Answered step by step

Verified Expert Solution

Question

1 Approved Answer

OYEN Sdn Bhd purchased an electrical oven from MOCI Bhd under a hire-purchase agreement on 1 January 2020 and was scheduled to complete the

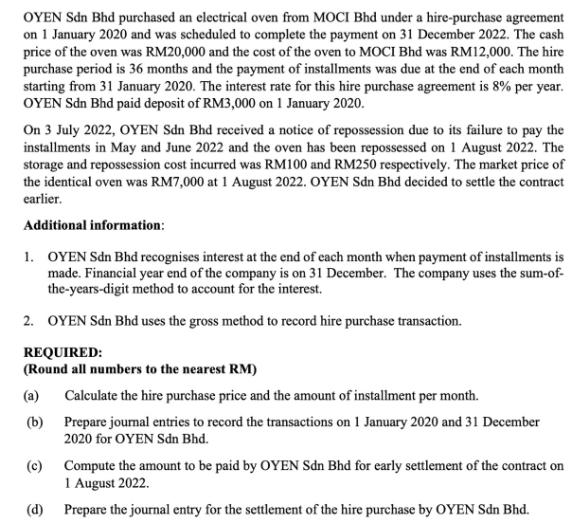

OYEN Sdn Bhd purchased an electrical oven from MOCI Bhd under a hire-purchase agreement on 1 January 2020 and was scheduled to complete the payment on 31 December 2022. The cash price of the oven was RM20,000 and the cost of the oven to MOCI Bhd was RM12,000. The hire purchase period is 36 months and the payment of installments was due at the end of each month starting from 31 January 2020. The interest rate for this hire purchase agreement is 8% per year. OYEN Sdn Bhd paid deposit of RM3,000 on 1 January 2020. On 3 July 2022, OYEN Sdn Bhd received a notice of repossession due to its failure to pay the installments in May and June 2022 and the oven has been repossessed on 1 August 2022. The storage and repossession cost incurred was RM100 and RM250 respectively. The market price of the identical oven was RM7,000 at 1 August 2022. OYEN Sdn Bhd decided to settle the contract earlier. Additional information: 1. OYEN Sdn Bhd recognises interest at the end of each month when payment of installments is made. Financial year end of the company is on 31 December. The company uses the sum-of- the-years-digit method to account for the interest. 2. OYEN Sdn Bhd uses the gross method to record hire purchase transaction. REQUIRED: (Round all numbers to the nearest RM) (a) Calculate the hire purchase price and the amount of installment per month. (b) Prepare journal entries to record the transactions on 1 January 2020 and 31 December 2020 for OYEN Sdn Bhd. (c) Compute the amount to be paid by OYEN Sdn Bhd for early settlement of the contract on 1 August 2022. (d) Prepare the journal entry for the settlement of the hire purchase by OYEN Sdn Bhd. OYEN Sdn Bhd purchased an electrical oven from MOCI Bhd under a hire-purchase agreement on 1 January 2020 and was scheduled to complete the payment on 31 December 2022. The cash price of the oven was RM20,000 and the cost of the oven to MOCI Bhd was RM12,000. The hire purchase period is 36 months and the payment of installments was due at the end of each month starting from 31 January 2020. The interest rate for this hire purchase agreement is 8% per year. OYEN Sdn Bhd paid deposit of RM3,000 on 1 January 2020. On 3 July 2022, OYEN Sdn Bhd received a notice of repossession due to its failure to pay the installments in May and June 2022 and the oven has been repossessed on 1 August 2022. The storage and repossession cost incurred was RM100 and RM250 respectively. The market price of the identical oven was RM7,000 at 1 August 2022. OYEN Sdn Bhd decided to settle the contract earlier. Additional information: 1. OYEN Sdn Bhd recognises interest at the end of each month when payment of installments is made. Financial year end of the company is on 31 December. The company uses the sum-of- the-years-digit method to account for the interest. 2. OYEN Sdn Bhd uses the gross method to record hire purchase transaction. REQUIRED: (Round all numbers to the nearest RM) (a) Calculate the hire purchase price and the amount of installment per month. (b) Prepare journal entries to record the transactions on 1 January 2020 and 31 December 2020 for OYEN Sdn Bhd. (c) Compute the amount to be paid by OYEN Sdn Bhd for early settlement of the contract on 1 August 2022. (d) Prepare the journal entry for the settlement of the hire purchase by OYEN Sdn Bhd.

Step by Step Solution

★★★★★

3.32 Rating (146 Votes )

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started