Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Overbuilt Construction Company entered into a contract to construct an warehouse building for its client for $800,000. Overbuilt provides the following information about the contract

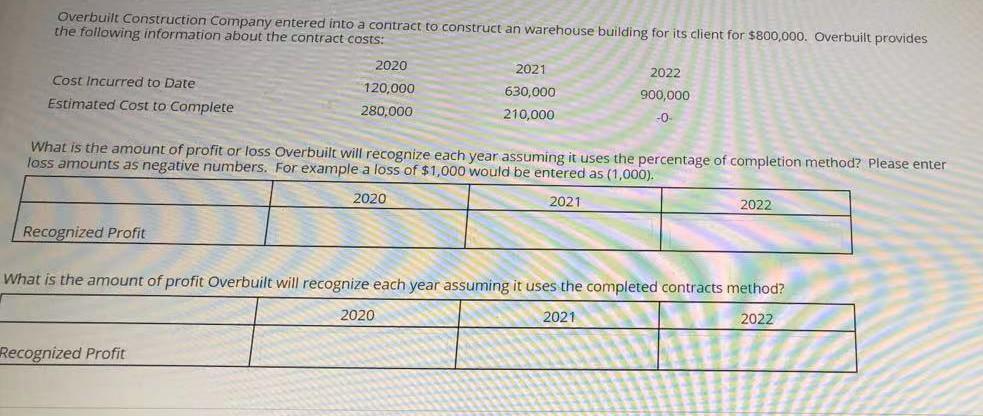

Overbuilt Construction Company entered into a contract to construct an warehouse building for its client for $800,000. Overbuilt provides the following information about the contract costs: 2020 2021 2022 Cost Incurred to Date 120,000 630,000 900,000 Estimated Cost to Complete 280,000 210,000 -0 What is the amount of profit or loss Overbuilt will recognize each year assuming it uses the percentage of completion method? Please enter loss amounts as negative numbers. For example a loss of $1,000 would be entered as (1,000). 2020 2021 2022 Recognized Profit What is the amount of profit Overbuilt will recognize each year assuming it uses the completed contracts method? 2020 2021 2022 Recognized Profit

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started