Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Over the recent 5-yr period your financial advisor has achieved the following returns for your portfolio: year 1=+30%, year 2=25%; year 3=+20%; year 4=15%; year

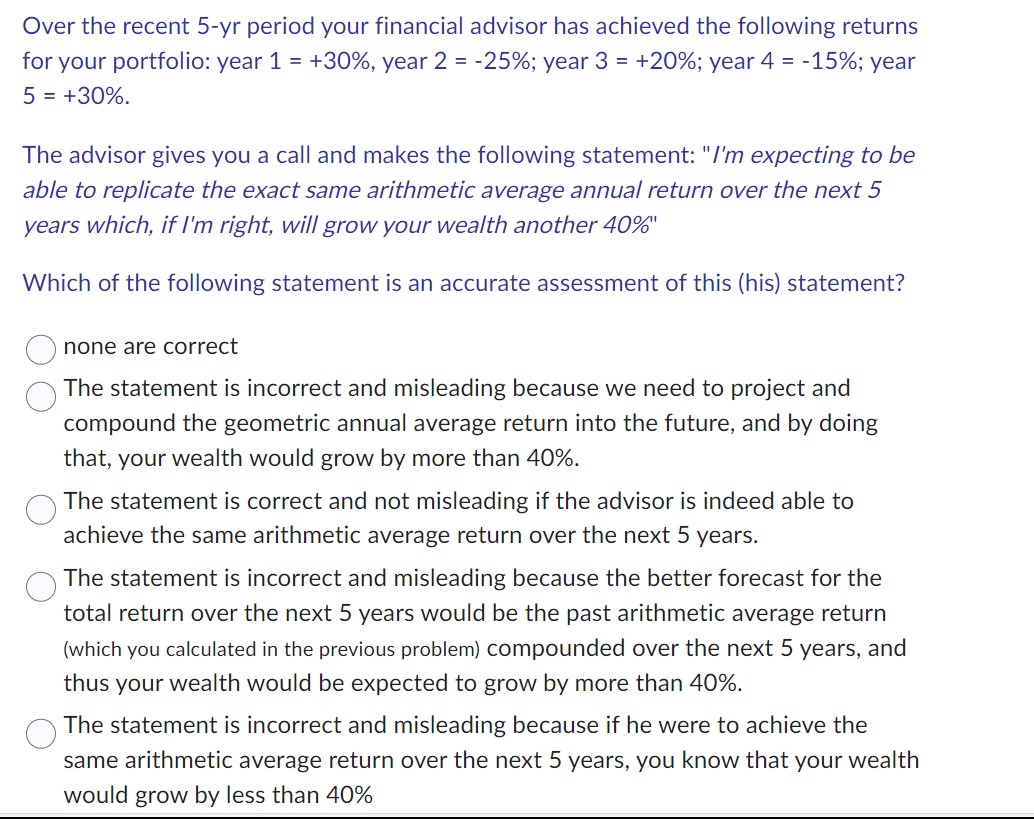

Over the recent 5-yr period your financial advisor has achieved the following returns for your portfolio: year 1=+30%, year 2=25%; year 3=+20%; year 4=15%; year 5=+30%. The advisor gives you a call and makes the following statement: "I'm expecting to be able to replicate the exact same arithmetic average annual return over the next 5 years which, if I'm right, will grow your wealth another 40\%" Which of the following statement is an accurate assessment of this (his) statement? none are correct The statement is incorrect and misleading because we need to project and compound the geometric annual average return into the future, and by doing that, your wealth would grow by more than 40%. The statement is correct and not misleading if the advisor is indeed able to achieve the same arithmetic average return over the next 5 years. The statement is incorrect and misleading because the better forecast for the total return over the next 5 years would be the past arithmetic average return (which you calculated in the previous problem) compounded over the next 5 years, and thus your wealth would be expected to grow by more than 40%. The statement is incorrect and misleading because if he were to achieve the same arithmetic average return over the next 5 years, you know that your wealth would grow by less than 40%

Over the recent 5-yr period your financial advisor has achieved the following returns for your portfolio: year 1=+30%, year 2=25%; year 3=+20%; year 4=15%; year 5=+30%. The advisor gives you a call and makes the following statement: "I'm expecting to be able to replicate the exact same arithmetic average annual return over the next 5 years which, if I'm right, will grow your wealth another 40\%" Which of the following statement is an accurate assessment of this (his) statement? none are correct The statement is incorrect and misleading because we need to project and compound the geometric annual average return into the future, and by doing that, your wealth would grow by more than 40%. The statement is correct and not misleading if the advisor is indeed able to achieve the same arithmetic average return over the next 5 years. The statement is incorrect and misleading because the better forecast for the total return over the next 5 years would be the past arithmetic average return (which you calculated in the previous problem) compounded over the next 5 years, and thus your wealth would be expected to grow by more than 40%. The statement is incorrect and misleading because if he were to achieve the same arithmetic average return over the next 5 years, you know that your wealth would grow by less than 40% Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started