Answered step by step

Verified Expert Solution

Question

1 Approved Answer

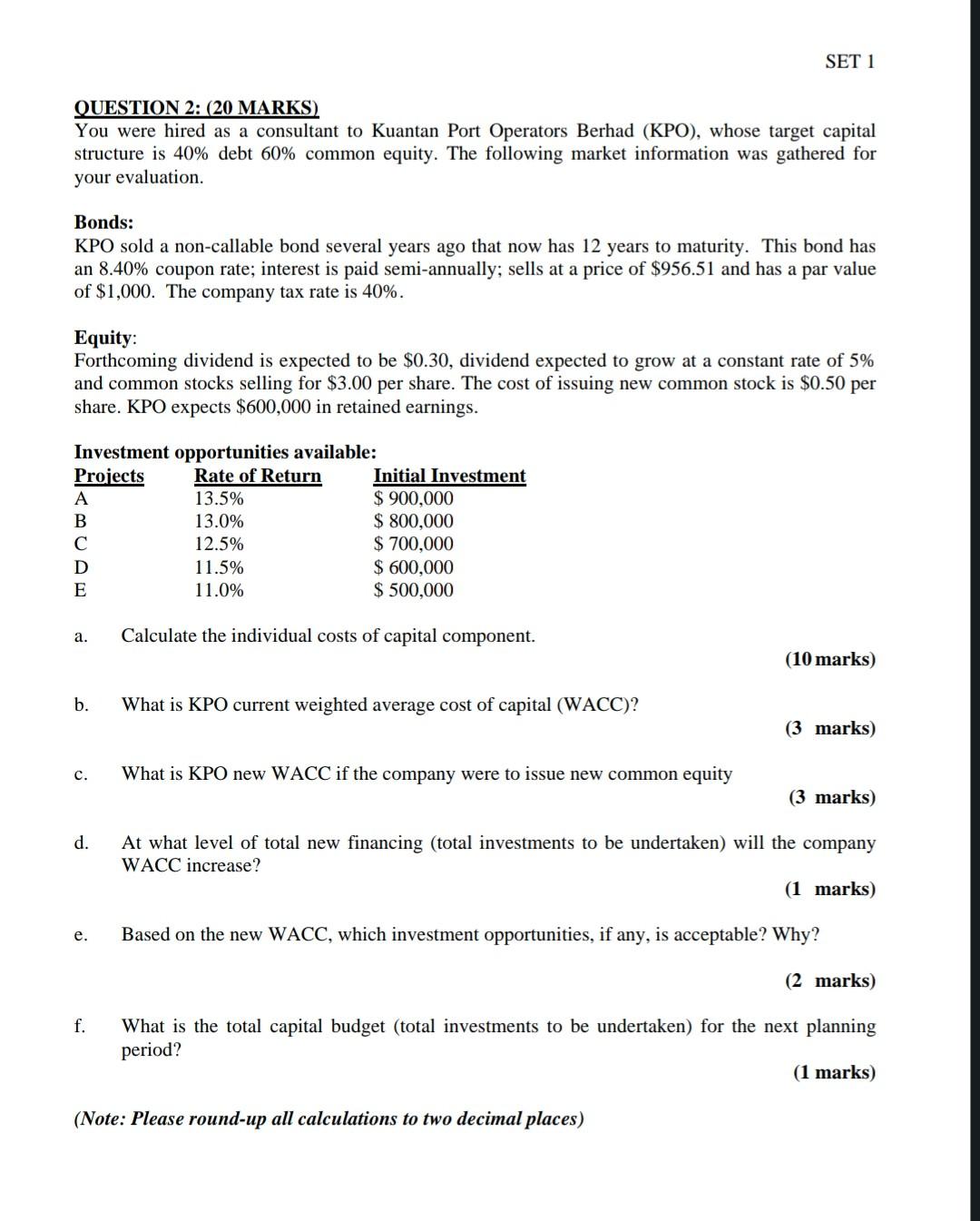

OUESTION 2: (20 MARKS) You were hired as a consultant to Kuantan Port Operators Berhad (KPO), whose target capital structure is 40% debt 60% common

OUESTION 2: (20 MARKS) You were hired as a consultant to Kuantan Port Operators Berhad (KPO), whose target capital structure is 40% debt 60% common equity. The following market information was gathered for your evaluation. Bonds: KPO sold a non-callable bond several years ago that now has 12 years to maturity. This bond has an 8.40% coupon rate; interest is paid semi-annually; sells at a price of $956.51 and has a par value of $1,000. The company tax rate is 40%. Equity: Forthcoming dividend is expected to be $0.30, dividend expected to grow at a constant rate of 5% and common stocks selling for $3.00 per share. The cost of issuing new common stock is $0.50 per share. KPO expects $600,000 in retained earnings. a. Calculate the individual costs of capital component. (10 marks) b. What is KPO current weighted average cost of capital (WACC)? (3 marks) c. What is KPO new WACC if the company were to issue new common equity (3 marks) d. At what level of total new financing (total investments to be undertaken) will the company WACC increase? (1 marks) e. Based on the new WACC, which investment opportunities, if any, is acceptable? Why? ( 2 marks) f. What is the total capital budget (total investments to be undertaken) for the next planning period? (1 marks) (Note: Please round-up all calculations to two decimal places)

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started