Question

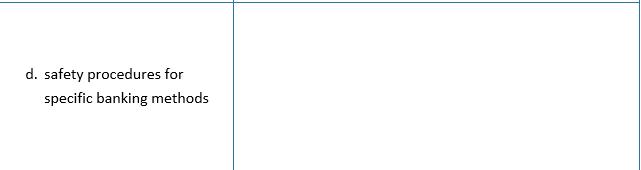

Outline the key features of policies and procedures relating to processing the following financial transactions, in the table below Task 2 Banking Follow the link

Outline the key features of policies and procedures relating to processing the following financial transactions, in the table below

Task 2 Banking

Follow the link below to the "GUIDE FOR HANDLING AND TRANSPORTING CASH"

https://www.safeworkaustralia.gov.au/system/files/documents/1703/guide-handling-transporting-cash.pdf

This guide has been produced by Safe Work Australia and provides guidance for persons conducting a business or running an organisation about their legal obligations in managing the health and safety risks associated with handling and transporting cash.

i. When handling cash, what does the guide recommend as control measures to minimise risk (2 examples)

ii. What recommendation does the guide make to transport cash in a safe manner?

iii. To improve efficiency and minimise cash handling, your organisation is proposing to implement electronic banking for all receipts and payments. Identify security procedures for electronic banking an organisation needs to consider to adopt electronic banking.

Electronic Deposits

Electronic Payments

iv. Identify "proof of lodgement" for these following deposit methods:

o Cash and cheques deposited in the local bank branch

_________________________________________________________________

o Direct deposit into company account by a customer _________________________________________________________________

o Electronic payments by customers at POS _________________________________________________________________

- Review the vendor details - should know if the vendor is existing. As well as the mode or terms of their payments. Details should also be the same to what were written in the invoice.

Question 3

Access the link https://www.accc.gov.au/publications/debt-collection-guideline-for-collectors-creditors and explain what laws the guideline covers and which other laws are referred to?

Question 4

Access the link https://www.accc.gov.au/publications/debt-collection-guideline-for-collectors-creditors Section 14 Repayment negotiations, what are some of the key recommendations for repayment arrangements that can feature in a debt recovery plan?

Question 5

Access Finance Policy and Procedure Manual. Refer to Cl_TransReportLedgers_AE_SR_PolicyandProcedures.docx for Piper Retail Services Finance Policy and Procedure Manual.

i) What are the key requirements of the organisational policy and procedure for reconciling financial accounts?

ii) What is the key requirement of the organisational credit policy?

Useful Links:

https://www.accc.gov.au/business/treating-customers-fairly/debt-collection

https://nexacollect.com/debt-recovery/become-good-collector/

https://www.accc.gov.au/publications/debt-collection-guideline-for-collectors-creditors

https://www.ato.gov.au/Business/Record-keeping-for-business/Setting-up-and-managing-records/Record-keeping-help-for-small-businesses/

https://www.ato.gov.au/Business/Record-keeping-for-business/Setting-up-and-managing-records/Record-keeping-help-for-small-businesses/#Helpweprovide

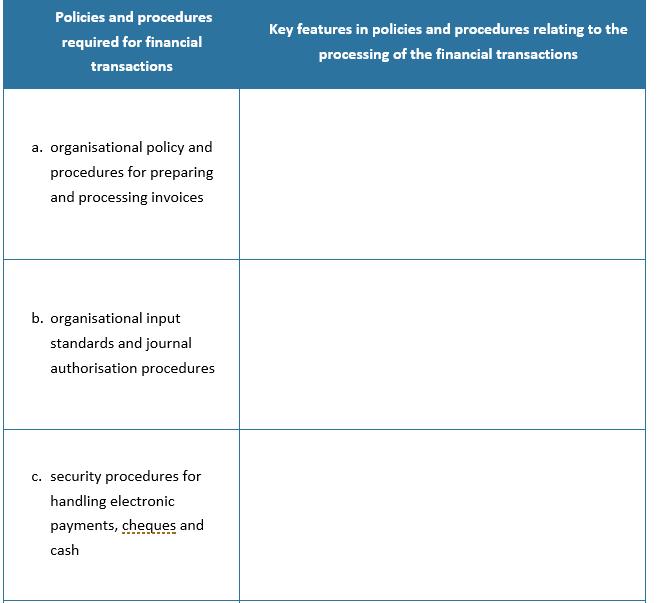

d. safety procedures for specific banking methods

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started