Question

Overall, the task is about helping Rio Tinto Group (ASX: RIO) delivering financial returns in the short and long term in a way that generates

Overall, the task is about helping Rio Tinto Group (ASX: RIO) delivering financial returns in the short and long term in a way that generates positive value for society and the environment. Your attempt should involve the below steps: 1) Present the business case for change, setting out why action on human rights will also add value to the company. 2) Provide commercially viable and scalable solution(s) for the company to adapt their business model and practices to support human rights for all. 3) Demonstrate how your solution(s) could be rolled out across the company's operations and value chain, such as across business units, regions and/or supply chains etc. 4) Develop a financial model using the Excel and demonstrates how the solutions would impact financial performance. As a guide you may include (but not be limited to) the following analysis: o Analysis of income statement and balance sheet. The analysis should be based on the company's publicly available financial information. o A complete ratio analysis (e.g., profitability, efficiency, liquidity, market performance) for the financial statements. o Analysis of share price history and trading volumes over the analysing period. o Apply the valuation technique(s) taught in this course and undertake a current valuation of the equity for the company. Whether this share is correctly valued, undervalued, or overvalued. o What would be your recommended solutions? You many consider a comparative analysis before and after changing the business model/practices/approaches and show how the financial bottom line would differ after adopting your strategies. o How successful the company has been at maximizing stakeholders value over short- medium- and long- term? How well the company is performing in sustainability, and environmental, social, and governance aspects? Consider using appropriate metrics and benchmarks. o Explain all your assumptions used in the valuations and estimations; for the technique(s) and model(s) adopted state why you think they are appropriate for your company. o Criticaldiscussthestrengthsandweaknessesofyouranalysis,andanyotherrisks e.g. economic-wide and firm-specific risk factors. 5) Map how your proposed solution(s) impact both positively and negatively on specific UN Sustainable Development Goals (SDGs) and targets. 6) Explain what success would look like both commercially and in terms of impact on human rights.

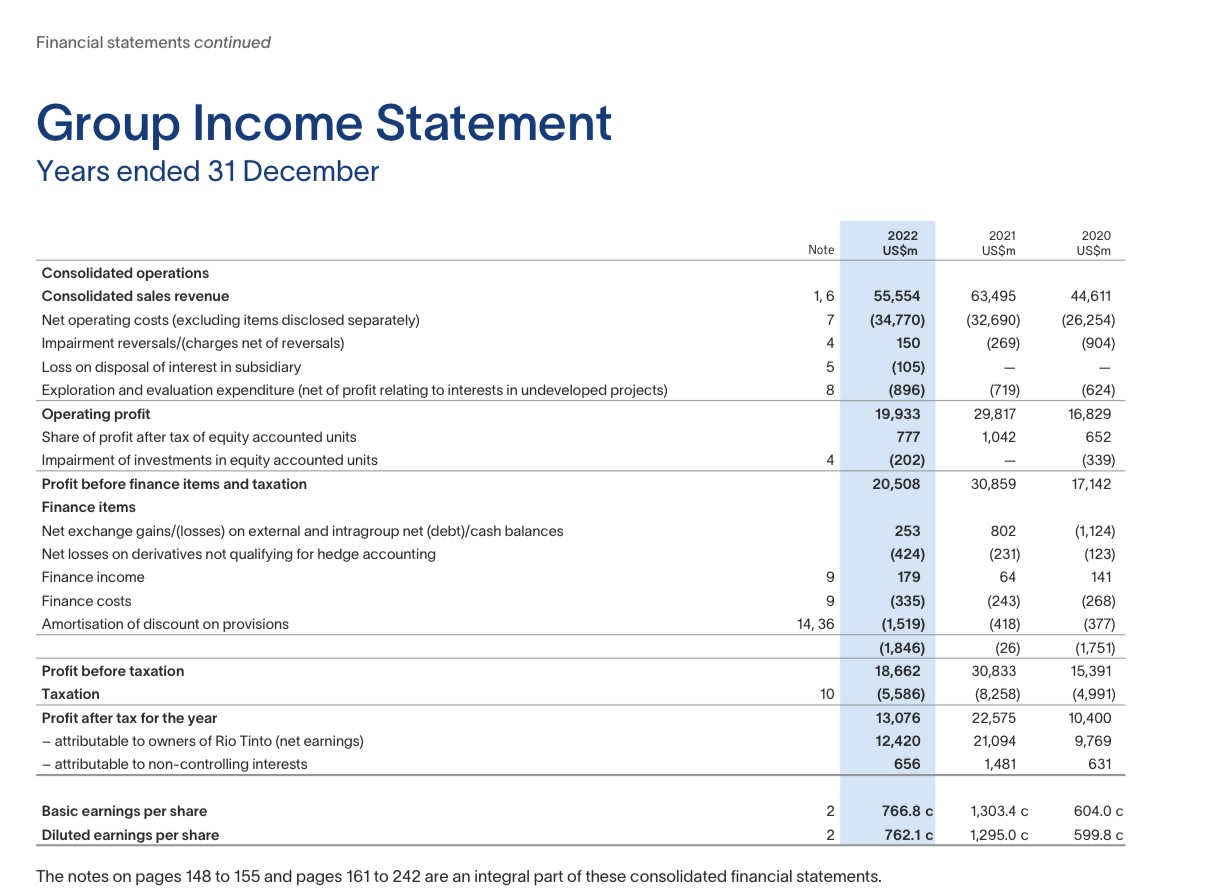

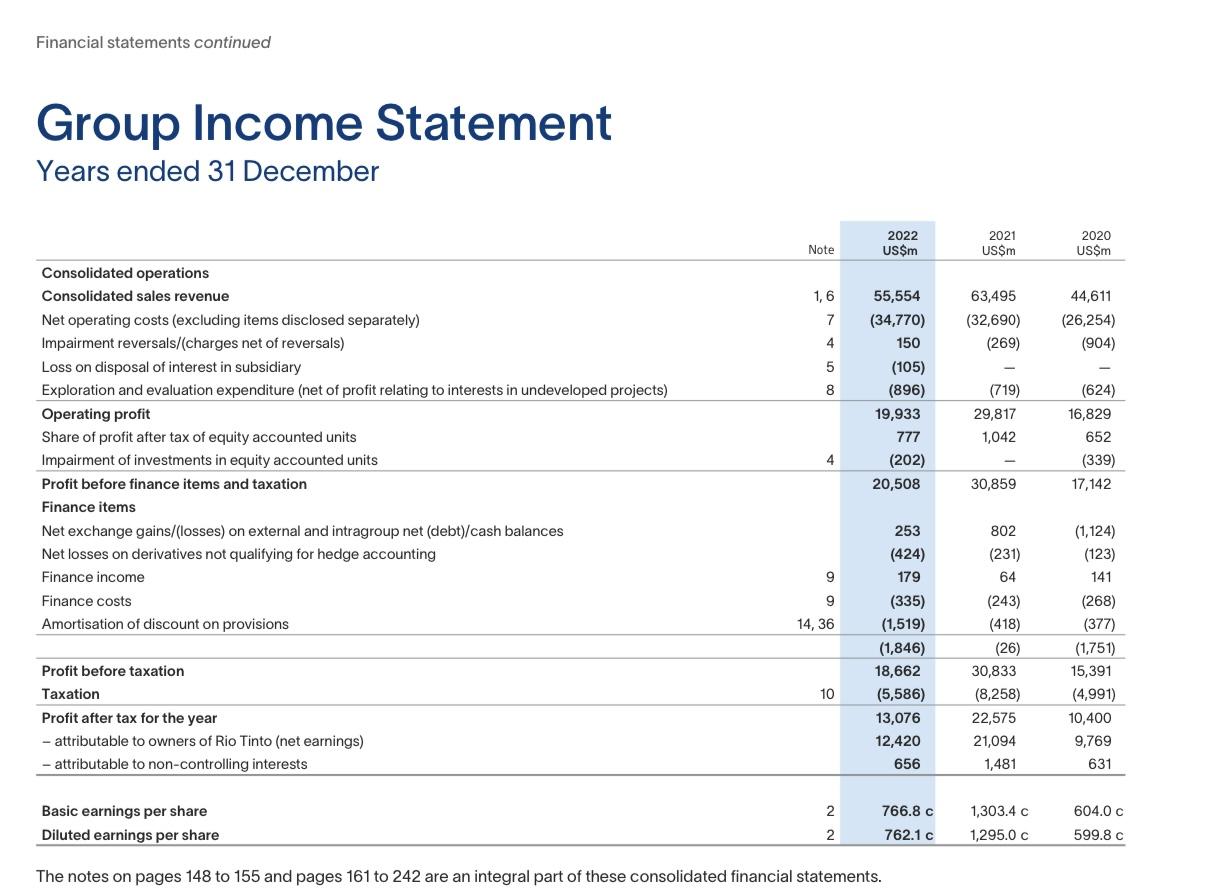

Financial statements continued Group Income Statement Years ended 31 December Consolidated operations Consolidated sales revenue Net operating costs (excluding items disclosed separately) Impairment reversals/(charges net of reversals) Loss on disposal of interest in subsidiary Exploration and evaluation expenditure (net of profit relating to interests in undeveloped projects) Operating profit Share of profit after tax of equity accounted units Impairment of investments in equity accounted units Profit before finance items and taxation Finance items Net exchange gains/(losses) on external and intragroup net (debt)/cash balances Net losses on derivatives not qualifying for hedge accounting Finance income Finance costs Amortisation of discount on provisions Profit before taxation Taxation Profit after tax for the year - attributable to owners of Rio Tinto (net earnings) - attributable to non-controlling interests Note 1,6 7 4 5 8 4 9 9 14, 36 10 2 2 2022 US$m 55,554 (34,770) 150 (105) (896) 19,933 777 (202) 20,508 Basic earnings per share Diluted earnings per share The notes on pages 148 to 155 and pages 161 to 242 are an integral part of these consolidated financial statements. 253 (424) 179 (335) (1,519) (1,846) 18,662 (5,586) 13,076 12,420 656 766.8 c 762.1 c 2021 US$m 63,495 (32,690) (269) (719) 29,817 1,042 30,859 802 (231) 64 (243) (418) (26) 30,833 (8,258) 22,575 21,094 1,481 1,303.4 c 1,295.0 c 2020 US$m 44,611 (26,254) (904) (624) 16,829 652 (339) 17,142 (1,124) (123) 141 (268) (377) (1,751) 15,391 (4,991) 10,400 9,769 631 604.0 c 599.8 c

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Business Case for Change The business case for Rio Tinto Group ASX RIO to take action on human rights is multifaceted and encompasses both financial and nonfinancial benefits By prioritizing human rig...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started