Answered step by step

Verified Expert Solution

Question

1 Approved Answer

8.34 Otto-Rentals Ltd. is setting up a new car rental operation. In the first year they purchase 12 vehicles for a total of $296,000.

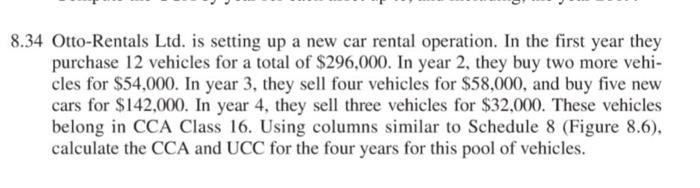

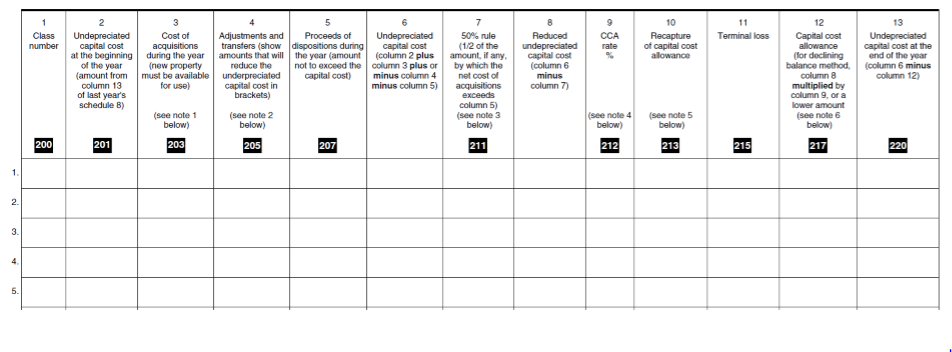

8.34 Otto-Rentals Ltd. is setting up a new car rental operation. In the first year they purchase 12 vehicles for a total of $296,000. In year 2, they buy two more vehi- cles for $54,000. In year 3, they sell four vehicles for $58,000, and buy five new cars for $142,000. In year 4, they sell three vehicles for $32,000. These vehicles belong in CCA Class 16. Using columns similar to Schedule 8 (Figure 8.6), calculate the CCA and UCC for the four years for this pool of vehicles. 1. 2. 3. 4. 5. Class number 200 2 Undepreciated capital cost at the beginning of the year (amount from column 13 of last year's schedule 8) 201 3 Cost of acquisitions during the year (new property must be available for use) (see note 1 below) 203 Adjustments and transfers (show amounts that will reduce the underpreciated capital cost in brackets) (see note 2 below) 205 5 Proceeds of dispositions during the year (amount not to exceed the capital cost) 207 Undepreciated capital cost (column 2 plus column 3 plus or minus column 4 minus column 5) 7 50% rule (1/2 of the amount, if any, by which the net cost of acquisitions exceeds column 5) (see note 3 below) 211 Reduced undepreciated capital cost (column 6 minus column 7) 9 CCA rate (see note 4 below) 212 10 Recapture of capital cost allowance (see note 5 below) 213 11 Terminal loss 215 12 Capital cost allowance (for declining balance method, column 8 multiplied by column 9, or a lower amount (see note 6 below) 217 13 Undepreciated capital cost at the end of the year (column 6 minus column 12) 220

Step by Step Solution

★★★★★

3.52 Rating (152 Votes )

There are 3 Steps involved in it

Step: 1

1 2 3 4 5 6 7 8 9 10 11 12 13 Class Number Undepreciated capital cost at the beginning of the yearam...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started