, debt profitability, and market e. Summarize the firm's overall financial position on the basis of your findings in part (b) a. Calculate the firm's 2019 financial ratios, and then Sil in the preceding table. (Assume a 365-day year) Caloulate the firm's ratio values for 2019 below Martin Manufacturing Company Historical and Industry Average Ratios Actual 2017 1.7 Actual 2018 Actual Ratio Current ratio 2019KS( 2019 Round to one decimal place.) Click to select your answer(s)