Answered step by step

Verified Expert Solution

Question

1 Approved Answer

P 1, 2 P4 Required: P 3 P4 P5 Preparing job cost sheet for computing costs of jobs and providing related journal entries. Oak

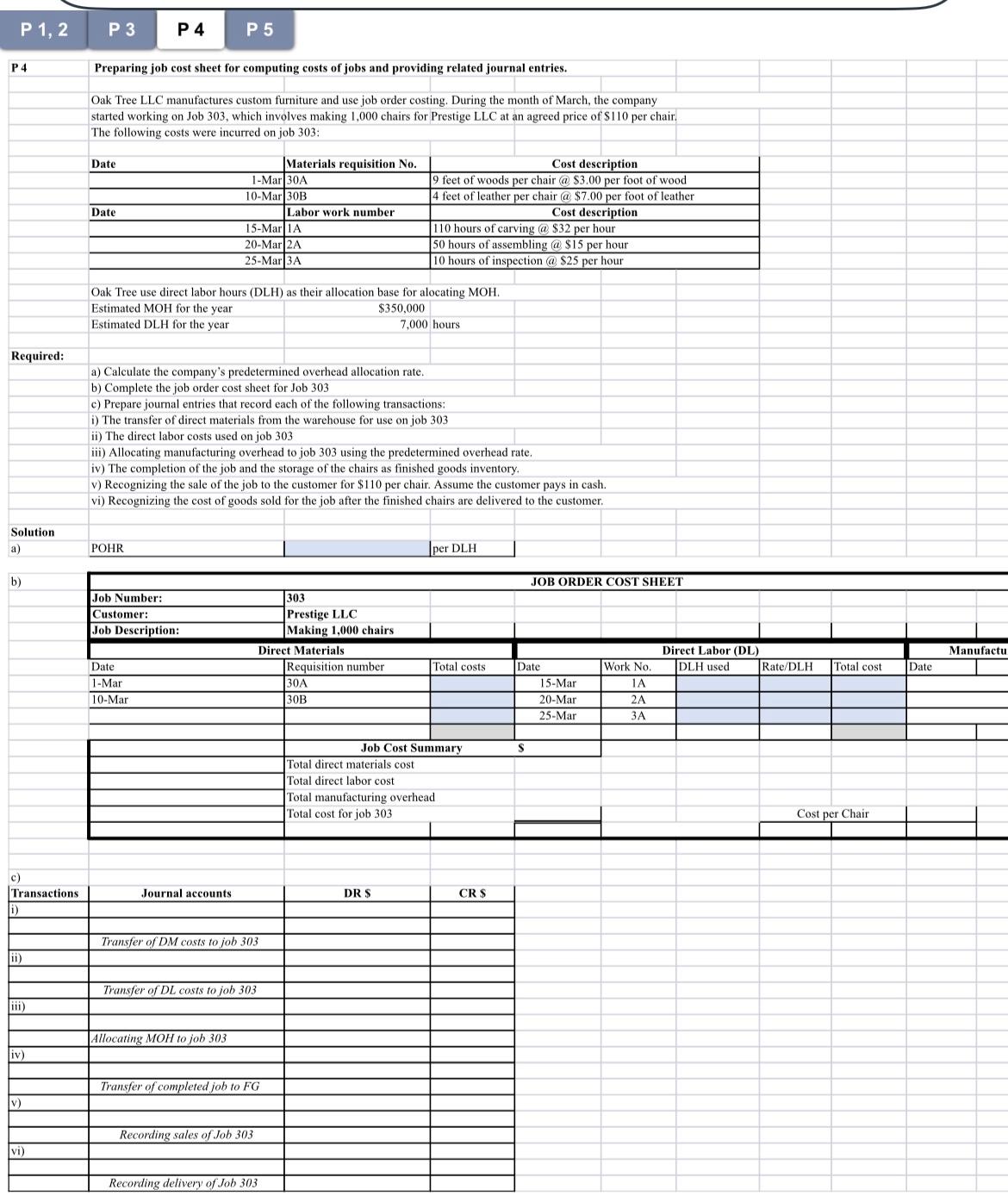

P 1, 2 P4 Required: P 3 P4 P5 Preparing job cost sheet for computing costs of jobs and providing related journal entries. Oak Tree LLC manufactures custom furniture and use job order costing. During the month of March, the company started working on Job 303, which involves making 1,000 chairs for Prestige LLC at an agreed price of $110 per chair. The following costs were incurred on job 303:1 Date Date Materials requisition No. 1-Mar 30A 10-Mar 30B Labor work number 15-Mar 1A 20-Mar 2A 25-Mar 3A Cost description 9 feet of woods per chair @ $3.00 per foot of wood 4 feet of leather per chair @ $7.00 per foot of leather Cost description 110 hours of carving @ $32 per hour 50 hours of assembling @ $15 per hour 10 hours of inspection @ $25 per hour Oak Tree use direct labor hours (DLH) as their allocation base for alocating MOH. Estimated MOH for the year Estimated DLH for the year $350,000 7,000 hours Solution a) Calculate the company's predetermined overhead allocation rate. b) Complete the job order cost sheet for Job 303 c) Prepare journal entries that record each of the following transactions: i) The transfer of direct materials from the warehouse for use on job 303 ii) The direct labor costs used on job 303 iii) Allocating manufacturing overhead to job 303 using the predetermined overhead rate. iv) The completion of the job and the storage of the chairs as finished goods inventory. v) Recognizing the sale of the job to the customer for $110 per chair. Assume the customer pays in cash. vi) Recognizing the cost of goods sold for the job after the finished chairs are delivered to the customer. (a) b) c) Transactions i) POHR per DLH JOB ORDER COST SHEET Job Number: Customer: 303 Job Description: Prestige LLC Making 1,000 chairs Direct Materials Date Requisition number Total costs Date Work No. Direct Labor (DL) DLH used Manufactu Rate/DLH Total cost Date 1-Mar 10-Mar 30A 30B 15-Mar 20-Mar 25-Mar 1A 2A 3A Journal accounts. Transfer of DM costs to job 303 ii) Transfer of DL costs to job 303 iii) Allocating MOH to job 303 iv) Transfer of completed job to FG V) Recording sales of Job 303 vi) Recording delivery of Job 303 Job Cost Summary S Total direct materials cost Total direct labor cost Total manufacturing overhead. Total cost for job 303 DR S CR $ Cost per Chair

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started