Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Overview Imagine that you are working as a financial accountant for Peyton Approved, and you have been charged with revising its financial information. The

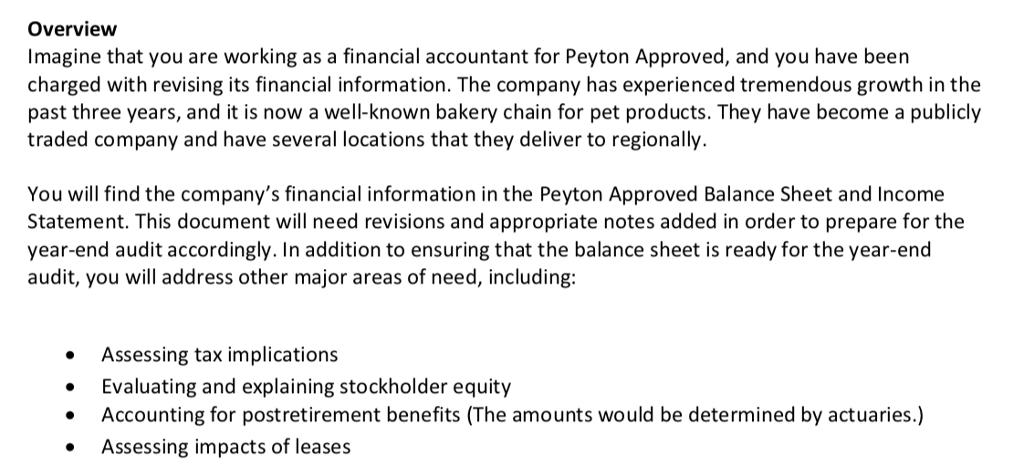

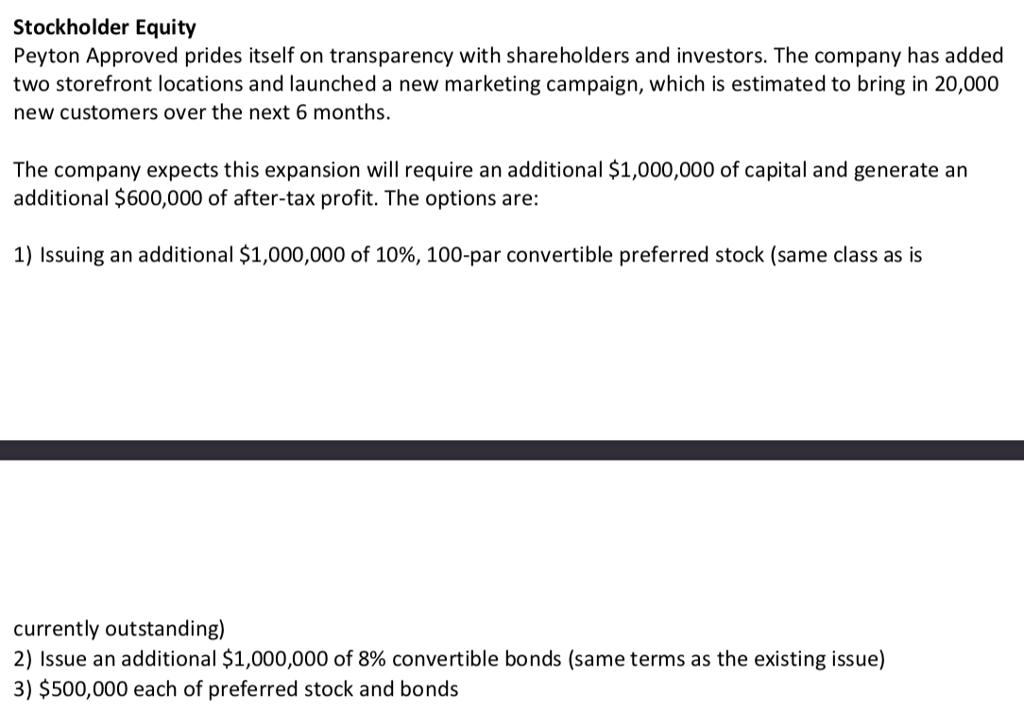

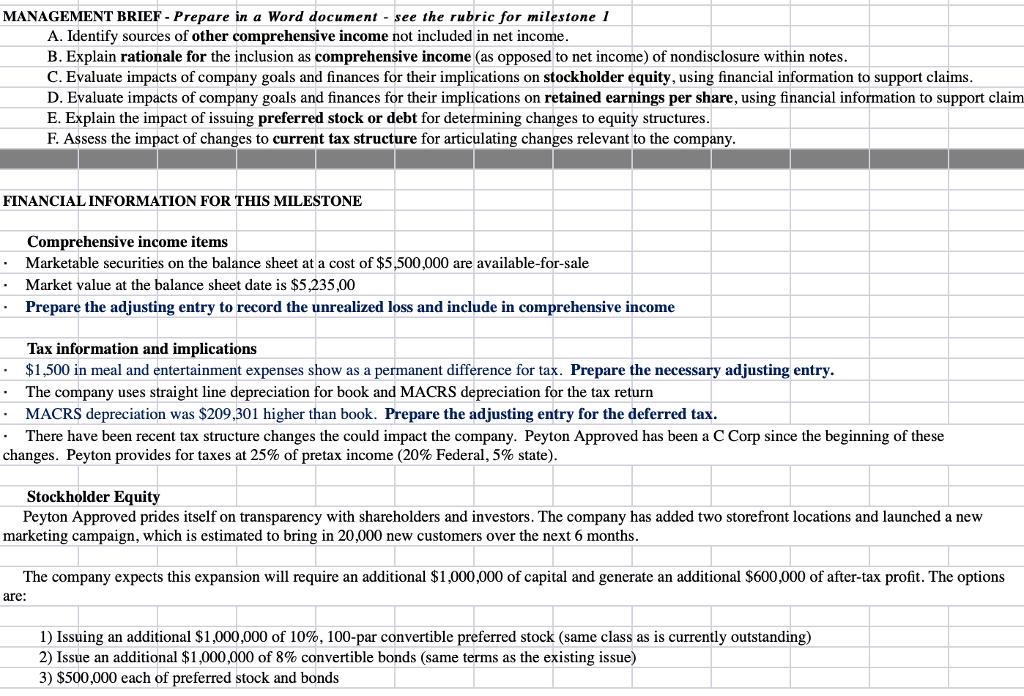

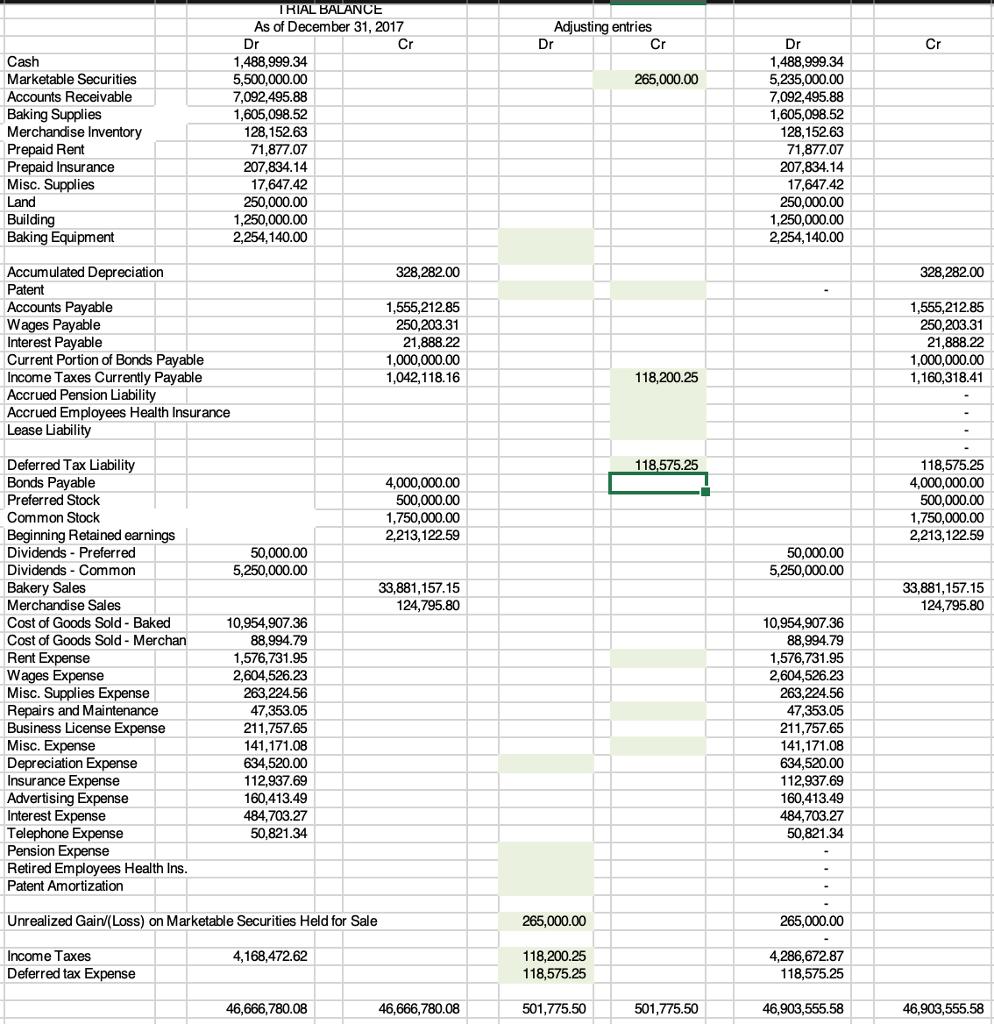

Overview Imagine that you are working as a financial accountant for Peyton Approved, and you have been charged with revising its financial information. The company has experienced tremendous growth in the past three years, and it is now a well-known bakery chain for pet products. They have become a publicly traded company and have several locations that they deliver to regionally. You will find the company's financial information in the Peyton Approved Balance Sheet and Income Statement. This document will need revisions and appropriate notes added in order to prepare for the year-end audit accordingly. In addition to ensuring that the balance sheet is ready for the year-end audit, you will address other major areas of need, including: Assessing tax implications Evaluating and explaining stockholder equity Accounting for postretirement benefits (The amounts would be determined by actuaries.) Assessing impacts of leases Stockholder Equity Peyton Approved prides itself on transparency with shareholders and investors. The company has added two storefront locations and launched a new marketing campaign, which is estimated to bring in 20,000 new customers over the next 6 months. The company expects this expansion will require an additional $1,000,000 of capital and generate an additional $600,000 of after-tax profit. The options are: 1) Issuing an additional $1,000,000 of 10%, 100-par convertible preferred stock (same class as is currently outstanding) 2) Issue an additional $1,000,000 of 8% convertible bonds (same terms as the existing issue) 3) $500,000 each of preferred stock and bonds MANAGEMENT BRIEF - Prepare in a Word document - see the rubric for milestone 1 A. Identify sources of other comprehensive income not included in net income. B. Explain rationale for the inclusion as comprehensive income (as opposed to net income) of nondisclosure within notes. FINANCIAL INFORMATION FOR THIS MILESTONE . . . Tax information and implications $1,500 in meal and entertainment expenses show as a permanent difference for tax. Prepare the necessary adjusting entry. The company uses straight line depreciation for book and MACRS depreciation for the tax return MACRS depreciation was $209,301 higher than book. Prepare the adjusting entry for the deferred tax. There have been recent tax structure changes the could impact the company. Peyton Approved has been a C Corp since the beginning of these changes. Peyton provides for taxes at 25% of pretax income (20% Federal, 5% state). . C. Evaluate impacts of company goals and finances for their implications on stockholder equity, using financial information to support claims. D. Evaluate impacts of company goals and finances for their implications on retained earnings per share, using financial information to support claim E. Explain the impact of issuing preferred stock or debt for determining changes to equity structures. F. Assess the impact of changes to current tax structure for articulating changes relevant to the company. . . Comprehensive income items Marketable securities on the balance sheet at a cost of $5,500,000 are available-for-sale Market value at the balance sheet date is $5,235,00 Prepare the adjusting entry to record the unrealized loss and include in comprehensive income Stockholder Equity Peyton Approved prides itself on transparency with shareholders and investors. The company has added two storefront locations and launched a new marketing campaign, which is estimated to bring in 20,000 new customers over the next 6 months. The company expects this expansion will require an additional $1,000,000 of capital and generate an additional $600,000 of after-tax profit. The options are: 1) Issuing an additional $1,000,000 of 10%, 100-par convertible preferred stock (same class as is currently outstanding) 2) Issue an additional $1,000,000 of 8% convertible bonds (same terms as the existing issue) 3) $500,000 each of preferred stock and bonds Cash Marketable Securities Accounts Receivable Baking Supplies Merchandise Inventory Prepaid Rent Prepaid Insurance Misc. Supplies Land Building Baking Equipment Accumulated Depreciation Patent Accounts Payable Wages Payable Interest Payable Current Portion of Bonds Payable Income Taxes Currently Payable Accrued Pension Liability Accrued Employees Health Insurance Lease Liability Deferred Tax Liability Bonds Payable Preferred Stock Common Stock Beginning Retained earnings Dividends Preferred Dividends - Common Bakery Sales Merchandise Sales Cost of Goods Sold - Baked Cost of Goods Sold - Merchan Rent Expense Wages Expense Misc. Supplies Expense Repairs and Maintenance Business License Expense Misc. Expense Depreciation Expense Insurance Expense Advertising Expense Interest Expense Telephone Expense Pension Expense Retired Employees Health Ins. Patent Amortization TRIAL BALANCE As of December 31, 2017 Dr Cr Income Taxes Deferred tax Expense 1,488.999.34 5,500,000.00 7,092,495.88 1,605,098.52 128,152.63 71,877.07 207,834.14 17,647.42 250,000.00 1,250,000.00 2,254,140.00 50,000.00 5,250,000.00 10,954,907.36 88,994.79 1,576,731.95 2,604,526.23 263,224.56 47,353.05 211,757.65 141,171.08 634,520.00 112,937.69 160,413.49 484,703.27 50,821.34 Unrealized Gain/(Loss) on Marketable Securities Held for Sale 4,168,472.62 46,666,780.08 328,282.00 1,555,212.85 250,203.31 21,888.22 1,000,000.00 1,042,118.16 4,000,000.00 500,000.00 1,750,000.00 2,213,122.59 33,881,157.15 124,795.80 46,666,780.08 Adjusting entries Dr 265,000.00 118,200.25 118,575.25 501,775.50 Cr 265,000.00 118,200.25 118,575.25 501,775.50 Dr 1,488,999.34 5,235,000.00 7,092,495.88 1,605,098.52 128,152.63 71,877.07 207,834.14 17,647.42 250,000.00 1,250,000.00 2,254,140.00 50,000.00 5,250,000.00 10,954,907.36 88,994.79 1,576,731.95 2,604,526.23 263,224.56 47,353.05 211,757.65 141,171.08 634,520.00 112,937.69 160,413.49 484,703.27 50,821.34 265,000.00 4,286,672.87 118,575.25 46,903,555.58 Cr 328,282.00 1,555,212.85 250,203.31 21,888.22 1,000,000.00 1,160,318.41 118,575.25 4,000,000.00 500,000.00 1,750,000.00 2,213,122.59 33,881,157.15 124,795.80 46,903,555.58 Overview Imagine that you are working as a financial accountant for Peyton Approved, and you have been charged with revising its financial information. The company has experienced tremendous growth in the past three years, and it is now a well-known bakery chain for pet products. They have become a publicly traded company and have several locations that they deliver to regionally. You will find the company's financial information in the Peyton Approved Balance Sheet and Income Statement. This document will need revisions and appropriate notes added in order to prepare for the year-end audit accordingly. In addition to ensuring that the balance sheet is ready for the year-end audit, you will address other major areas of need, including: Assessing tax implications Evaluating and explaining stockholder equity Accounting for postretirement benefits (The amounts would be determined by actuaries.) Assessing impacts of leases Stockholder Equity Peyton Approved prides itself on transparency with shareholders and investors. The company has added two storefront locations and launched a new marketing campaign, which is estimated to bring in 20,000 new customers over the next 6 months. The company expects this expansion will require an additional $1,000,000 of capital and generate an additional $600,000 of after-tax profit. The options are: 1) Issuing an additional $1,000,000 of 10%, 100-par convertible preferred stock (same class as is currently outstanding) 2) Issue an additional $1,000,000 of 8% convertible bonds (same terms as the existing issue) 3) $500,000 each of preferred stock and bonds MANAGEMENT BRIEF - Prepare in a Word document - see the rubric for milestone 1 A. Identify sources of other comprehensive income not included in net income. B. Explain rationale for the inclusion as comprehensive income (as opposed to net income) of nondisclosure within notes. FINANCIAL INFORMATION FOR THIS MILESTONE . . . Tax information and implications $1,500 in meal and entertainment expenses show as a permanent difference for tax. Prepare the necessary adjusting entry. The company uses straight line depreciation for book and MACRS depreciation for the tax return MACRS depreciation was $209,301 higher than book. Prepare the adjusting entry for the deferred tax. There have been recent tax structure changes the could impact the company. Peyton Approved has been a C Corp since the beginning of these changes. Peyton provides for taxes at 25% of pretax income (20% Federal, 5% state). . C. Evaluate impacts of company goals and finances for their implications on stockholder equity, using financial information to support claims. D. Evaluate impacts of company goals and finances for their implications on retained earnings per share, using financial information to support claim E. Explain the impact of issuing preferred stock or debt for determining changes to equity structures. F. Assess the impact of changes to current tax structure for articulating changes relevant to the company. . . Comprehensive income items Marketable securities on the balance sheet at a cost of $5,500,000 are available-for-sale Market value at the balance sheet date is $5,235,00 Prepare the adjusting entry to record the unrealized loss and include in comprehensive income Stockholder Equity Peyton Approved prides itself on transparency with shareholders and investors. The company has added two storefront locations and launched a new marketing campaign, which is estimated to bring in 20,000 new customers over the next 6 months. The company expects this expansion will require an additional $1,000,000 of capital and generate an additional $600,000 of after-tax profit. The options are: 1) Issuing an additional $1,000,000 of 10%, 100-par convertible preferred stock (same class as is currently outstanding) 2) Issue an additional $1,000,000 of 8% convertible bonds (same terms as the existing issue) 3) $500,000 each of preferred stock and bonds Cash Marketable Securities Accounts Receivable Baking Supplies Merchandise Inventory Prepaid Rent Prepaid Insurance Misc. Supplies Land Building Baking Equipment Accumulated Depreciation Patent Accounts Payable Wages Payable Interest Payable Current Portion of Bonds Payable Income Taxes Currently Payable Accrued Pension Liability Accrued Employees Health Insurance Lease Liability Deferred Tax Liability Bonds Payable Preferred Stock Common Stock Beginning Retained earnings Dividends Preferred Dividends - Common Bakery Sales Merchandise Sales Cost of Goods Sold - Baked Cost of Goods Sold - Merchan Rent Expense Wages Expense Misc. Supplies Expense Repairs and Maintenance Business License Expense Misc. Expense Depreciation Expense Insurance Expense Advertising Expense Interest Expense Telephone Expense Pension Expense Retired Employees Health Ins. Patent Amortization TRIAL BALANCE As of December 31, 2017 Dr Cr Income Taxes Deferred tax Expense 1,488.999.34 5,500,000.00 7,092,495.88 1,605,098.52 128,152.63 71,877.07 207,834.14 17,647.42 250,000.00 1,250,000.00 2,254,140.00 50,000.00 5,250,000.00 10,954,907.36 88,994.79 1,576,731.95 2,604,526.23 263,224.56 47,353.05 211,757.65 141,171.08 634,520.00 112,937.69 160,413.49 484,703.27 50,821.34 Unrealized Gain/(Loss) on Marketable Securities Held for Sale 4,168,472.62 46,666,780.08 328,282.00 1,555,212.85 250,203.31 21,888.22 1,000,000.00 1,042,118.16 4,000,000.00 500,000.00 1,750,000.00 2,213,122.59 33,881,157.15 124,795.80 46,666,780.08 Adjusting entries Dr 265,000.00 118,200.25 118,575.25 501,775.50 Cr 265,000.00 118,200.25 118,575.25 501,775.50 Dr 1,488,999.34 5,235,000.00 7,092,495.88 1,605,098.52 128,152.63 71,877.07 207,834.14 17,647.42 250,000.00 1,250,000.00 2,254,140.00 50,000.00 5,250,000.00 10,954,907.36 88,994.79 1,576,731.95 2,604,526.23 263,224.56 47,353.05 211,757.65 141,171.08 634,520.00 112,937.69 160,413.49 484,703.27 50,821.34 265,000.00 4,286,672.87 118,575.25 46,903,555.58 Cr 328,282.00 1,555,212.85 250,203.31 21,888.22 1,000,000.00 1,160,318.41 118,575.25 4,000,000.00 500,000.00 1,750,000.00 2,213,122.59 33,881,157.15 124,795.80 46,903,555.58 Overview Imagine that you are working as a financial accountant for Peyton Approved, and you have been charged with revising its financial information. The company has experienced tremendous growth in the past three years, and it is now a well-known bakery chain for pet products. They have become a publicly traded company and have several locations that they deliver to regionally. You will find the company's financial information in the Peyton Approved Balance Sheet and Income Statement. This document will need revisions and appropriate notes added in order to prepare for the year-end audit accordingly. In addition to ensuring that the balance sheet is ready for the year-end audit, you will address other major areas of need, including: Assessing tax implications Evaluating and explaining stockholder equity Accounting for postretirement benefits (The amounts would be determined by actuaries.) Assessing impacts of leases Stockholder Equity Peyton Approved prides itself on transparency with shareholders and investors. The company has added two storefront locations and launched a new marketing campaign, which is estimated to bring in 20,000 new customers over the next 6 months. The company expects this expansion will require an additional $1,000,000 of capital and generate an additional $600,000 of after-tax profit. The options are: 1) Issuing an additional $1,000,000 of 10%, 100-par convertible preferred stock (same class as is currently outstanding) 2) Issue an additional $1,000,000 of 8% convertible bonds (same terms as the existing issue) 3) $500,000 each of preferred stock and bonds MANAGEMENT BRIEF - Prepare in a Word document - see the rubric for milestone 1 A. Identify sources of other comprehensive income not included in net income. B. Explain rationale for the inclusion as comprehensive income (as opposed to net income) of nondisclosure within notes. FINANCIAL INFORMATION FOR THIS MILESTONE . . . Tax information and implications $1,500 in meal and entertainment expenses show as a permanent difference for tax. Prepare the necessary adjusting entry. The company uses straight line depreciation for book and MACRS depreciation for the tax return MACRS depreciation was $209,301 higher than book. Prepare the adjusting entry for the deferred tax. There have been recent tax structure changes the could impact the company. Peyton Approved has been a C Corp since the beginning of these changes. Peyton provides for taxes at 25% of pretax income (20% Federal, 5% state). . C. Evaluate impacts of company goals and finances for their implications on stockholder equity, using financial information to support claims. D. Evaluate impacts of company goals and finances for their implications on retained earnings per share, using financial information to support claim E. Explain the impact of issuing preferred stock or debt for determining changes to equity structures. F. Assess the impact of changes to current tax structure for articulating changes relevant to the company. . . Comprehensive income items Marketable securities on the balance sheet at a cost of $5,500,000 are available-for-sale Market value at the balance sheet date is $5,235,00 Prepare the adjusting entry to record the unrealized loss and include in comprehensive income Stockholder Equity Peyton Approved prides itself on transparency with shareholders and investors. The company has added two storefront locations and launched a new marketing campaign, which is estimated to bring in 20,000 new customers over the next 6 months. The company expects this expansion will require an additional $1,000,000 of capital and generate an additional $600,000 of after-tax profit. The options are: 1) Issuing an additional $1,000,000 of 10%, 100-par convertible preferred stock (same class as is currently outstanding) 2) Issue an additional $1,000,000 of 8% convertible bonds (same terms as the existing issue) 3) $500,000 each of preferred stock and bonds Cash Marketable Securities Accounts Receivable Baking Supplies Merchandise Inventory Prepaid Rent Prepaid Insurance Misc. Supplies Land Building Baking Equipment Accumulated Depreciation Patent Accounts Payable Wages Payable Interest Payable Current Portion of Bonds Payable Income Taxes Currently Payable Accrued Pension Liability Accrued Employees Health Insurance Lease Liability Deferred Tax Liability Bonds Payable Preferred Stock Common Stock Beginning Retained earnings Dividends Preferred Dividends - Common Bakery Sales Merchandise Sales Cost of Goods Sold - Baked Cost of Goods Sold - Merchan Rent Expense Wages Expense Misc. Supplies Expense Repairs and Maintenance Business License Expense Misc. Expense Depreciation Expense Insurance Expense Advertising Expense Interest Expense Telephone Expense Pension Expense Retired Employees Health Ins. Patent Amortization TRIAL BALANCE As of December 31, 2017 Dr Cr Income Taxes Deferred tax Expense 1,488.999.34 5,500,000.00 7,092,495.88 1,605,098.52 128,152.63 71,877.07 207,834.14 17,647.42 250,000.00 1,250,000.00 2,254,140.00 50,000.00 5,250,000.00 10,954,907.36 88,994.79 1,576,731.95 2,604,526.23 263,224.56 47,353.05 211,757.65 141,171.08 634,520.00 112,937.69 160,413.49 484,703.27 50,821.34 Unrealized Gain/(Loss) on Marketable Securities Held for Sale 4,168,472.62 46,666,780.08 328,282.00 1,555,212.85 250,203.31 21,888.22 1,000,000.00 1,042,118.16 4,000,000.00 500,000.00 1,750,000.00 2,213,122.59 33,881,157.15 124,795.80 46,666,780.08 Adjusting entries Dr 265,000.00 118,200.25 118,575.25 501,775.50 Cr 265,000.00 118,200.25 118,575.25 501,775.50 Dr 1,488,999.34 5,235,000.00 7,092,495.88 1,605,098.52 128,152.63 71,877.07 207,834.14 17,647.42 250,000.00 1,250,000.00 2,254,140.00 50,000.00 5,250,000.00 10,954,907.36 88,994.79 1,576,731.95 2,604,526.23 263,224.56 47,353.05 211,757.65 141,171.08 634,520.00 112,937.69 160,413.49 484,703.27 50,821.34 265,000.00 4,286,672.87 118,575.25 46,903,555.58 Cr 328,282.00 1,555,212.85 250,203.31 21,888.22 1,000,000.00 1,160,318.41 118,575.25 4,000,000.00 500,000.00 1,750,000.00 2,213,122.59 33,881,157.15 124,795.80 46,903,555.58 Overview Imagine that you are working as a financial accountant for Peyton Approved, and you have been charged with revising its financial information. The company has experienced tremendous growth in the past three years, and it is now a well-known bakery chain for pet products. They have become a publicly traded company and have several locations that they deliver to regionally. You will find the company's financial information in the Peyton Approved Balance Sheet and Income Statement. This document will need revisions and appropriate notes added in order to prepare for the year-end audit accordingly. In addition to ensuring that the balance sheet is ready for the year-end audit, you will address other major areas of need, including: Assessing tax implications Evaluating and explaining stockholder equity Accounting for postretirement benefits (The amounts would be determined by actuaries.) Assessing impacts of leases Stockholder Equity Peyton Approved prides itself on transparency with shareholders and investors. The company has added two storefront locations and launched a new marketing campaign, which is estimated to bring in 20,000 new customers over the next 6 months. The company expects this expansion will require an additional $1,000,000 of capital and generate an additional $600,000 of after-tax profit. The options are: 1) Issuing an additional $1,000,000 of 10%, 100-par convertible preferred stock (same class as is currently outstanding) 2) Issue an additional $1,000,000 of 8% convertible bonds (same terms as the existing issue) 3) $500,000 each of preferred stock and bonds MANAGEMENT BRIEF - Prepare in a Word document - see the rubric for milestone 1 A. Identify sources of other comprehensive income not included in net income. B. Explain rationale for the inclusion as comprehensive income (as opposed to net income) of nondisclosure within notes. FINANCIAL INFORMATION FOR THIS MILESTONE . . . Tax information and implications $1,500 in meal and entertainment expenses show as a permanent difference for tax. Prepare the necessary adjusting entry. The company uses straight line depreciation for book and MACRS depreciation for the tax return MACRS depreciation was $209,301 higher than book. Prepare the adjusting entry for the deferred tax. There have been recent tax structure changes the could impact the company. Peyton Approved has been a C Corp since the beginning of these changes. Peyton provides for taxes at 25% of pretax income (20% Federal, 5% state). . C. Evaluate impacts of company goals and finances for their implications on stockholder equity, using financial information to support claims. D. Evaluate impacts of company goals and finances for their implications on retained earnings per share, using financial information to support claim E. Explain the impact of issuing preferred stock or debt for determining changes to equity structures. F. Assess the impact of changes to current tax structure for articulating changes relevant to the company. . . Comprehensive income items Marketable securities on the balance sheet at a cost of $5,500,000 are available-for-sale Market value at the balance sheet date is $5,235,00 Prepare the adjusting entry to record the unrealized loss and include in comprehensive income Stockholder Equity Peyton Approved prides itself on transparency with shareholders and investors. The company has added two storefront locations and launched a new marketing campaign, which is estimated to bring in 20,000 new customers over the next 6 months. The company expects this expansion will require an additional $1,000,000 of capital and generate an additional $600,000 of after-tax profit. The options are: 1) Issuing an additional $1,000,000 of 10%, 100-par convertible preferred stock (same class as is currently outstanding) 2) Issue an additional $1,000,000 of 8% convertible bonds (same terms as the existing issue) 3) $500,000 each of preferred stock and bonds Cash Marketable Securities Accounts Receivable Baking Supplies Merchandise Inventory Prepaid Rent Prepaid Insurance Misc. Supplies Land Building Baking Equipment Accumulated Depreciation Patent Accounts Payable Wages Payable Interest Payable Current Portion of Bonds Payable Income Taxes Currently Payable Accrued Pension Liability Accrued Employees Health Insurance Lease Liability Deferred Tax Liability Bonds Payable Preferred Stock Common Stock Beginning Retained earnings Dividends Preferred Dividends - Common Bakery Sales Merchandise Sales Cost of Goods Sold - Baked Cost of Goods Sold - Merchan Rent Expense Wages Expense Misc. Supplies Expense Repairs and Maintenance Business License Expense Misc. Expense Depreciation Expense Insurance Expense Advertising Expense Interest Expense Telephone Expense Pension Expense Retired Employees Health Ins. Patent Amortization TRIAL BALANCE As of December 31, 2017 Dr Cr Income Taxes Deferred tax Expense 1,488.999.34 5,500,000.00 7,092,495.88 1,605,098.52 128,152.63 71,877.07 207,834.14 17,647.42 250,000.00 1,250,000.00 2,254,140.00 50,000.00 5,250,000.00 10,954,907.36 88,994.79 1,576,731.95 2,604,526.23 263,224.56 47,353.05 211,757.65 141,171.08 634,520.00 112,937.69 160,413.49 484,703.27 50,821.34 Unrealized Gain/(Loss) on Marketable Securities Held for Sale 4,168,472.62 46,666,780.08 328,282.00 1,555,212.85 250,203.31 21,888.22 1,000,000.00 1,042,118.16 4,000,000.00 500,000.00 1,750,000.00 2,213,122.59 33,881,157.15 124,795.80 46,666,780.08 Adjusting entries Dr 265,000.00 118,200.25 118,575.25 501,775.50 Cr 265,000.00 118,200.25 118,575.25 501,775.50 Dr 1,488,999.34 5,235,000.00 7,092,495.88 1,605,098.52 128,152.63 71,877.07 207,834.14 17,647.42 250,000.00 1,250,000.00 2,254,140.00 50,000.00 5,250,000.00 10,954,907.36 88,994.79 1,576,731.95 2,604,526.23 263,224.56 47,353.05 211,757.65 141,171.08 634,520.00 112,937.69 160,413.49 484,703.27 50,821.34 265,000.00 4,286,672.87 118,575.25 46,903,555.58 Cr 328,282.00 1,555,212.85 250,203.31 21,888.22 1,000,000.00 1,160,318.41 118,575.25 4,000,000.00 500,000.00 1,750,000.00 2,213,122.59 33,881,157.15 124,795.80 46,903,555.58

Step by Step Solution

★★★★★

3.26 Rating (170 Votes )

There are 3 Steps involved in it

Step: 1

Analyzing inventory costs You will need to review the balance sheet income statement and other relev...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started