Answered step by step

Verified Expert Solution

Question

1 Approved Answer

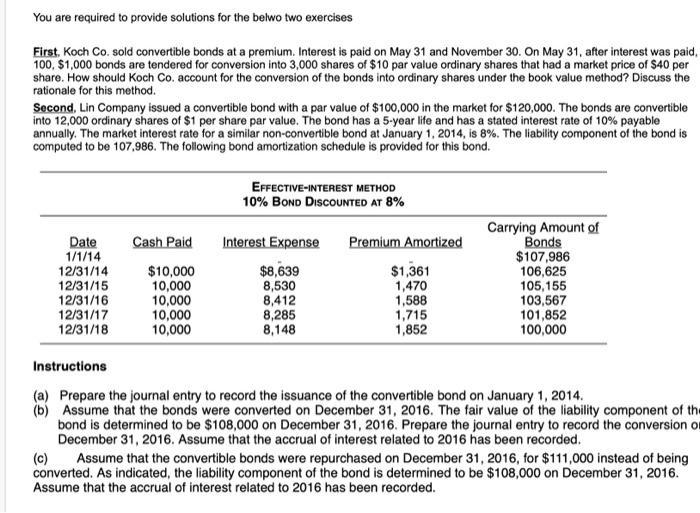

You are required to provide solutions for the belwo two exercises First, Koch Co. sold convertible bonds at a premium. Interest is paid on

You are required to provide solutions for the belwo two exercises First, Koch Co. sold convertible bonds at a premium. Interest is paid on May 31 and November 30. On May 31, after interest was paid, 100, $1,000 bonds are tendered for conversion into 3,000 shares of $10 par value ordinary shares that had a market price of $40 per share. How should Koch Co. account for the conversion of the bonds into ordinary shares under the book value method? Discuss the rationale for this method. Second, Lin Company issued a convertible bond with a par value of $100,000 in the market for $120,000. The bonds are convertible into 12,000 ordinary shares of $1 per share par value. The bond has a 5-year life and has a stated interest rate of 10% payable annually. The market interest rate for a similar non-convertible bond at January 1, 2014, is 8%. The liability component of the bond is computed to be 107,986. The following bond amortization schedule is provided for this bond. Date 1/1/14 12/31/14 12/31/15 12/31/16 12/31/17 12/31/18 Cash Paid $10,000 10,000 10,000 10,000 10,000 EFFECTIVE-INTEREST METHOD 10% BOND DISCOUNTED AT 8% Interest Expense Premium Amortized $8,639 8,530 8,412 8,285 8,148 $1,361 1,470 1,588 1,715 1,852 Carrying Amount of Bonds $107,986 106,625 105,155 103,567 101,852 100,000 Instructions (a) Prepare the journal entry to record the issuance of the convertible bond on January 1, 2014. (b) Assume that the bonds were converted on December 31, 2016. The fair value of the liability component of the bond is determined to be $108,000 on December 31, 2016. Prepare the journal entry to record the conversion or December 31, 2016. Assume that the accrual of interest related to 2016 has been recorded. (c) Assume that the convertible bonds were repurchased on December 31, 2016, for $111,000 instead of being converted. As indicated, the liability component of the bond is determined to be $108,000 on December 31, 2016. Assume that the accrual of interest related to 2016 has been recorded.

Step by Step Solution

★★★★★

3.50 Rating (167 Votes )

There are 3 Steps involved in it

Step: 1

a Journal Entry to record issuance of the convertible bond on January 1 2014 Debit Cash 120000 Debit ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started