Answered step by step

Verified Expert Solution

Question

1 Approved Answer

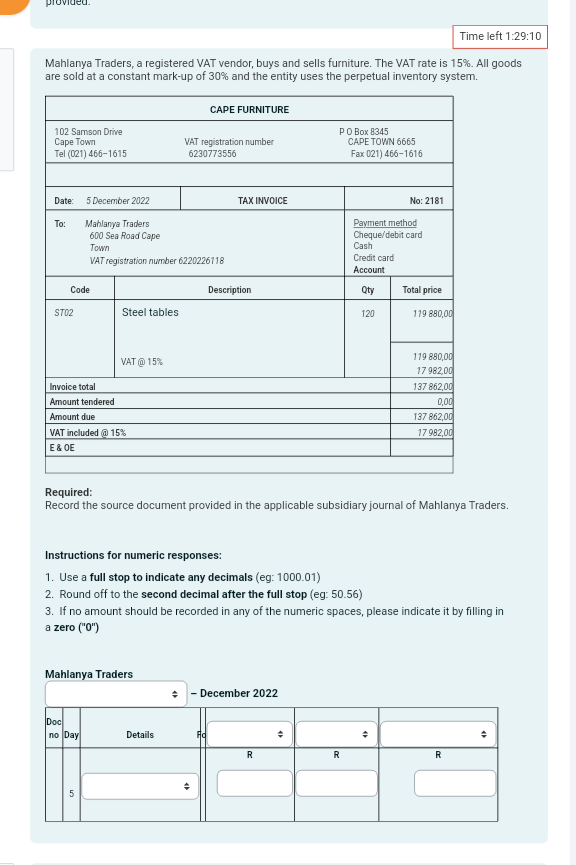

ovided. Time left 1:29:10 Mahlanya Traders, a registered VAT vendor, buys and sells furniture. The VAT rate is 15%. All goods are sold at

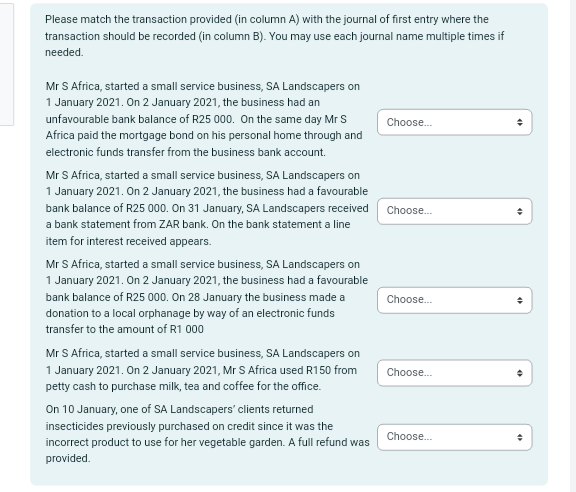

ovided. Time left 1:29:10 Mahlanya Traders, a registered VAT vendor, buys and sells furniture. The VAT rate is 15%. All goods are sold at a constant mark-up of 30% and the entity uses the perpetual inventory system. CAPE FURNITURE 102 Samson Drive Cape Town Tel (021) 466-1615 Date: To: Code ST02 Invoice total Amount tendered Amount due 5 December 2022 Mahlanya Traders 600 Sea Road Cape Town VAT registration number 6220226118 Steel tables VAT included @ 15% E & OE VAT @ 15% Doc no Day 10 VAT registration number 6230773556 Mahlanya Traders TAX INVOICE Details Description Instructions for numeric responses: 1. Use a full stop to indicate any decimals (eg: 1000.01) 2. Round off to the second decimal after the full stop (eg: 50.56) Fo - December 2022 PO Box 8345 CAPE TOWN 6665 Fax 021) 466-1616 Required: Record the source document provided in the applicable subsidiary journal of Mahlanya Traders. R + Payment method Cheque/debit card Cash Credit card Account Qty 3. If no amount should be recorded in any of the numeric spaces, please indicate it by filling in a zero ("0") 120 R No: 2181 Total price 42 119 880,00 119 880,00 17 982,00 137 862,00 0,00 137 862,00 17982,00 R + Please match the transaction provided (in column A) with the journal of first entry where the transaction should be recorded (in column B). You may use each journal name multiple times if needed. Mr S Africa, started a small service business, SA Landscapers on 1 January 2021. On 2 January 2021, the business had an unfavourable bank balance of R25 000. On the same day Mr S Africa paid the mortgage bond on his personal home through and electronic funds transfer from the business bank account. Mr S Africa, started a small service business, SA Landscapers on 1 January 2021. On 2 January 2021, the business had a favourable bank balance of R25 000. On 31 January, SA Landscapers received Choose... a bank statement from ZAR bank. On the bank statement a line item for interest received appears. Mr S Africa, started a small service business, SA Landscapers on 1 January 2021. On 2 January 2021, the business had a favourable bank balance of R25 000. On 28 January the business made a donation to a local orphanage by way of an electronic funds transfer to the amount of R1 000 Mr S Africa, started a small service business, SA Landscapers on 1 January 2021. On 2 January 2021, Mr S Africa used R150 from petty cash to purchase milk, tea and coffee for the office. Choose... On 10 January, one of SA Landscapers' clients returned insecticides previously purchased on credit since it was the incorrect product to use for her vegetable garden. A full refund was provided. Choose... Choose... Choose...

Step by Step Solution

There are 3 Steps involved in it

Step: 1

The source document provided is a tax invoice from CAPE FURNITURE for the purchase of steel tables by Mahlanya Traders To record this transaction in the applicable subsidiary journal of Mahlanya Trade...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started