Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Otto has the following strategy to save for his retirement. On January 1, 2022, he deposits $ 80,000 into a savings account. From then

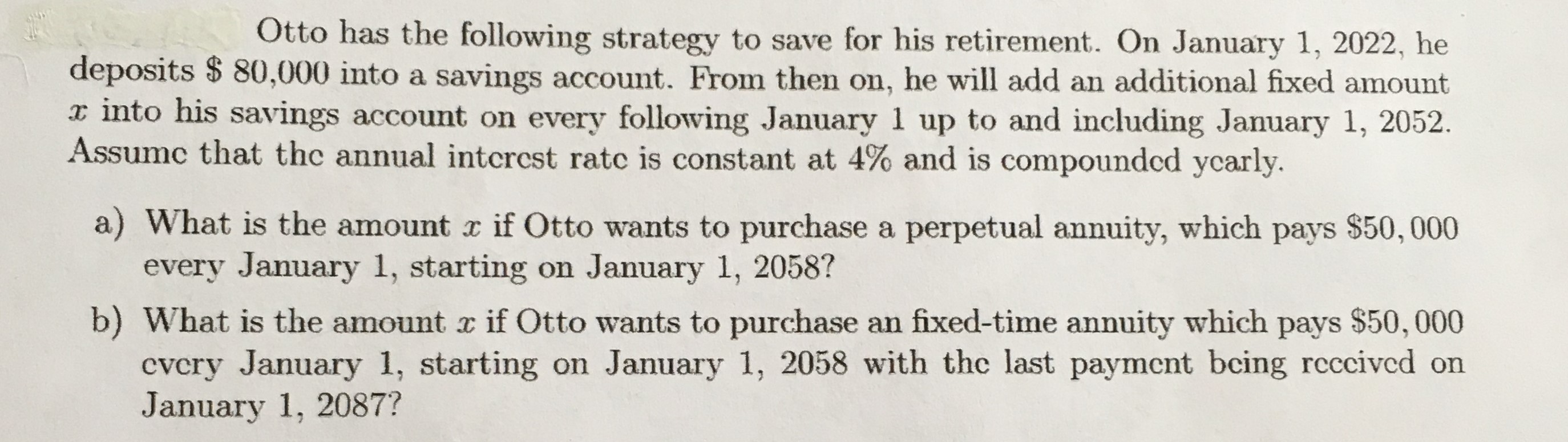

Otto has the following strategy to save for his retirement. On January 1, 2022, he deposits $ 80,000 into a savings account. From then on, he will add an additional fixed amount x into his savings account on every following January 1 up to and including January 1, 2052. Assume that the annual interest rate is constant at 4% and is compounded yearly. a) What is the amount x if Otto wants to purchase a perpetual annuity, which pays $50,000 every January 1, starting on January 1, 2058? b) What is the amount x if Otto wants to purchase an fixed-time annuity which pays $50,000 every January 1, starting on January 1, 2058 with the last payment being received on January 1, 2087?

Step by Step Solution

★★★★★

3.52 Rating (149 Votes )

There are 3 Steps involved in it

Step: 1

Solving for Ottos Retirement Savings a Perpetual Annuity and b FixedTime Annuity We can solve this p...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started