Answered step by step

Verified Expert Solution

Question

1 Approved Answer

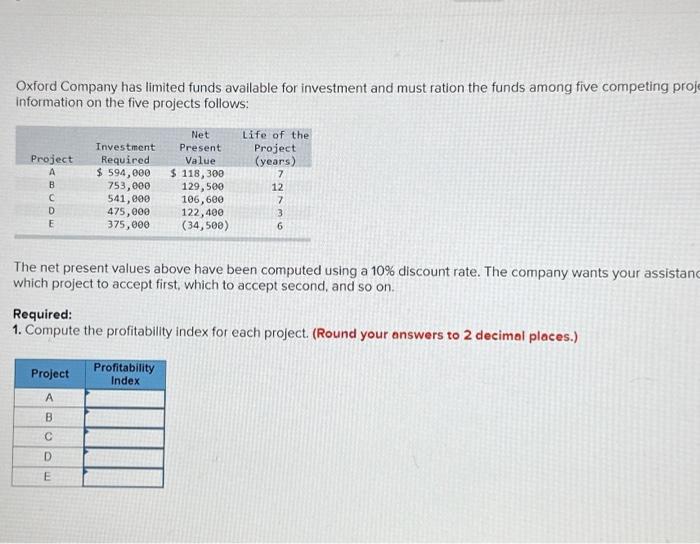

Oxford Company has limited funds available for investment and must ration the funds among five competing proj information on the five projects follows: Project A

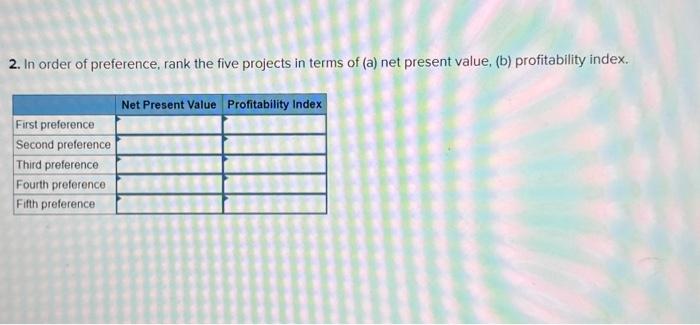

Oxford Company has limited funds available for investment and must ration the funds among five competing proj information on the five projects follows: Project A BUDE Investment Required $ 594,000 753,000 541,000 475,000 375,000 Project A B C D E Net Present Value $ 118,300 129,500 106,600 122,400 (34,500) Life of the Project (years) 7 The net present values above have been computed using a 10% discount rate. The company wants your assistanc which project to accept first, which to accept second, and so on. Profitability Index 12 7 3 6 Required: 1. Compute the profitability index for each project. (Round your answers to 2 decimal places.)

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started