Overview

In the first milestone, you prepared a client analysis. In this milestone, you will create the stock analysis and portfolio development sections of your final project.

First, you must understand what you are investing in. You have to know the underlying characteristics of the investment. What type of asset is it? What type of security? How is it priced? What are the expected cash flows? Who are the typical investors and what are their typical motives? If you do not understand the answers to those questions, then the initial expectations you develop about the value and risk of the asset will be fundamentally flawed. This sets you up for missteps that can lead to underperforming your investment objectives.

Second, you must be able to estimate the value of the asset. Valuation is about assessing the estimated cash flows of the asset. This is a key component of discerning absolute return potential and the differences between competing assets. It has a significant influence on the third step in the process as well.

The third step is developing a thesis about an asset's expected return and the associated risk. This is accomplished by assessing your valuation estimates against the current market price and any developing economic or market dynamics that may impact your expected valuation or its pricing. The market is constantly changing, and these expectations need to be monitored on a regular basis to ensure they continue to correspond to the objectives you are trying to achieve.

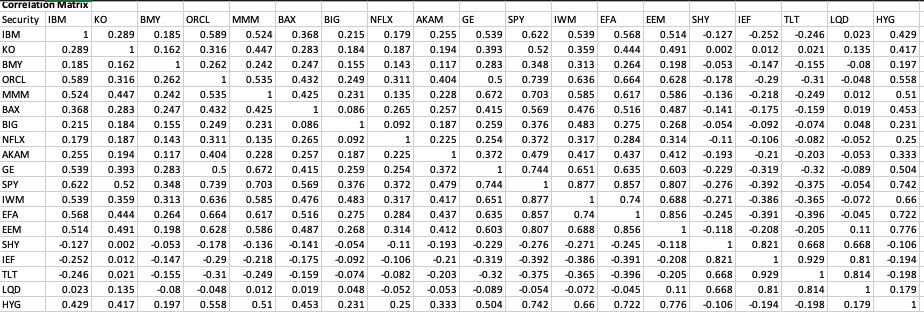

Finally, you must understand how the assets in a portfolio interact with one another. It is likely that you will not have just one investment, so any additional assets will impact the overall performance of the portfolio. You want to formulate a plan to add assets that, when combined together, will have the potential to meet your objectives. Putting all of these steps together into a consistent, thorough process will position you to better meet the investment objectives laid out at the beginning.

Prompt

This milestone involves creating a draft of the stock analysis and portfolio development sections of the final project. Use the provided spreadsheet to calculate your portfolio's standard deviation and the Final Project Scenarios document.

Specifically, the following critical elements must be addressed:

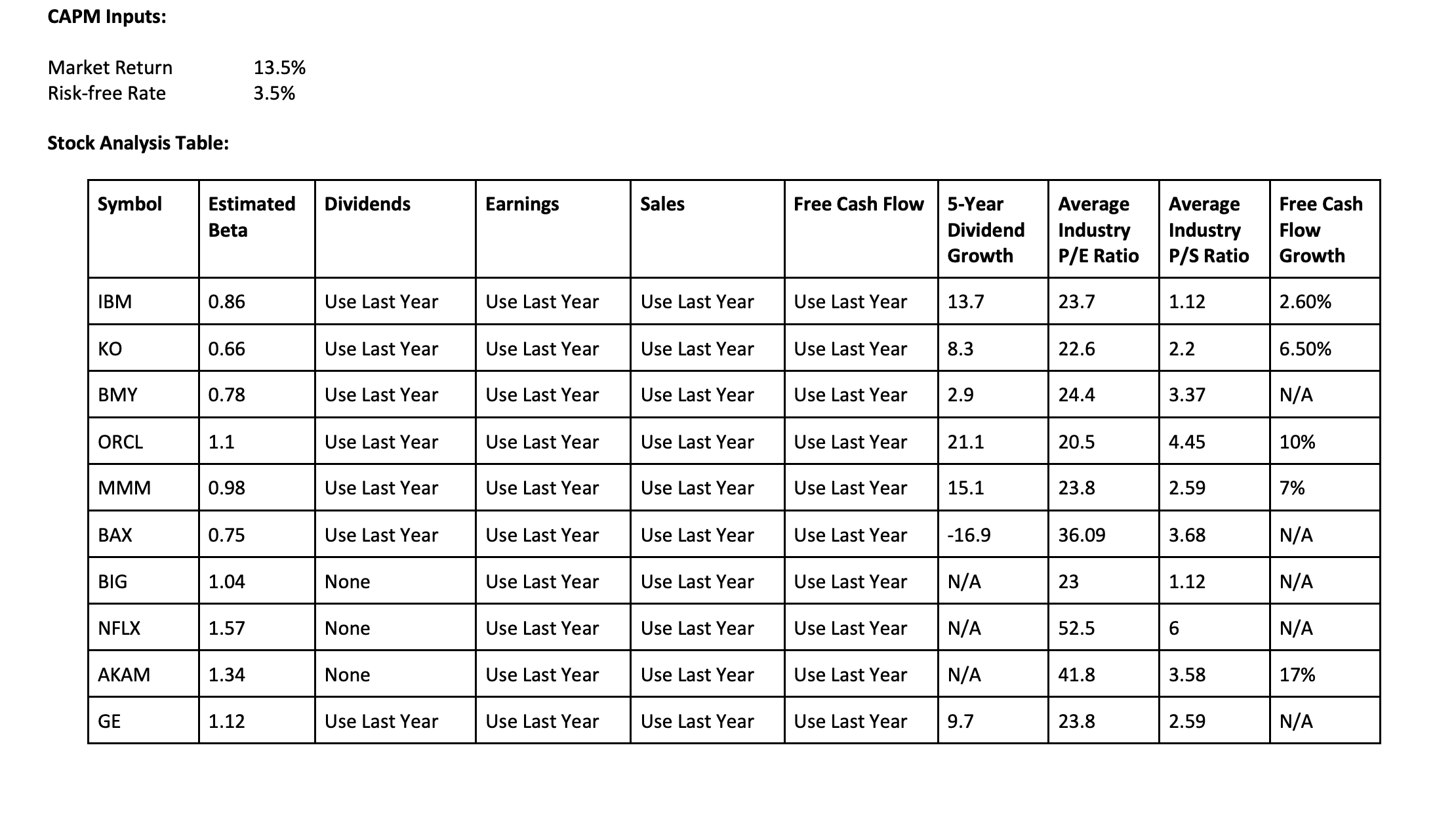

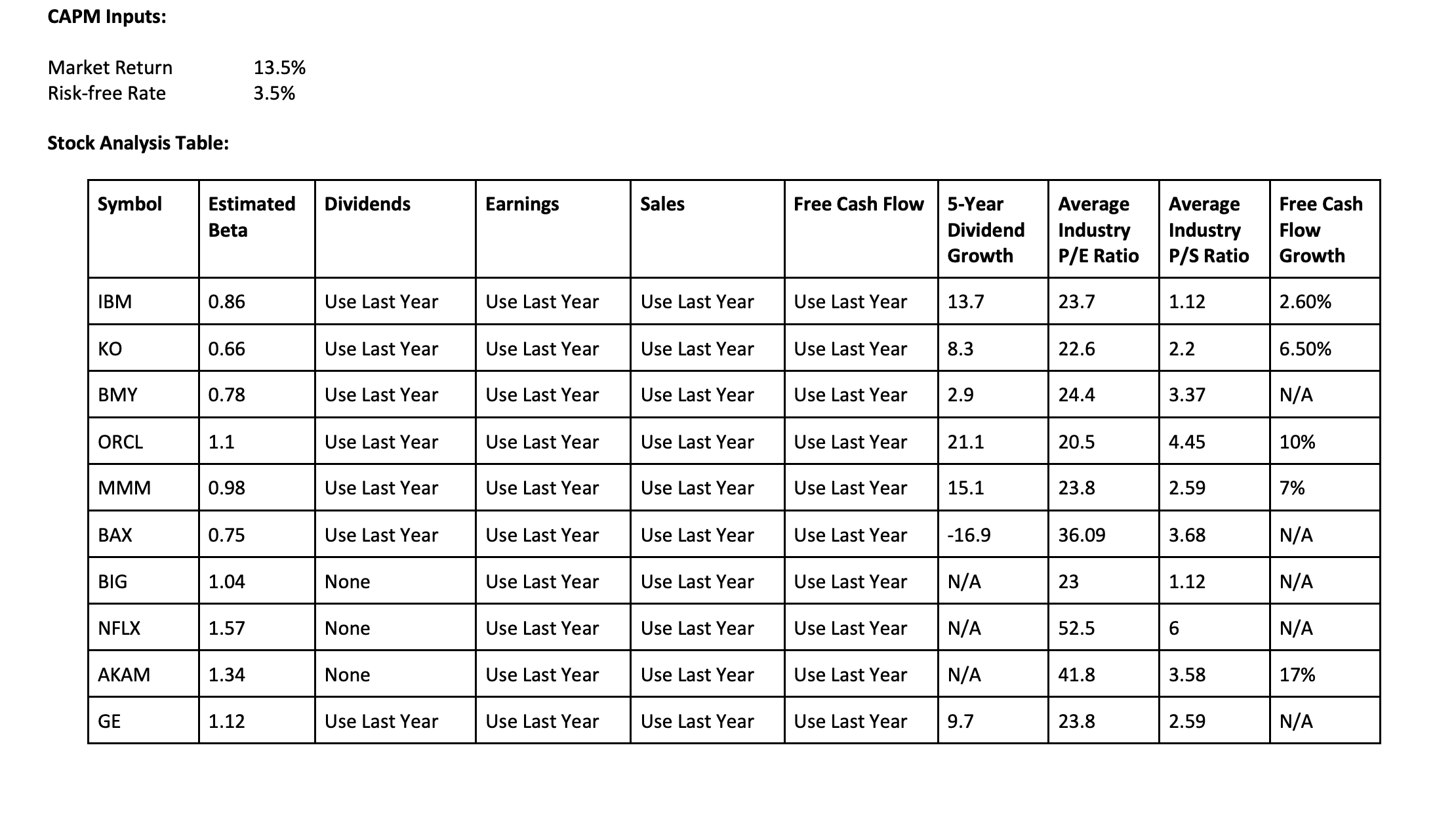

- Stock Analysis: In this section, you will select five stocks from the provided list and determine their values by applying an appropriate valuation model from the following options: price to multiple model (earning or sales), dividend valuation model, or free cash flow to equity valuation model.

- Determine the value of each stock by using an appropriate model based on the characteristics provided for each stock; use each model at least once.

- Provide a rationale for the stock valuation method you chose for each stock. Cite specific information to support your decisions.

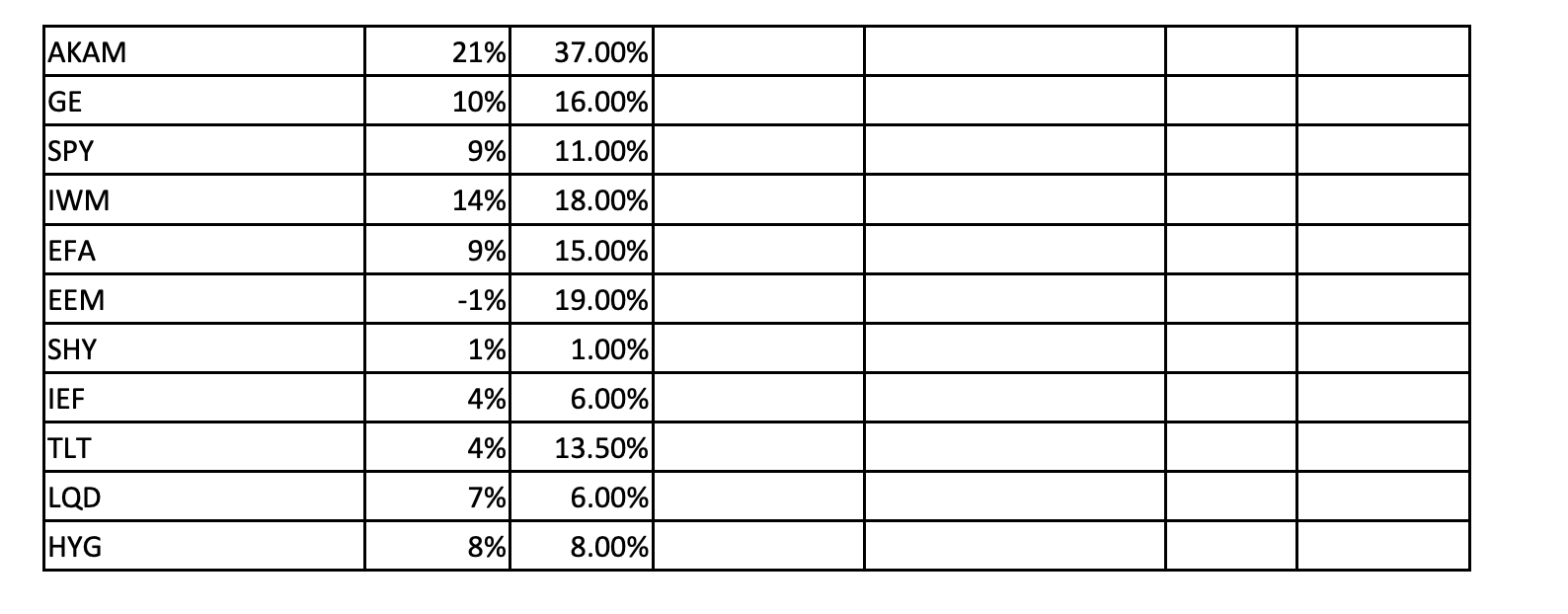

- Using the calculated valuation, the current market price, and historical performance, determine the expected return for each stock.

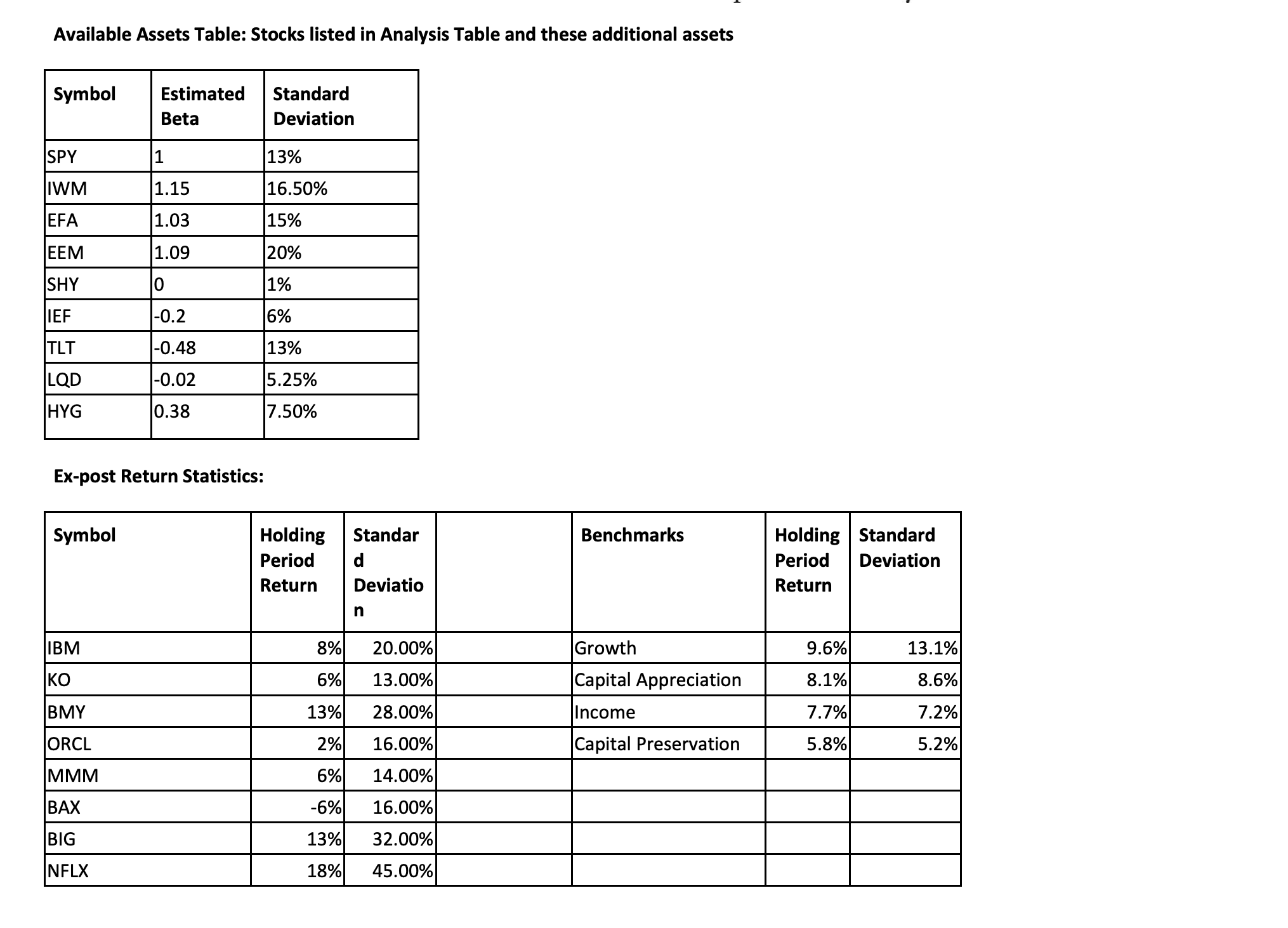

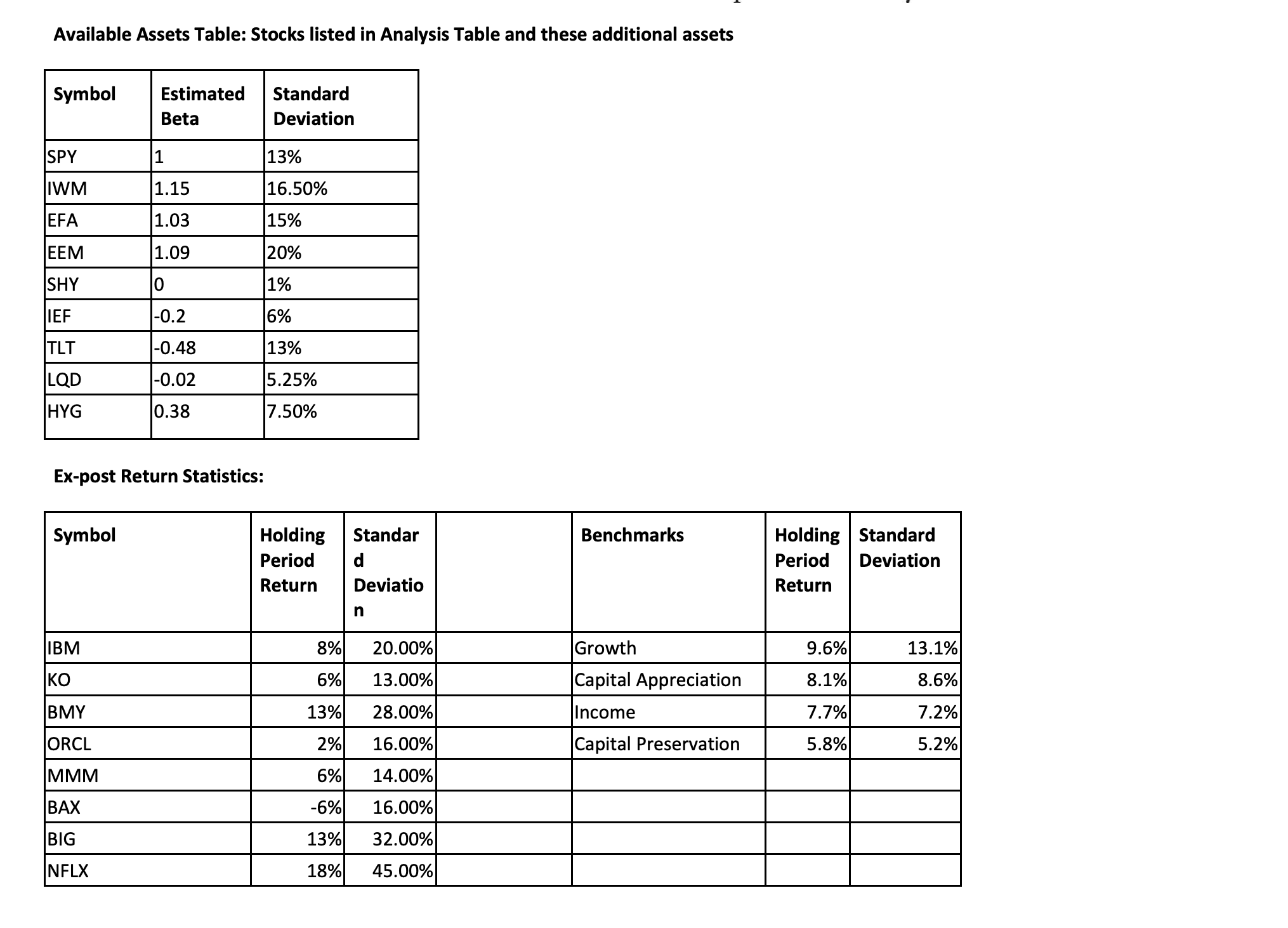

- Portfolio Development: In this section, you will develop a portfolio for a client (Ezra or Jacob and Rachel) based on the clients risk tolerance, return objectives, and liquidity objectives. You will select appropriate assets from the provided list.

- For the client, develop a portfolio from the list of assets provided that is informed by your analysis of the clients objectives and (if applicable) the stock valuation you determined.

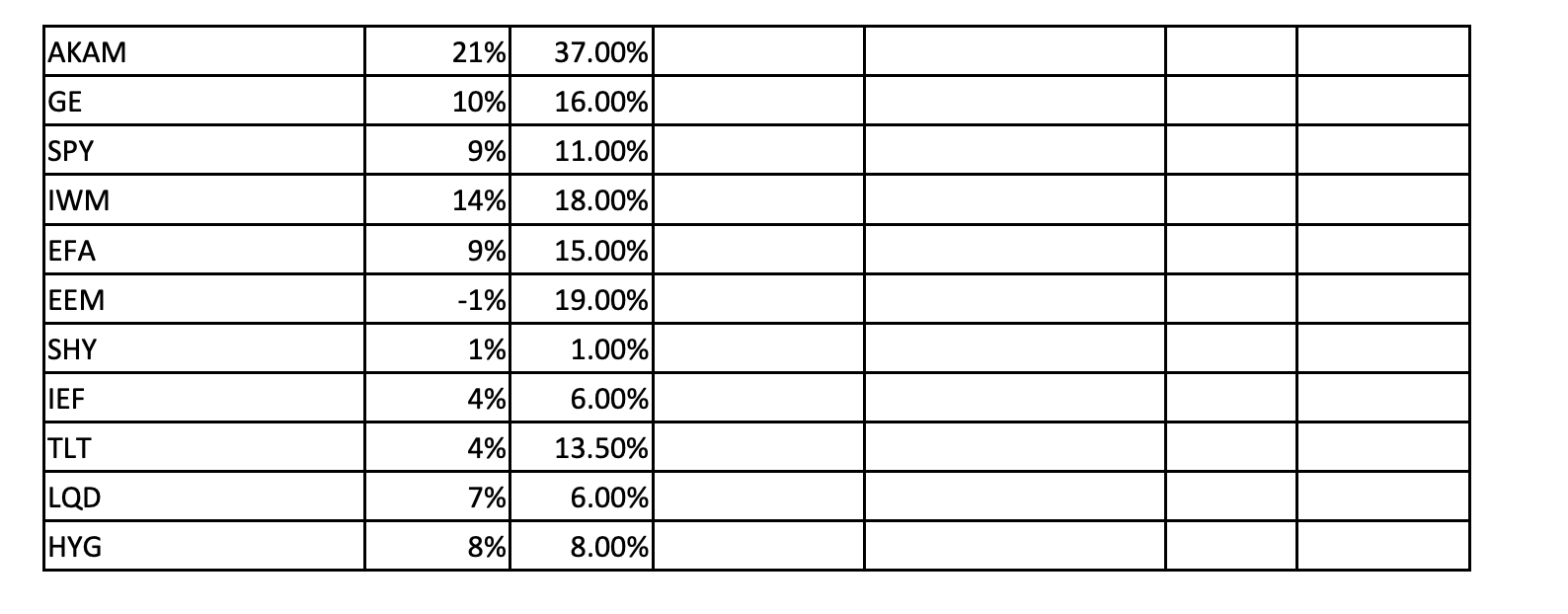

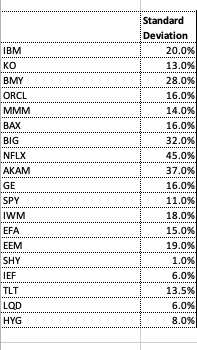

- Calculate the expected portfolio return using the CAPM (beta) model. Based on the risk tolerance and return objective of the client you didnt choose for this assignment, would you design an investment portfolio that has a higher or lower expected portfolio return, and why?

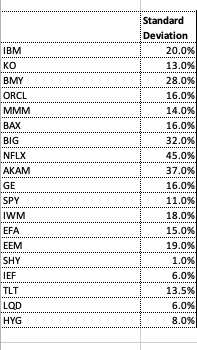

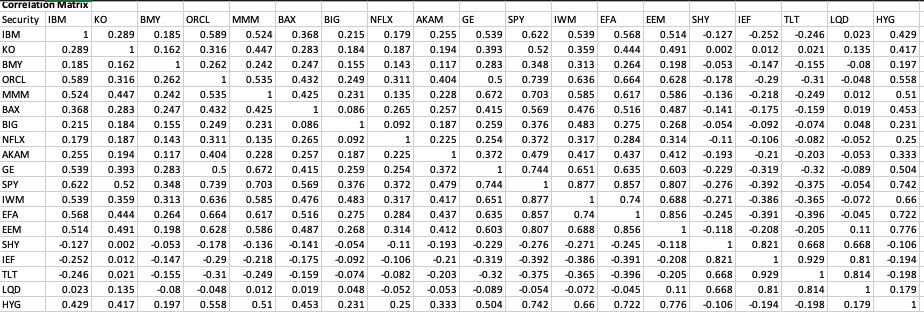

- Calculate the expected portfolio standard deviation. Based on the risk tolerance and return objective of the client that you didnt choose for this assignment, would you design an investment portfolio that has a higher or lower expected standard deviation, and why?

What to Submit

Your client analysis should be a 3- to 5-page Microsoft Word document, double spaced, with 12-pt. Times New Roman font, one-inch margins, and citations cited in APA format. Note that your submission may be longer than 6 pages as work must be shown for all calculations. You may use and upload an Excel workbook to show your calculations. In your written paper, if you are referring to data that is found within an uploaded Excel workbook, be sure to include a citationfor example, the portfolios expected return is 7.2% (E64, Sheet1, WB1), where E64 is the cell that the calculation took place in, Sheet1 is the tab, and WB1 is designating the name of your file. This ensures that your instructor can quickly and accurately check data entry, formula use, and financial calculations.

Stock Analysis Table: Available Assets Table: Stocks listed in Analysis Table and these additional assets Ex-post Return Statistics: \begin{tabular}{|c|c|c|c|c|c|c|} \hline AKAM & 21% & 37.00% & & & & \\ \hline GE & 10% & 16.00% & & & & \\ \hline SPY & 9% & 11.00% & & & & \\ \hline IWM & 14% & 18.00% & & & & \\ \hline EFA & 9% & 15.00% & & & & \\ \hline EEM & 1% & 19.00% & & & & \\ \hline SHY & 1% & 1.00% & & & & \\ \hline IEF & 4% & 6.00% & & & & \\ \hline TLT & 4% & 13.50% & & & & \\ \hline LQD & 7% & 6.00% & & & & \\ \hline HYG & 8% & 8.00% & & & & \\ \hline \end{tabular} \begin{tabular}{|c|c|} \hline & StandardDeviation \\ \hline IBM & 20.0% \\ \hline KO & 13.0% \\ \hline BMY & 28.0% \\ \hline ORCL & 16.0% \\ \hline MMM & 14.0% \\ \hline BAX & 16.0% \\ \hline BIG & 32.0% \\ \hline NFLX & 45.0% \\ \hline AKAM & 37.0% \\ \hline GE & 16.0% \\ \hline SPY & 11.0% \\ \hline IWM & 18.0% \\ \hline EFA & 15.0% \\ \hline EEM & 19.0% \\ \hline SHY & 1.0% \\ \hline IEF & 6.0% \\ \hline TLT & 13.5% \\ \hline LQD & 6.0% \\ \hline HYG & 8.0% \\ \hline \end{tabular} \begin{tabular}{|c|c|c|c|c|c|c|c|c|c|c|c|c|c|c|c|c|c|c|c|} \hline \multicolumn{2}{|c|}{ Correlation Matrix } & \multirow[b]{2}{*}{ KO } & \multirow[b]{2}{*}{ BMY } & \multirow[b]{2}{*}{ ORCL } & \multirow[b]{2}{*}{ MMM } & \multirow[b]{2}{*}{ BAX } & \multirow[b]{2}{*}{ BIG } & \multirow[b]{2}{*}{ NFLX } & \multirow[b]{2}{*}{ AKAM } & \multirow[b]{2}{*}{ GE } & \multirow[b]{2}{*}{ SPY } & \multirow[b]{2}{*}{ IWM } & \multirow[b]{2}{*}{ EFA } & \multirow[b]{2}{*}{ EEM } & \multirow[b]{2}{*}{ SHY } & \multirow[b]{2}{*}{ IEF } & \multirow[b]{2}{*}{ TLT } & \multirow[b]{2}{*}{ LQD } & \multirow[b]{2}{*}{ HYG } \\ \hline Security & IBM & & & & & & & & & & & & & & & & & & \\ \hline IBM & 1 & 0.289 & 0.185 & 0.589 & 0.524 & 0.368 & 0.215 & 0.179 & 0.255 & 0.539 & 0.622 & 0.539 & 0.568 & 0.514 & -0.127 & -0.252 & -0.246 & 0.023 & 0.429 \\ \hline Ko & 0.289 & 1 & 0.162 & 0.316 & 0.447 & 0.283 & 0.184 & 0.187 & 0.194 & 0.393 & 0.52 & 0.359 & 0.444 & 0.491 & 0.002 & 0.012 & 0.021 & 0.135 & 0.417 \\ \hline BMY & 0.185 & 0.162 & 1 & 0.262 & 0.242 & 0.247 & 0.155 & 0.143 & 0.117 & 0.283 & 0.348 & 0.313 & 0.264 & 0.198 & -0.053 & -0.147 & -0.155 & -0.08 & 0.197 \\ \hline RCL & 589 & 0.316 & 0.262 & 1 & 1.535 & 0.432 & 0.249 & 0.311 & 0.404 & 0.5 & 0.739 & 0.636 & 0.664 & 0.628 & -0.178 & -0.29 & -0.31 & -0.048 & 0.558 \\ \hline MMM & .524 & 0.447 & 0.242 & 0.535 & 1 & 0.425 & 0.231 & 0.135 & 0.228 & 0.672 & 0.703 & 0.585 & 0.617 & 0.586 & -0.136 & -0.218 & -0.249 & 0.012 & 0.51 \\ \hline BAX & 0.368 & 0.283 & 0.247 & 0.432 & 0.425 & 1 & 0.086 & 0.265 & 0.257 & 0.415 & 0.569 & 0.476 & 0.516 & 0.487 & -0.141 & -0.175 & -0.159 & 0.019 & 0.453 \\ \hline BIG & 0.215 & 0.184 & 0.155 & 0.249 & 0.231 & 0.086 & 1 & 0.092 & 0.187 & 0.259 & 0.376 & 0.483 & 0.275 & 0.268 & -0.054 & -0.092 & -0.074 & 0.048 & 0.231 \\ \hline NFLX & 0.179 & 0.187 & 0.143 & 0.311 & 0.135 & 0.265 & 0.092 & 1 & 225 & .254 & 0.372 & 0.317 & 0.284 & 0.314 & -0.11 & -0.106 & -0.082 & -0.052 & 0.25 \\ \hline AKAM & 0.255 & 194 & 117 & .404 & 228 & 0.257 & 0.187 & .225 & 1 & 0.372 & 0.479 & 0.417 & 0.437 & 0.412 & -0.193 & -0.21 & -0.203 & -0.053 & 0.333 \\ \hline SE & 0.539 & 0.393 & 0.283 & 0.5 & 0.672 & 0.415 & 0.259 & 0.254 & 0.372 & 1 & 0.744 & 0.651 & 0.635 & 0.603 & -0.229 & -0.319 & -0.32 & -0.089 & 0.504 \\ \hline SPY & 0.622 & 0.52 & 0.348 & 0.739 & 0.703 & 0.569 & 0.376 & 0.372 & 0.479 & 0.744 & 1 & 0.877 & 0.857 & 0.807 & -0.276 & -0.392 & -0.375 & -0.054 & 0.742 \\ \hline IWM & 0.539 & 0.359 & 0.313 & 0.636 & 0.585 & 0.476 & 0.483 & 0.317 & 0.417 & 0.651 & 0.877 & 1 & 0.74 & 0.688 & -0.271 & -0.386 & -0.365 & -0.072 & 0.66 \\ \hline EFA & 0.568 & 0.444 & 0.264 & 0.664 & 0.617 & 0.516 & 0.275 & 0.284 & 0.437 & 0.635 & 0.857 & 0.74 & 1 & 0.856 & -0.245 & -0.391 & -0.396 & -0.045 & 0.722 \\ \hline EEM & 0.514 & 0.491 & 0.198 & 0.628 & 0.586 & 0.487 & 0.268 & 0.314 & 0.412 & 0.603 & 0.807 & 0.688 & 0.856 & 1 & -0.118 & -0.208 & -0.205 & 0.11 & 0.776 \\ \hline SHY & -0.127 & 0.002 & -0.053 & -0.178 & -0.136 & -0.141 & -0.054 & -0.11 & -0.193 & -0.229 & -0.276 & -0.271 & -0.245 & -0.118 & 1 & 0.821 & 0.668 & 0.668 & -0.106 \\ \hline IEF & -0.252 & 0.012 & -0.147 & -0.29 & -0.218 & -0.175 & -0.092 & -0.106 & -0.21 & -0.319 & -0.392 & -0.386 & -0.391 & -0.208 & 0.821 & 1 & 0.929 & 0.81 & -0.194 \\ \hline TLT & -0.246 & 0.021 & -0.155 & -0.31 & -0.249 & -0.159 & -0.074 & -0.082 & -0.203 & -0.32 & -0.375 & -0.365 & -0.396 & -0.205 & 0.668 & 0.929 & 1 & 0.814 & -0.198 \\ \hline LQD & 0.023 & 0.135 & -0.08 & -0.048 & 0.012 & 0.019 & 0.048 & -0.052 & -0.053 & -0.089 & -0.054 & -0.072 & -0.045 & 0.11 & 0.668 & 0.81 & 0.814 & 1 & 0.179 \\ \hline HYG & 0.429 & 0.417 & 0.197 & 0.558 & 0.51 & 0.453 & 0.231 & 0.25 & 0.333 & 0.504 & 0.742 & 0.66 & 0.722 & 0.776 & -0.106 & -0.194 & -0.198 & 0.179 & \\ \hline \end{tabular} Stock Analysis Table: Available Assets Table: Stocks listed in Analysis Table and these additional assets Ex-post Return Statistics: \begin{tabular}{|c|c|c|c|c|c|c|} \hline AKAM & 21% & 37.00% & & & & \\ \hline GE & 10% & 16.00% & & & & \\ \hline SPY & 9% & 11.00% & & & & \\ \hline IWM & 14% & 18.00% & & & & \\ \hline EFA & 9% & 15.00% & & & & \\ \hline EEM & 1% & 19.00% & & & & \\ \hline SHY & 1% & 1.00% & & & & \\ \hline IEF & 4% & 6.00% & & & & \\ \hline TLT & 4% & 13.50% & & & & \\ \hline LQD & 7% & 6.00% & & & & \\ \hline HYG & 8% & 8.00% & & & & \\ \hline \end{tabular} \begin{tabular}{|c|c|} \hline & StandardDeviation \\ \hline IBM & 20.0% \\ \hline KO & 13.0% \\ \hline BMY & 28.0% \\ \hline ORCL & 16.0% \\ \hline MMM & 14.0% \\ \hline BAX & 16.0% \\ \hline BIG & 32.0% \\ \hline NFLX & 45.0% \\ \hline AKAM & 37.0% \\ \hline GE & 16.0% \\ \hline SPY & 11.0% \\ \hline IWM & 18.0% \\ \hline EFA & 15.0% \\ \hline EEM & 19.0% \\ \hline SHY & 1.0% \\ \hline IEF & 6.0% \\ \hline TLT & 13.5% \\ \hline LQD & 6.0% \\ \hline HYG & 8.0% \\ \hline \end{tabular} \begin{tabular}{|c|c|c|c|c|c|c|c|c|c|c|c|c|c|c|c|c|c|c|c|} \hline \multicolumn{2}{|c|}{ Correlation Matrix } & \multirow[b]{2}{*}{ KO } & \multirow[b]{2}{*}{ BMY } & \multirow[b]{2}{*}{ ORCL } & \multirow[b]{2}{*}{ MMM } & \multirow[b]{2}{*}{ BAX } & \multirow[b]{2}{*}{ BIG } & \multirow[b]{2}{*}{ NFLX } & \multirow[b]{2}{*}{ AKAM } & \multirow[b]{2}{*}{ GE } & \multirow[b]{2}{*}{ SPY } & \multirow[b]{2}{*}{ IWM } & \multirow[b]{2}{*}{ EFA } & \multirow[b]{2}{*}{ EEM } & \multirow[b]{2}{*}{ SHY } & \multirow[b]{2}{*}{ IEF } & \multirow[b]{2}{*}{ TLT } & \multirow[b]{2}{*}{ LQD } & \multirow[b]{2}{*}{ HYG } \\ \hline Security & IBM & & & & & & & & & & & & & & & & & & \\ \hline IBM & 1 & 0.289 & 0.185 & 0.589 & 0.524 & 0.368 & 0.215 & 0.179 & 0.255 & 0.539 & 0.622 & 0.539 & 0.568 & 0.514 & -0.127 & -0.252 & -0.246 & 0.023 & 0.429 \\ \hline Ko & 0.289 & 1 & 0.162 & 0.316 & 0.447 & 0.283 & 0.184 & 0.187 & 0.194 & 0.393 & 0.52 & 0.359 & 0.444 & 0.491 & 0.002 & 0.012 & 0.021 & 0.135 & 0.417 \\ \hline BMY & 0.185 & 0.162 & 1 & 0.262 & 0.242 & 0.247 & 0.155 & 0.143 & 0.117 & 0.283 & 0.348 & 0.313 & 0.264 & 0.198 & -0.053 & -0.147 & -0.155 & -0.08 & 0.197 \\ \hline RCL & 589 & 0.316 & 0.262 & 1 & 1.535 & 0.432 & 0.249 & 0.311 & 0.404 & 0.5 & 0.739 & 0.636 & 0.664 & 0.628 & -0.178 & -0.29 & -0.31 & -0.048 & 0.558 \\ \hline MMM & .524 & 0.447 & 0.242 & 0.535 & 1 & 0.425 & 0.231 & 0.135 & 0.228 & 0.672 & 0.703 & 0.585 & 0.617 & 0.586 & -0.136 & -0.218 & -0.249 & 0.012 & 0.51 \\ \hline BAX & 0.368 & 0.283 & 0.247 & 0.432 & 0.425 & 1 & 0.086 & 0.265 & 0.257 & 0.415 & 0.569 & 0.476 & 0.516 & 0.487 & -0.141 & -0.175 & -0.159 & 0.019 & 0.453 \\ \hline BIG & 0.215 & 0.184 & 0.155 & 0.249 & 0.231 & 0.086 & 1 & 0.092 & 0.187 & 0.259 & 0.376 & 0.483 & 0.275 & 0.268 & -0.054 & -0.092 & -0.074 & 0.048 & 0.231 \\ \hline NFLX & 0.179 & 0.187 & 0.143 & 0.311 & 0.135 & 0.265 & 0.092 & 1 & 225 & .254 & 0.372 & 0.317 & 0.284 & 0.314 & -0.11 & -0.106 & -0.082 & -0.052 & 0.25 \\ \hline AKAM & 0.255 & 194 & 117 & .404 & 228 & 0.257 & 0.187 & .225 & 1 & 0.372 & 0.479 & 0.417 & 0.437 & 0.412 & -0.193 & -0.21 & -0.203 & -0.053 & 0.333 \\ \hline SE & 0.539 & 0.393 & 0.283 & 0.5 & 0.672 & 0.415 & 0.259 & 0.254 & 0.372 & 1 & 0.744 & 0.651 & 0.635 & 0.603 & -0.229 & -0.319 & -0.32 & -0.089 & 0.504 \\ \hline SPY & 0.622 & 0.52 & 0.348 & 0.739 & 0.703 & 0.569 & 0.376 & 0.372 & 0.479 & 0.744 & 1 & 0.877 & 0.857 & 0.807 & -0.276 & -0.392 & -0.375 & -0.054 & 0.742 \\ \hline IWM & 0.539 & 0.359 & 0.313 & 0.636 & 0.585 & 0.476 & 0.483 & 0.317 & 0.417 & 0.651 & 0.877 & 1 & 0.74 & 0.688 & -0.271 & -0.386 & -0.365 & -0.072 & 0.66 \\ \hline EFA & 0.568 & 0.444 & 0.264 & 0.664 & 0.617 & 0.516 & 0.275 & 0.284 & 0.437 & 0.635 & 0.857 & 0.74 & 1 & 0.856 & -0.245 & -0.391 & -0.396 & -0.045 & 0.722 \\ \hline EEM & 0.514 & 0.491 & 0.198 & 0.628 & 0.586 & 0.487 & 0.268 & 0.314 & 0.412 & 0.603 & 0.807 & 0.688 & 0.856 & 1 & -0.118 & -0.208 & -0.205 & 0.11 & 0.776 \\ \hline SHY & -0.127 & 0.002 & -0.053 & -0.178 & -0.136 & -0.141 & -0.054 & -0.11 & -0.193 & -0.229 & -0.276 & -0.271 & -0.245 & -0.118 & 1 & 0.821 & 0.668 & 0.668 & -0.106 \\ \hline IEF & -0.252 & 0.012 & -0.147 & -0.29 & -0.218 & -0.175 & -0.092 & -0.106 & -0.21 & -0.319 & -0.392 & -0.386 & -0.391 & -0.208 & 0.821 & 1 & 0.929 & 0.81 & -0.194 \\ \hline TLT & -0.246 & 0.021 & -0.155 & -0.31 & -0.249 & -0.159 & -0.074 & -0.082 & -0.203 & -0.32 & -0.375 & -0.365 & -0.396 & -0.205 & 0.668 & 0.929 & 1 & 0.814 & -0.198 \\ \hline LQD & 0.023 & 0.135 & -0.08 & -0.048 & 0.012 & 0.019 & 0.048 & -0.052 & -0.053 & -0.089 & -0.054 & -0.072 & -0.045 & 0.11 & 0.668 & 0.81 & 0.814 & 1 & 0.179 \\ \hline HYG & 0.429 & 0.417 & 0.197 & 0.558 & 0.51 & 0.453 & 0.231 & 0.25 & 0.333 & 0.504 & 0.742 & 0.66 & 0.722 & 0.776 & -0.106 & -0.194 & -0.198 & 0.179 & \\ \hline \end{tabular}