Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Overview In this case study, you, the student will set up a new company file using the Express Start instead of the Detailed Start. You

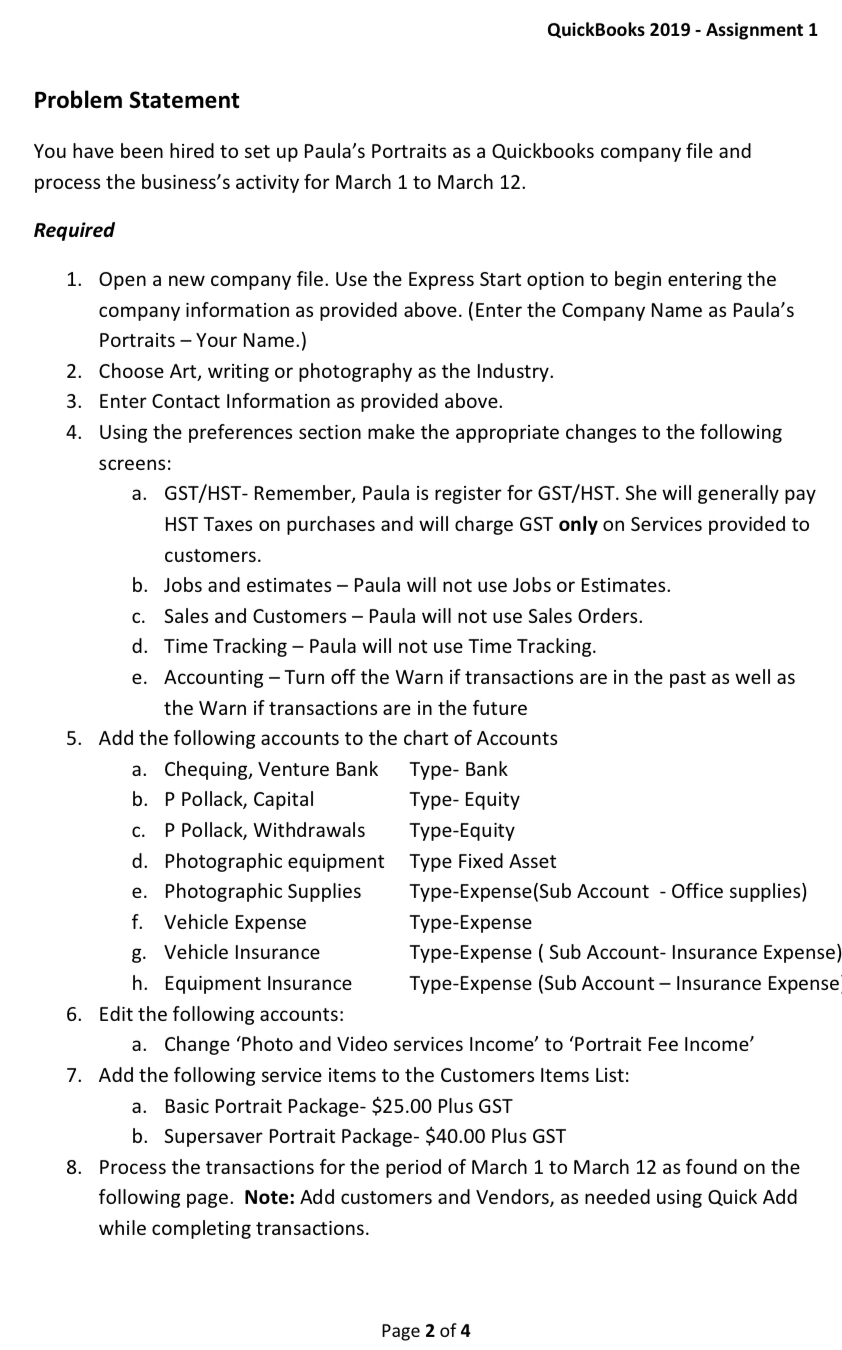

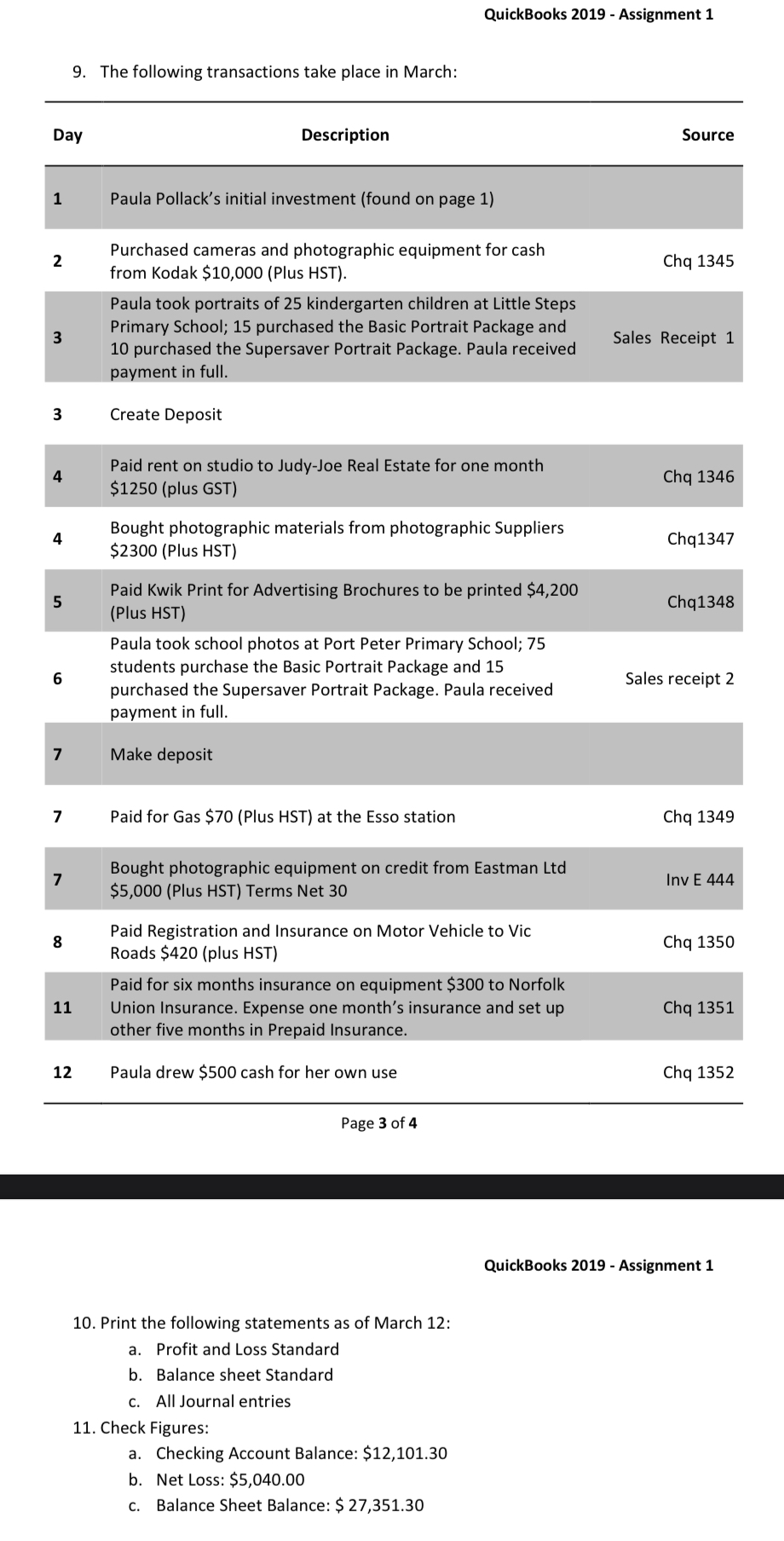

Overview In this case study, you, the student will set up a new company file using the Express Start instead of the Detailed Start. You will use the Preferences Section to make Changes and will add the needed Accounts to the Chart of accounts. You will add Items, Customers and Vendors to the appropriate lists using Quick add. Accounting Information Paula Pollack has been working as a photographer for a large firm. After several requests from friends and contacts to take pictures privately, she has decided to go into business on her own and has registered the name Paula's Portraits. March will be the first month of her fiscal year and January will be the first month of her Calendar/Tax year. Looking at her local market and her experience, Paula has identified Children's and School photography as her areas to specialize in. Paula will offer two packages to students: - Basic Portrait Package -25.00 plus GST - Supersaver Portrait Package -40.00 plus GST These packages are sold to families in advance. The schools distribute the portrait flyer and collect cash and cheques prior to Picture Day. This ensures that Paula receives her payment before the photo sitting sessions. She has rented a studio at 123 Parsons Place, Port Peter, Ontario N7L 4T4 and has taken $30,000 of her savings and deposited it in an account for the business at the venture Bank, Port Peter on March 1. (Use a Journal Entry to Debit $30,000 to Chequing, Venture Bank and Credit $30,000 to P Pollack, Capital.) Paula registered for GST to be reported quarterly, and Tax rate is GST 5%, and HST 13% Problem Statement You have been hired to set up Paula's Portraits as a Quickbooks company file and process the business's activity for March 1 to March 12. Required 1. Open a new company file. Use the Express Start option to begin entering the company information as provided above. (Enter the Company Name as Paula's Portraits - Your Name.) 2. Choose Art, writing or photography as the Industry. 3. Enter Contact Information as provided above. 4. Using the preferences section make the appropriate changes to the following screens: a. GST/HST- Remember, Paula is register for GST/HST. She will generally pay HST Taxes on purchases and will charge GST only on Services provided to customers. b. Jobs and estimates - Paula will not use Jobs or Estimates. c. Sales and Customers - Paula will not use Sales Orders. d. Time Tracking - Paula will not use Time Tracking. e. Accounting - Turn off the Warn if transactions are in the past as well as the Warn if transactions are in the future 5. Add the following accounts to the chart of Accounts a. Chequing, Venture Bank Type- Bank b. P Pollack, Capital Type- Equity c. P Pollack, Withdrawals Type-Equity d. Photographic equipment Type Fixed Asset e. Photographic Supplies Type-Expense(Sub Account - Office supplies) f. Vehicle Expense Type-Expense g. Vehicle Insurance Type-Expense ( Sub Account- Insurance Expens h. Equipment Insurance Type-Expense (Sub Account - Insurance Expen: 6. Edit the following accounts: a. Change 'Photo and Video services Income' to 'Portrait Fee Income' 7. Add the following service items to the Customers Items List: a. Basic Portrait Package- $25.00 Plus GST b. Supersaver Portrait Package- $40.00 Plus GST 8. Process the transactions for the period of March 1 to March 12 as found on the following page. Note: Add customers and Vendors, as needed using Quick Add while completing transactions. 10. Print the following statements as of March 12: a. Profit and Loss Standard b. Balance sheet Standard c. All Journal entries 11. Check Figures: a. Checking Account Balance: \$12,101.30 b. Net Loss: $5,040.00 c. Balance Sheet Balance: $27,351.30

Overview In this case study, you, the student will set up a new company file using the Express Start instead of the Detailed Start. You will use the Preferences Section to make Changes and will add the needed Accounts to the Chart of accounts. You will add Items, Customers and Vendors to the appropriate lists using Quick add. Accounting Information Paula Pollack has been working as a photographer for a large firm. After several requests from friends and contacts to take pictures privately, she has decided to go into business on her own and has registered the name Paula's Portraits. March will be the first month of her fiscal year and January will be the first month of her Calendar/Tax year. Looking at her local market and her experience, Paula has identified Children's and School photography as her areas to specialize in. Paula will offer two packages to students: - Basic Portrait Package -25.00 plus GST - Supersaver Portrait Package -40.00 plus GST These packages are sold to families in advance. The schools distribute the portrait flyer and collect cash and cheques prior to Picture Day. This ensures that Paula receives her payment before the photo sitting sessions. She has rented a studio at 123 Parsons Place, Port Peter, Ontario N7L 4T4 and has taken $30,000 of her savings and deposited it in an account for the business at the venture Bank, Port Peter on March 1. (Use a Journal Entry to Debit $30,000 to Chequing, Venture Bank and Credit $30,000 to P Pollack, Capital.) Paula registered for GST to be reported quarterly, and Tax rate is GST 5%, and HST 13% Problem Statement You have been hired to set up Paula's Portraits as a Quickbooks company file and process the business's activity for March 1 to March 12. Required 1. Open a new company file. Use the Express Start option to begin entering the company information as provided above. (Enter the Company Name as Paula's Portraits - Your Name.) 2. Choose Art, writing or photography as the Industry. 3. Enter Contact Information as provided above. 4. Using the preferences section make the appropriate changes to the following screens: a. GST/HST- Remember, Paula is register for GST/HST. She will generally pay HST Taxes on purchases and will charge GST only on Services provided to customers. b. Jobs and estimates - Paula will not use Jobs or Estimates. c. Sales and Customers - Paula will not use Sales Orders. d. Time Tracking - Paula will not use Time Tracking. e. Accounting - Turn off the Warn if transactions are in the past as well as the Warn if transactions are in the future 5. Add the following accounts to the chart of Accounts a. Chequing, Venture Bank Type- Bank b. P Pollack, Capital Type- Equity c. P Pollack, Withdrawals Type-Equity d. Photographic equipment Type Fixed Asset e. Photographic Supplies Type-Expense(Sub Account - Office supplies) f. Vehicle Expense Type-Expense g. Vehicle Insurance Type-Expense ( Sub Account- Insurance Expens h. Equipment Insurance Type-Expense (Sub Account - Insurance Expen: 6. Edit the following accounts: a. Change 'Photo and Video services Income' to 'Portrait Fee Income' 7. Add the following service items to the Customers Items List: a. Basic Portrait Package- $25.00 Plus GST b. Supersaver Portrait Package- $40.00 Plus GST 8. Process the transactions for the period of March 1 to March 12 as found on the following page. Note: Add customers and Vendors, as needed using Quick Add while completing transactions. 10. Print the following statements as of March 12: a. Profit and Loss Standard b. Balance sheet Standard c. All Journal entries 11. Check Figures: a. Checking Account Balance: \$12,101.30 b. Net Loss: $5,040.00 c. Balance Sheet Balance: $27,351.30 Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started