Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Overall Analysis: Give an overall analysis of the performance of the company. The financial statements tell a story about the business. What is the story

- Overall Analysis: Give an overall analysis of the performance of the company.

The financial statements tell a story about the business. What is the story for the profit/performance for this company?

Please help and show work please !! thank you

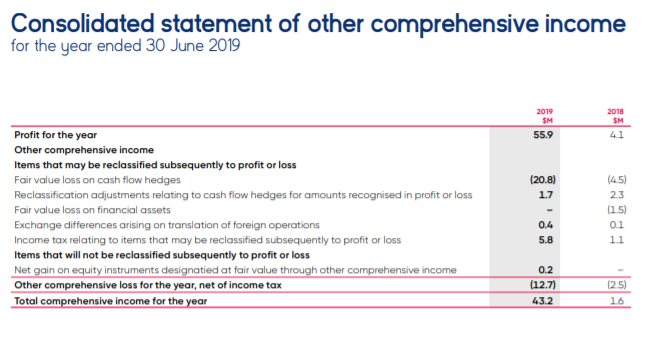

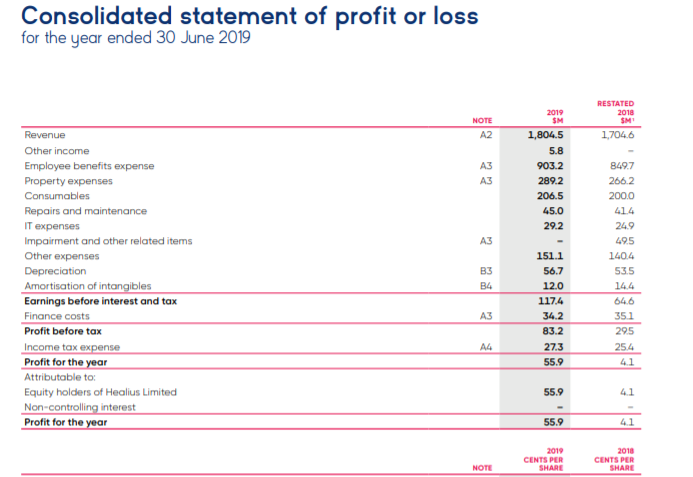

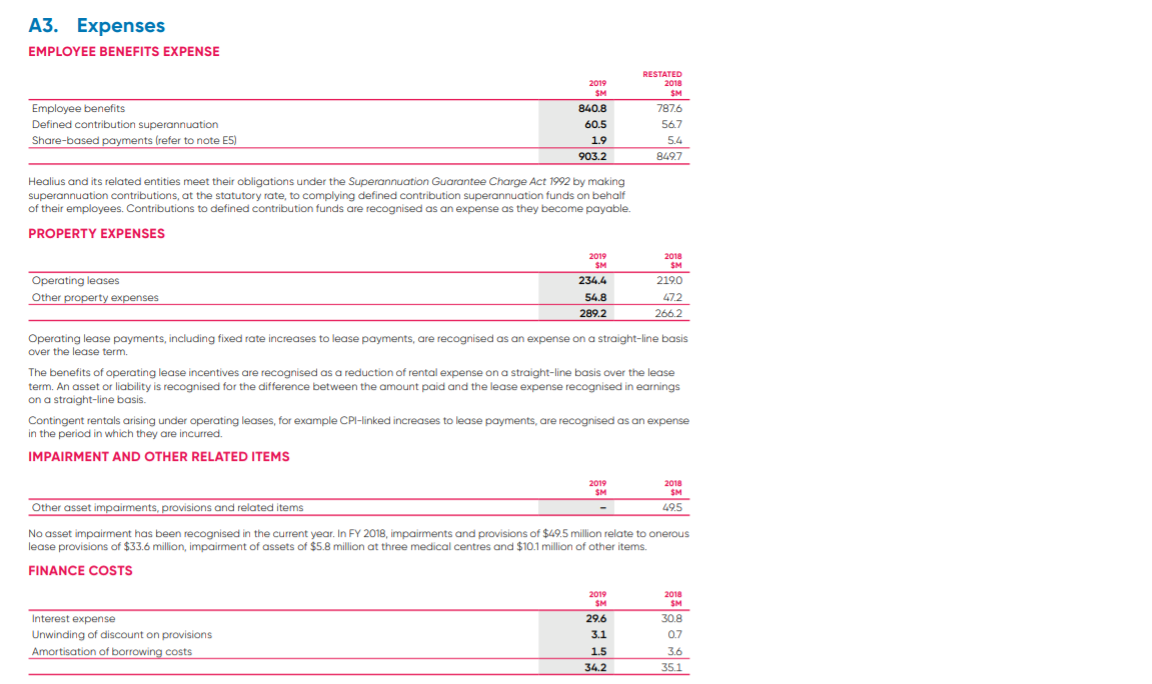

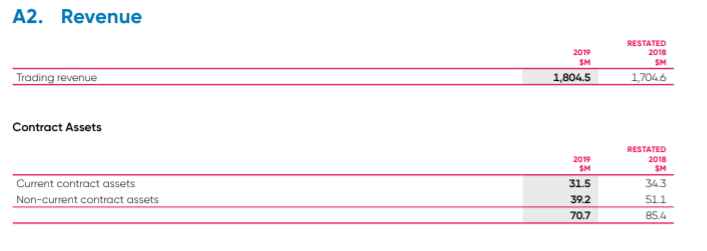

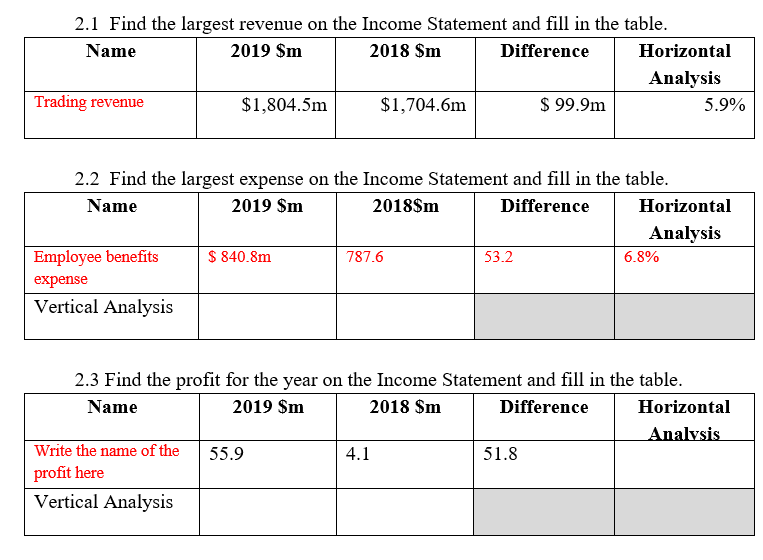

Consolidated statement of other comprehensive income for the year ended 30 June 2019 2019 SM 55.9 2018 SM 41 (20.8) 1.7 Profit for the year Other comprehensive income Items that may be reclassified subsequently to profit or loss Fair value loss on cash flow hedges Reclassification adjustments relating to cash flow hedges for amounts recognised in profit or loss Fair value loss on financial assets Exchange differences arising on translation of foreign operations Income tax relating to items that may be reclassified subsequently to profit or loss Items that will not be reclassified subsequently to profit or loss Net gain on equity instruments designatied at fair value through other comprehensive income Other comprehensive loss for the year, net of income tax Total comprehensive income for the year (4.5) 23 (1.5) 01 11 0.4 5.8 0.2 (12.7) 43.2 (2.5) 16 Consolidated statement of profit or loss for the year ended 30 June 2019 2019 RESTATED 2018 SM SME NOTE A2 1,7046 A3 A3 1,804.5 5.8 903.2 289.2 206.5 45.0 29.2 849.7 2662 200.0 A3 Revenue Other income Employee benefits expense Property expenses Consumables Repairs and maintenance IT expenses Impairment and other related items Other expenses Depreciation Amortisation of intangibles Earnings before interest and tax Finance costs Profit before tax Income tax expense Profit for the year Attributable to: Equity holders of Healius Limited Non-controlling interest Profit for the year B3 B4 1511 56.7 12.0 117.4 34.2 83.2 27.3 55.9 249 49.5 140.4 53.5 14.4 64.6 35.1 295 25.4 41 A3 A4 55.9 41 55.9 41 2019 CENTS PER SHARE 2018 CENTS PER SHARE NOTE A3. Expenses EMPLOYEE BENEFITS EXPENSE 2019 SM Employee benefits Defined contribution superannuation Share-based payments (refer to note E5) 840.8 60.5 1.9 903.2 RESTATED 2018 SM 787.6 56.7 5.4 8497 Healius and its related entities meet their obligations under the Superannuation Guarantee Charge Act 1992 by making superannuation contributions, at the statutory rate, to complying defined contribution superannuation funds on behalf of their employees. Contributions to defined contribution funds are recognised as an expense as they become payable. PROPERTY EXPENSES Operating leases Other property expenses 2019 SM SM 234.4 54.8 289.2 2018 SM 219.0 472 2662 Operating lease payments, including fixed rate increases to lease payments, are recognised as an expense on a straight-line basis over the lease term. The benefits of operating lease incentives are recognised as a reduction of rental expense on a straight-line basis over the lease term. An asset or liability is recognised for the difference between the amount paid and the lease expense recognised in earnings on a straight-line basis. Contingent rentals arising under operating leases, for example CPl-linked increases to lease payments, are recognised as an expense in the period in which they are incurred. IMPAIRMENT AND OTHER RELATED ITEMS 2019 SM 2018 SM 49.5 Other asset impairments, provisions and related items No asset impairment has been recognised in the current year. In FY 2018, impairments and provisions of $49.5 million relate to onerous lease provisions of $33.6 million, impairment of assets of $5.8 million at three medical centres and $10.1 million of other items. FINANCE COSTS 2019 SM 2018 SM SM Interest expense Unwinding of discount on provisions Amortisation of borrowing costs 29.6 3.1 1.5 34.2 30.8 07 3.6 35.1 A2. Revenue 2019 SM 1,804.5 RESTATED 2018 SM 1,7046 Trading revenue Contract Assets Current contract assets Non-current contract assets 2019 SM 31.5 39.2 70.7 RESTATED 2018 SM 343 511 85.4 2.1 Find the largest revenue on the Income Statement and fill in the table. Name 2019 $m 2018 $m Difference Horizontal Analysis Trading revenue $1,804.5m $1,704.6m $ 99.9m 5.9% 2.2 Find the largest expense on the Income Statement and fill in the table. Name 2019 $m 2018$m Difference Horizontal Analysis Employee benefits $ 840.8m 787.6 53.2 6.8% expense Vertical Analysis 2.3 Find the profit for the year on the Income Statement and fill in the table. Name 2019 $m 2018 Sm Difference Horizontal Analysis Write the name of the 55.9 4.1 51.8 profit here Vertical AnalysisStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started