Question

Othar information Joel Ltd acquired its 100 per cent interest in Parko Ltd on 1 July 2014, that is, five years earlier. At that date

Othar information

- Joel Ltd acquired its 100 per cent interest in Parko Ltd on 1 July 2014, that is, five years earlier. At that date the capital and reserves of Parko Ltd were:

Share capital $200 000

Retained earnings $180 000

$380 000

At the date of acquisition all assets were considered to be fairly valued.

- During the year Joel Ltd made total sales to Parko Ltd of $60 000, while Parko Ltd sold $50 000 in inventory to Joel Ltd.

- The opening inventory in Joel Ltd as at 1 July 2018 included inventory acquired from Parko Ltd for $40 000 that cost Parko Ltd $30 000 to produce.

- The closing inventory in Joel Ltd includes inventory acquired from Parko Ltd at a cost of $33 000. This cost Parko Ltd $28 000 to produce

- The closing inventory of Parko Ltd includes inventory acquired from Joel Ltd at a cost of $12 000. This cost Joel Ltd $10 000 to produce.

- On 1 July 2018 Parko Ltd sold an item of plant to Joel Ltd for $116 000 when its carrying value in Parko Ltds accounts was $81 000 (cost $135 000, accumulated depreciation $54 000). This plant is assessed as having

a remaining useful life of six years. The Group has a policy of measuring its property, plant and equipment using the cost model.

Parko Ltd paid $26 500 in management fees to Joel Ltd.

The tax rate is 30 per cent.

REQUIRED

Prepare a consolidated statement of financial position, a consolidated statement of profit or loss and other comprehensive income and a consolidated statement of changes in equity for Joel Ltd and Parko Ltd as at 30 June 2019. Also prepare a consolidated statement of changes in equity. LO

Please answer in word or excel

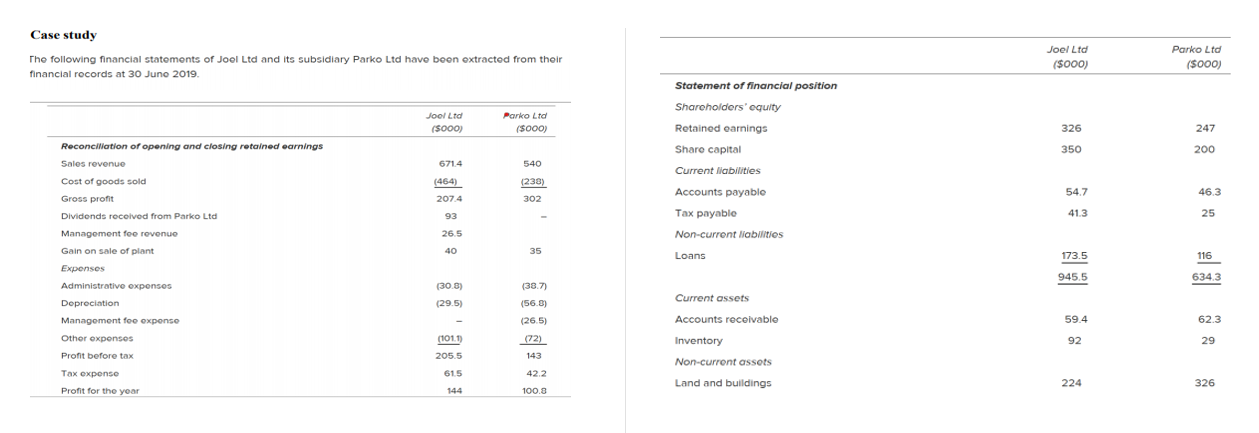

Case study The following financial statements of Joel Ltd and its subsidiary Parko Ltd have been extracted from their financial records at 30 Juno 2019. Joel Ltd ($000) Parko Ltd (5000) Parko Ltd Jool Ltd (5000) (5000) 326 247 350 200 6714 540 Statement of financial position Shareholders' equity Retained earnings Share capital Current liabilities Accounts payable Tax payable Non-current liabilities Loans (464) (238) Reconciliation of opening and closing retained earnings Sales revenue Cost of goods sold Gross pront Dividends rocolved from Parko Ltd Management for revenue Gain on sale of plant 54.7 46.3 207.4 302 93 41.3 25 26.5 40 35 173.5 116 Expenses 945.5 634.3 (30.5) (29.5) Administrative expenses Depreciation Management foo expense Other expenses Pront before tax (38.7) (56.8) (26.5) Current assets Accounts receivable Inventory 59.4 62.3 (1011) (72) 92 29 205.5 143 Non-current assets Tax expenso 615 42.2 Land and buildings 224 326 Profit for the year 144 100.3 Case study The following financial statements of Joel Ltd and its subsidiary Parko Ltd have been extracted from their financial records at 30 Juno 2019. Joel Ltd ($000) Parko Ltd (5000) Parko Ltd Jool Ltd (5000) (5000) 326 247 350 200 6714 540 Statement of financial position Shareholders' equity Retained earnings Share capital Current liabilities Accounts payable Tax payable Non-current liabilities Loans (464) (238) Reconciliation of opening and closing retained earnings Sales revenue Cost of goods sold Gross pront Dividends rocolved from Parko Ltd Management for revenue Gain on sale of plant 54.7 46.3 207.4 302 93 41.3 25 26.5 40 35 173.5 116 Expenses 945.5 634.3 (30.5) (29.5) Administrative expenses Depreciation Management foo expense Other expenses Pront before tax (38.7) (56.8) (26.5) Current assets Accounts receivable Inventory 59.4 62.3 (1011) (72) 92 29 205.5 143 Non-current assets Tax expenso 615 42.2 Land and buildings 224 326 Profit for the year 144 100.3Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started