Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Our Accounts Clerk prepared an acquisition analysis and calculated a gain on bargain purchase of $160,000 (being $112,000 cash paid less the subsidiary's equity

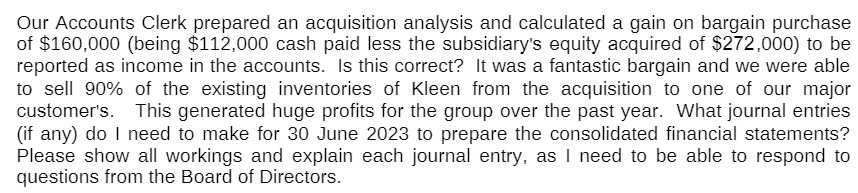

Our Accounts Clerk prepared an acquisition analysis and calculated a gain on bargain purchase of $160,000 (being $112,000 cash paid less the subsidiary's equity acquired of $272,000) to be reported as income in the accounts. Is this correct? It was a fantastic bargain and we were able to sell 90% of the existing inventories of Kleen from the acquisition to one of our major customer's. This generated huge profits for the group over the past year. What journal entries (if any) do I need to make for 30 June 2023 to prepare the consolidated financial statements? Please show all workings and explain each journal entry, as I need to be able to respond to questions from the Board of Directors.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started