Answered step by step

Verified Expert Solution

Question

1 Approved Answer

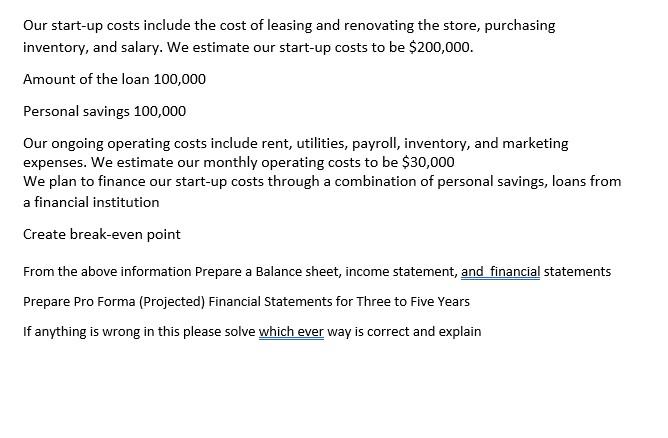

Our start-up costs include the cost of leasing and renovating the store, purchasing inventory, and salary. We estimate our start-up costs to be $200,000.

Our start-up costs include the cost of leasing and renovating the store, purchasing inventory, and salary. We estimate our start-up costs to be $200,000. Amount of the loan 100,000 Personal savings 100,000 Our ongoing operating costs include rent, utilities, payroll, inventory, and marketing expenses. We estimate our monthly operating costs to be $30,000 We plan to finance our start-up costs through a combination of personal savings, loans from a financial institution Create break-even point From the above information Prepare a Balance sheet, income statement, and financial statements Prepare Pro Forma (Projected) Financial Statements for Three to Five Years If anything is wrong in this please solve which ever way is correct and explain

Step by Step Solution

★★★★★

3.35 Rating (161 Votes )

There are 3 Steps involved in it

Step: 1

Based on the provided information I will prepare a simplified version of the requested financial sta...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started