Question

Owners of the Hungerford Hotel are considering whether or not they should hold the hotel or renovate it, as well as when they should consider

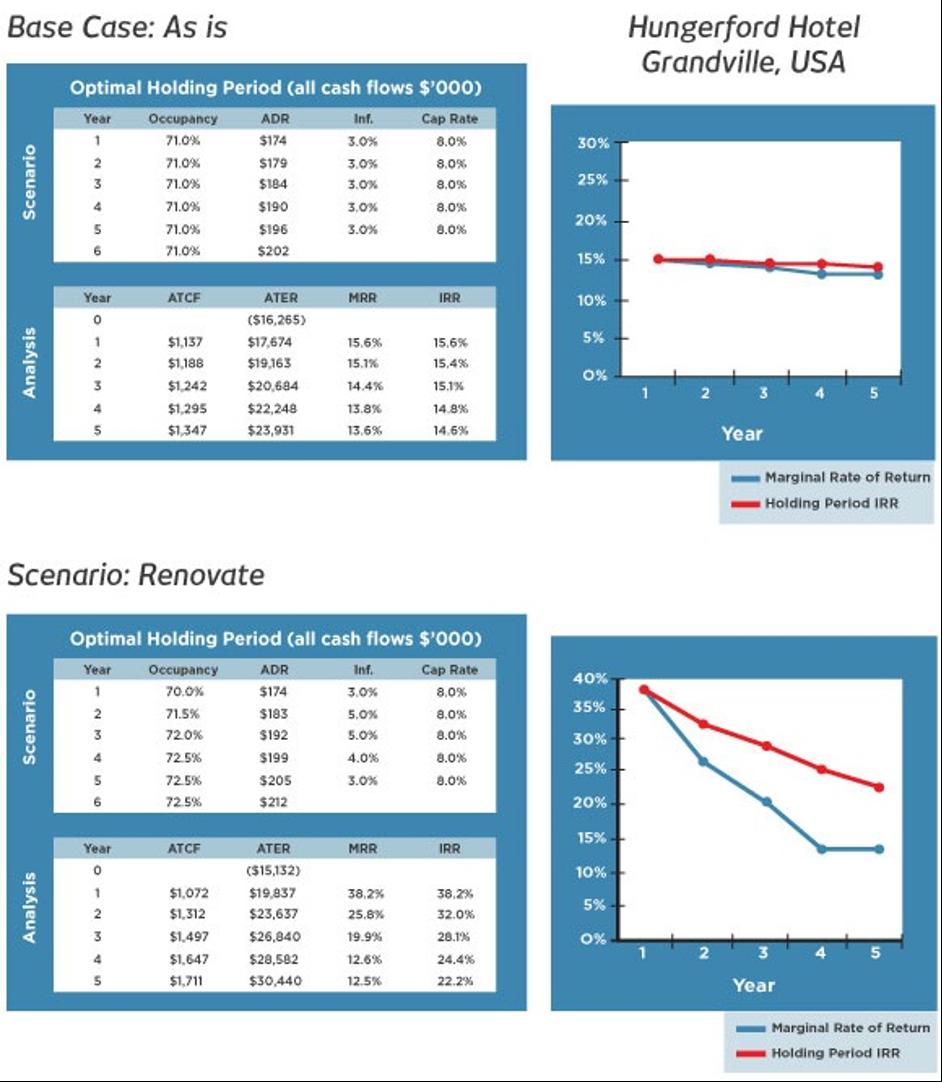

Owners of the Hungerford Hotel are considering whether or not they should hold the hotel or renovate it, as well as when they should consider selling the hotel. The first scenario is the base case. The second scenario is the renovation case, which assumes that the renovation has been completed. For both scenarios, you can assume that the hurdle rate is 14%.

Consider the two scenarios presented in the project. The owners have decided to renovate the Hungerford Hotel, with the intention of selling the property when the marginal rate of return peaks two years after the renovation.

Before acting on this decision, consider two rumors about the local market. The first concerns a major new industry relocating its headquarters to the market. If true, this will spark a major boom in the local hotel market. The other rumor, however, suggests quite the opposite. According to this rumor, the major local employer is relocating overseas. If true, the second rumor means a difficult period ahead for the local hotel market.

- If either of these rumors is true, do you think it would change the owner's renovation decision? Provide a clear rationale for your answer.

- What factors would you need to consider before going ahead on the renovation? Provide an explanation for each factor you list.

Base Case: As is Scenario Analysis Optimal Holding Period (all cash flows $'000) Year Occupancy 1 71.0% Analysis 2 3 4 5 6 Year 0 1 2 3 4 5 71.0% 71.0% 71.0% 71.0% 71.0% 2 3 4 5 6 ATCF Year 0 1 2 3 4 5 $1,137 $1,188 $1,242 $1,295 $1,347 Scenario: Renovate ADR $174 $179 $184 $190 $196 $202 ATCF ATER ($16,265) $17,674 $19,163 $20,684 $22,248 $23,931 $1,072 $1,312 $1,497 $1,647 $1,711 ADR $174 $183 $192 $199 $205 $212 ATER ($15,132) $19,837 $23,637 $26,840 3.0% 3.0% 3.0% 3,0% 3.0% Optimal Holding Period (all cash flows $'000) Year Occupancy 1 70.0% 71.5% 72.0% 72.5% 72.5% 72.5% $28,582 $30,440 MRR 15.6% 15.1% 14.4% 13.8% 13.6% Inf. 3.0% 5,0% 5.0% 4.0% 3.0% MRR Cap Rate 8.0% 8.0% 8.0% 8.0% 8.0% 38,2% 25.8% 19.9% 12.6% 12.5% IRR 15.6% 15.4% 15.1% 14.8% 14.6% Cap Rate 8.0% 8.0% 8.0% 8.0% 8.0% IRR 38.2% 32.0% 28.1% 24.4% 22.2% 30% 25% 20% 15% 10% 5% 0% 40% 35% 30% 25%- 20% 15%- 10%- 5% 0% Hungerford Hotel Grandville, USA 1 2 2 3 Year 5 Marginal Rate of Return Holding Period IRR 3 Year 5 Marginal Rate of Return Holding Period IRR

Step by Step Solution

3.45 Rating (148 Votes )

There are 3 Steps involved in it

Step: 1

The two rumorsone suggesting a boom in the local hotel market and the other suggesting a declinecould both have an impact on the owners decision to renovate the Hungerford Hotel Rumor of a Major New I...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started