Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Out Of the Box is a registered VAT vendor that sells craft supplies, and began trading on 1 August. All purchases are made from

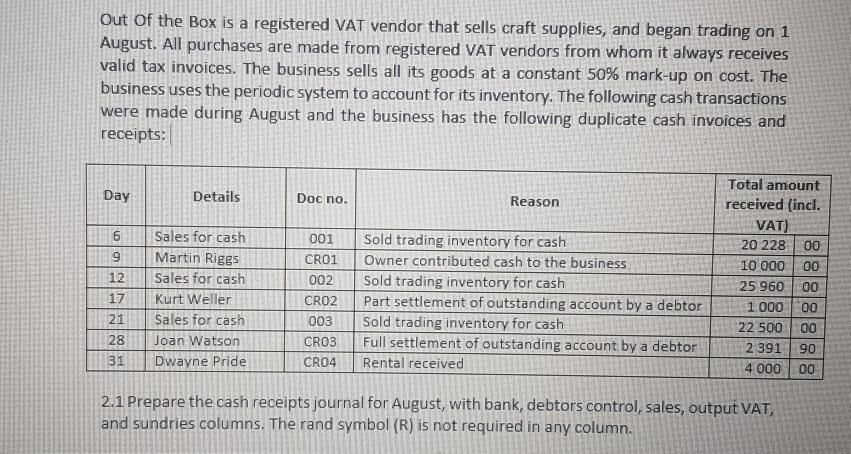

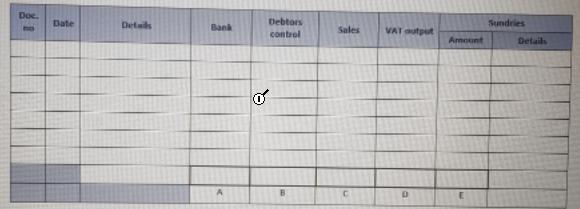

Out Of the Box is a registered VAT vendor that sells craft supplies, and began trading on 1 August. All purchases are made from registered VAT vendors from whom it always receives valid tax invoices. The business sells all its goods at a constant 50% mark-up on cost. The business uses the periodic system to account for its inventory. The following cash transactions were made during August and the business has the following duplicate cash invoices and receipts: Total amount Day Details Doc no. Reason received (incl. VAT) 6 Sales for cash Sold trading inventory for cash 001 20 228 00 Martin Riggs CRO1 Owner contributed cash to the business 10 000 00 12 Sales for cash 002 Sold trading inventory for cash 25 960 00 17 Kurt Weller Part settlement of outstanding account by a debtor Sold trading inventory for cash Full settlement of outstanding account by a debtor Rental received CRO2 1000 00 21 Sales for cash 003 22 500 00 28 Joan Watson CRO3 2 391 90 31 Dwayne Pride CRO4 4 000 00 2.1 Prepare the cash receipts journal for August, with bank, debtors control, sales, output VAT, and sundries columns. The rand symbol (R) is not required in any column. 8888888 Doe. Date Details Debtors Sundries Bank control Sales VATutput Amount Details of

Step by Step Solution

★★★★★

3.42 Rating (158 Votes )

There are 3 Steps involved in it

Step: 1

26 CASH RECEIPT JOURNAL 27 Sundries 28 DocNo Date Details Bank Debtors Contro...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started