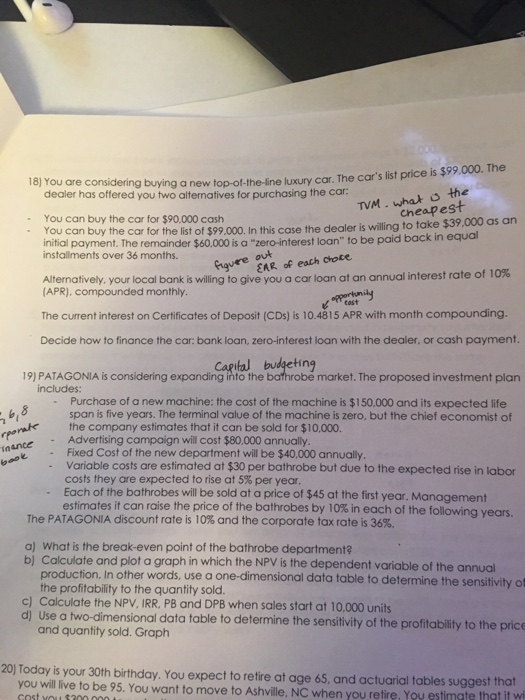

ouore considering buying a new top-of-the-ine luxury car. The car's list price is $99,000. The dealer has offered you two alternatives for purchasing the car You can buy the car for $90,000 cash Cheapest take $39,000 as an You can buy the car for the list of $99,000. In this case the dealer is willing to initial payment. The remainder $60.000 is a "zero-interest loan" to be paid back installments over 36 months in equal ouk gAR of each chote Alternatively, your local bank is willing to give you a car loan at an annual interest rate of 10% (APR). compounded monthly. tost The current interest on Certificates of Deposit (CDs) is 10.4815 APR with month compounding Decide how to finance the car: bank loan, zero-interest loan with the dealer, or cash payment tal bdaronen 19) PATAGONIA is considering expanding into the market. The proposed investment plan includes: Purchase of a new machine: the cost of the machine is $150,000 and its expected life span is five years. The terminal value of the machine is zero, but the chief economist of - a the company estimates that it can be sold for $10,000. Advertising campaign will cost $80,000 annually Fixed Cost of the new department will be $40,000 annually. Variable costs are estimated at $30 per bathrobe but due to the expected rise in labor costs they are expected to rise at 5% per year Each of the bathrobes will be sold at a price of $45 at the first year. Management estimates it can raise the price of the bathrobes by 10% in each of the following years. - - . The PATAGONIA discount rate is 10% and the corporate tax rate is 36%. a) What is the break-even point of the bathrobe department? b) Calculate and plot a graph in which the NPV is the dependent variable of the annual production, In other words, use a one-dimensional data table to determine the sensitivity of the profitability to the quantity sold. c) Calculate the NPV, IRR, PB and DPB when sales start at 10.000 units d Use a two-dimensional data table to determine the sensitivity of the profitability to the price and quantity sold. Graph 20 Today is your 30th birthday, You expect to retire at age 65, and actuarial tables suggest that you will live to be 95. You want to move to Ashville, NC when you retire, You estimate thet it