Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Other than FDIC-insured investments such as savings accounts and certificates of deposit (CDs), investing involves the risk of losing money. In general, the higher

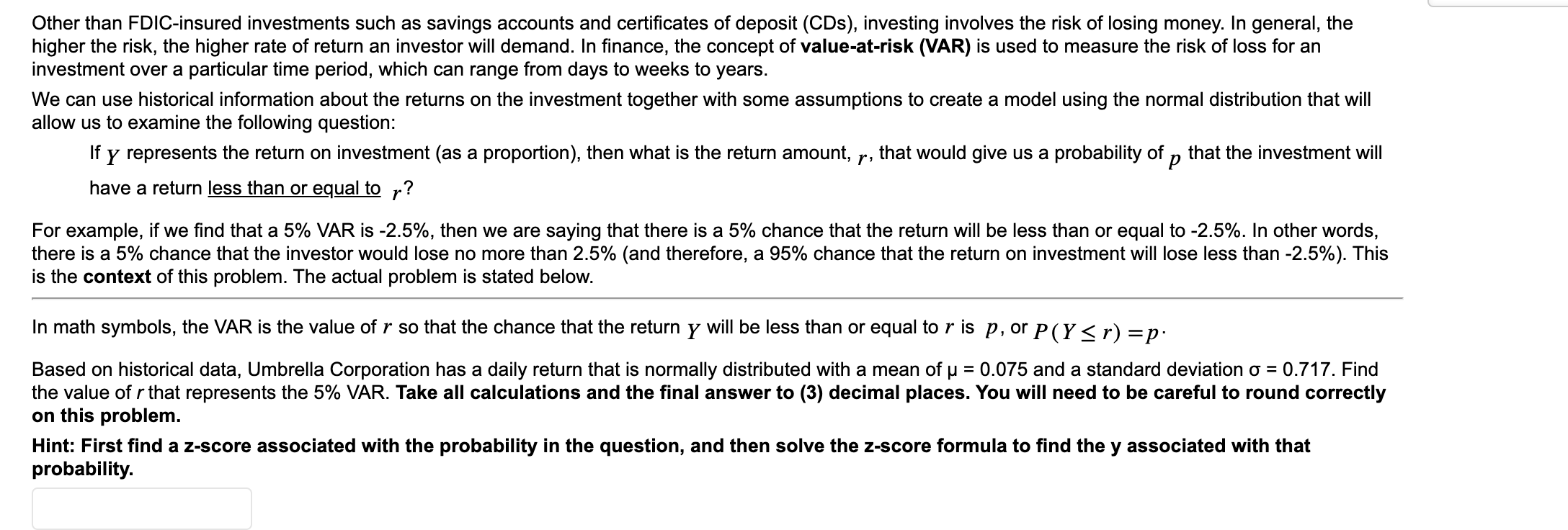

Other than FDIC-insured investments such as savings accounts and certificates of deposit (CDs), investing involves the risk of losing money. In general, the higher the risk, the higher rate of return an investor will demand. In finance, the concept of value-at-risk (VAR) is used to measure the risk of loss for an investment over a particular time period, which can range from days to weeks to years. We can use historical information about the returns on the investment together with some assumptions to create a model using the normal distribution that will allow us to examine the following question: If y represents the return on investment (as a proportion), then what is the return amount, , that would give us a probability of that the investment will have a return less than or equal to r? For example, if we find that a 5% VAR is -2.5%, then we are saying that there is a 5% chance that the return will be less than or equal to -2.5%. In other words, there is a 5% chance that the investor would lose no more than 2.5% (and therefore, a 95% chance that the return on investment will lose less than -2.5%). This is the context of this problem. The actual problem is stated below. In math symbols, the VAR is the value of r so that the chance that the return y will be less than or equal to r is p, or P (Yr) = p. = Based on historical data, Umbrella Corporation has a daily return that is normally distributed with a mean of u 0.075 and a standard deviation o = 0.717. Find the value of r that represents the 5% VAR. Take all calculations and the final answer to (3) decimal places. You will need to be careful to round correctly on this problem. Hint: First find a z-score associated with the probability in the question, and then solve the z-score formula to find the y associated with that probability.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Finding the 5 ValueatRisk VAR for Umbrella Corporation We are given mean daily return 0075 standard ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started