Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Our competitive analysis shows that Digby invested in new production facilities, including plant and equipment last year. It appears that this investment was funded two

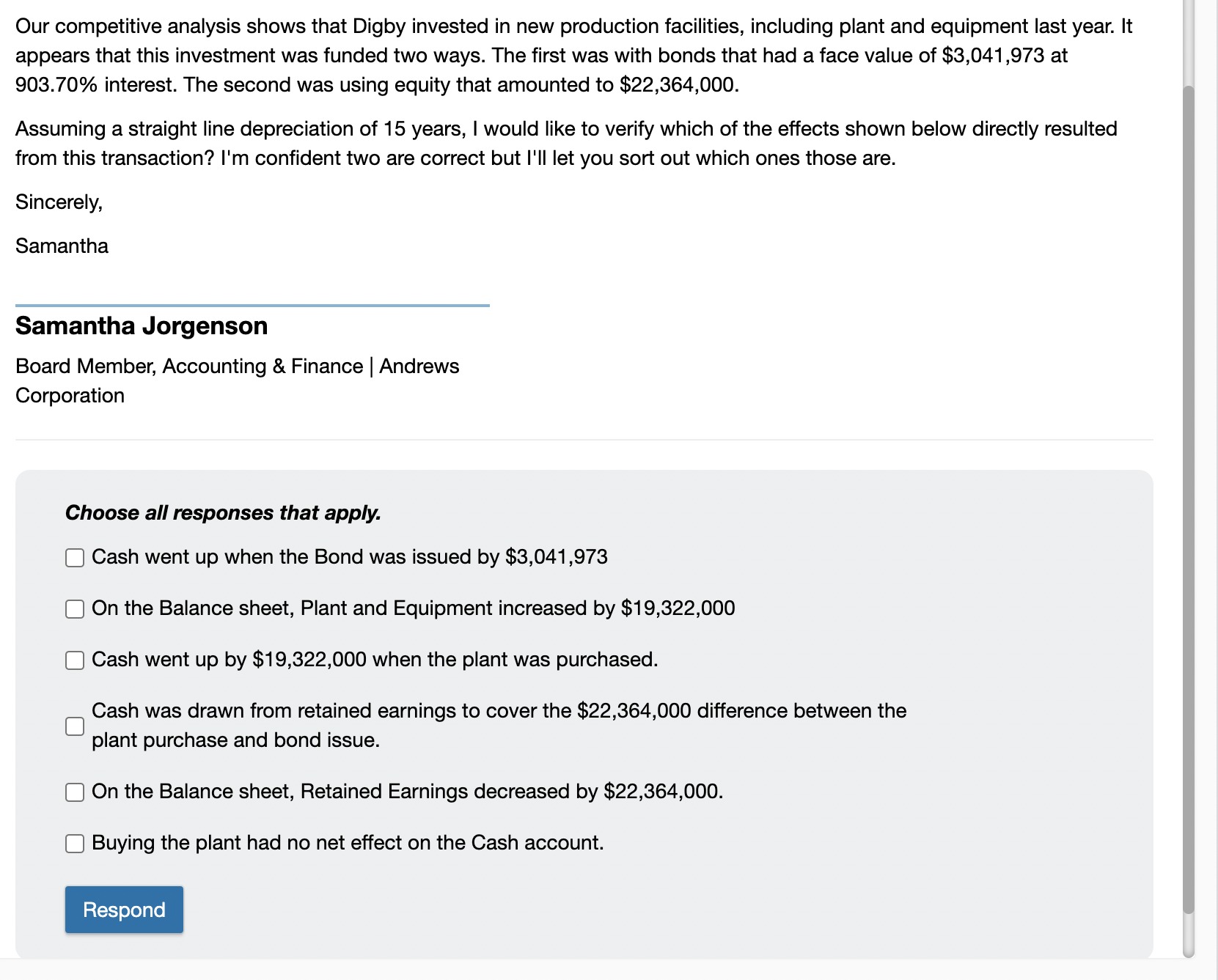

Our competitive analysis shows that Digby invested in new production facilities, including plant and equipment last year. It appears that this investment was funded two ways. The first was with bonds that had a face value of $3,041,973 at 903.70% interest. The second was using equity that amounted to $22,364,000. Assuming a straight line depreciation of 15 years, I would like to verify which of the effects shown below directly resulted from this transaction? I'm confident two are correct but I'll let you sort out which ones those are. Sincerely, Samantha Samantha Jorgenson Board Member, Accounting \& Finance | Andrews Corporation Choose all responses that apply. Cash went up when the Bond was issued by $3,041,973 On the Balance sheet, Plant and Equipment increased by $19,322,000 Cash went up by $19,322,000 when the plant was purchased. Cash was drawn from retained earnings to cover the $22,364,000 difference between the plant purchase and bond issue. On the Balance sheet, Retained Earnings decreased by $22,364,000. Buying the plant had no net effect on the Cash account

Our competitive analysis shows that Digby invested in new production facilities, including plant and equipment last year. It appears that this investment was funded two ways. The first was with bonds that had a face value of $3,041,973 at 903.70% interest. The second was using equity that amounted to $22,364,000. Assuming a straight line depreciation of 15 years, I would like to verify which of the effects shown below directly resulted from this transaction? I'm confident two are correct but I'll let you sort out which ones those are. Sincerely, Samantha Samantha Jorgenson Board Member, Accounting \& Finance | Andrews Corporation Choose all responses that apply. Cash went up when the Bond was issued by $3,041,973 On the Balance sheet, Plant and Equipment increased by $19,322,000 Cash went up by $19,322,000 when the plant was purchased. Cash was drawn from retained earnings to cover the $22,364,000 difference between the plant purchase and bond issue. On the Balance sheet, Retained Earnings decreased by $22,364,000. Buying the plant had no net effect on the Cash account Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started