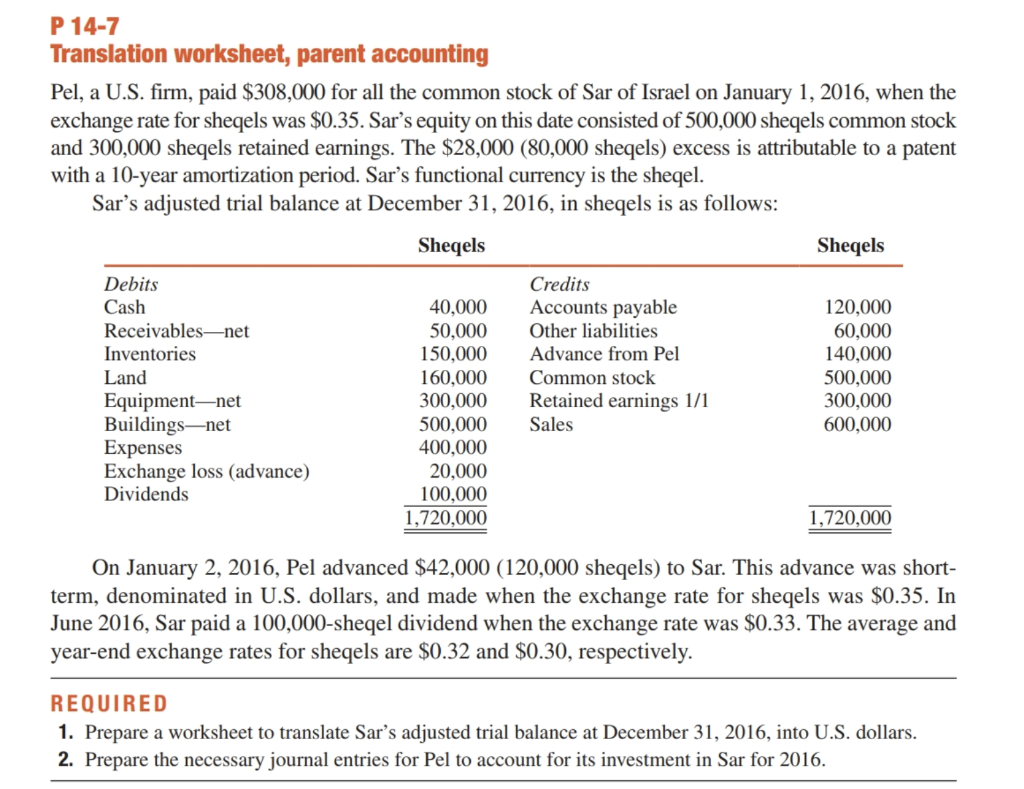

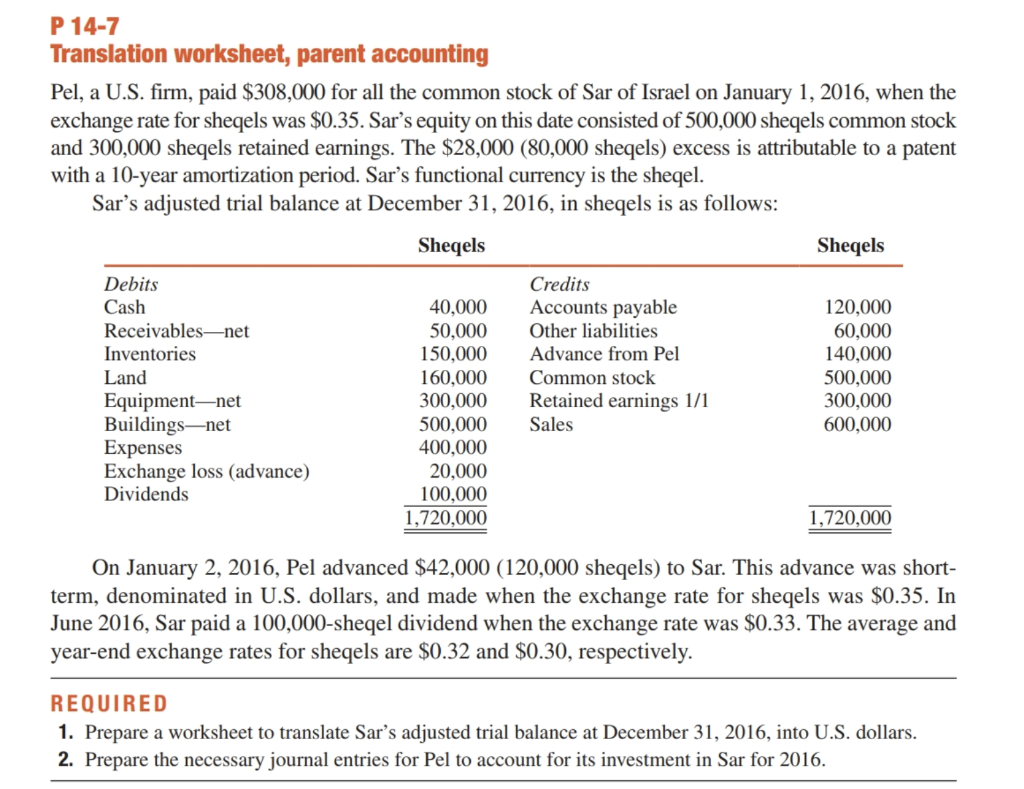

P 14-7 Translation worksheet, parent accounting Pel, a U.S. firm, paid $308,000 for all the common stock of Sar of Israel on January 1, 2016, when the exchange rate for sheqels was $0.35. Sar's equity on this date consisted of 500,000 sheqels common stock and 300,000 sheqels retained earnings. The $28,000 (80,000 sheqels) excess is attributable to a patent with a 10-year amortization period. Sar's functional currency is the sheqel. Sar's adjusted trial balance at December 31, 2016, in sheqels is as follows: Sheqels Sheqels Debits Cash Receivablesnet Inventories Land Equipment-net Buildingsnet Expenses Exchange loss (advance) Dividends 40,000 50,000 150,000 160,000 300,000 500,000 400,000 20,000 100,000 1,720,000 Credits Accounts payable Other liabilities Advance from Pel Common stock Retained earnings 1/1 Sales 120,000 60,000 140.000 500,000 300,000 600,000 1,720,000 On January 2, 2016, Pel advanced $42,000 (120,000 sheqels) to Sar. This advance was short- term, denominated in U.S. dollars, and made when the exchange rate for sheqels was $0.35. In June 2016, Sar paid a 100,000-sheqel dividend when the exchange rate was $0.33. The average and year-end exchange rates for sheqels are $0.32 and $0.30, respectively. REQUIRED 1. Prepare a worksheet to translate Sar's adjusted trial balance at December 31, 2016, into U.S. dollars. 2. Prepare the necessary journal entries for Pel to account for its investment in Sar for 2016. P 14-7 Translation worksheet, parent accounting Pel, a U.S. firm, paid $308,000 for all the common stock of Sar of Israel on January 1, 2016, when the exchange rate for sheqels was $0.35. Sar's equity on this date consisted of 500,000 sheqels common stock and 300,000 sheqels retained earnings. The $28,000 (80,000 sheqels) excess is attributable to a patent with a 10-year amortization period. Sar's functional currency is the sheqel. Sar's adjusted trial balance at December 31, 2016, in sheqels is as follows: Sheqels Sheqels Debits Cash Receivablesnet Inventories Land Equipment-net Buildingsnet Expenses Exchange loss (advance) Dividends 40,000 50,000 150,000 160,000 300,000 500,000 400,000 20,000 100,000 1,720,000 Credits Accounts payable Other liabilities Advance from Pel Common stock Retained earnings 1/1 Sales 120,000 60,000 140.000 500,000 300,000 600,000 1,720,000 On January 2, 2016, Pel advanced $42,000 (120,000 sheqels) to Sar. This advance was short- term, denominated in U.S. dollars, and made when the exchange rate for sheqels was $0.35. In June 2016, Sar paid a 100,000-sheqel dividend when the exchange rate was $0.33. The average and year-end exchange rates for sheqels are $0.32 and $0.30, respectively. REQUIRED 1. Prepare a worksheet to translate Sar's adjusted trial balance at December 31, 2016, into U.S. dollars. 2. Prepare the necessary journal entries for Pel to account for its investment in Sar for 2016